As a seasoned crypto investor, I’m always on the lookout for accurate and reliable metrics that can help me make informed decisions about my investments. The announcement by Coinbase regarding their new h-index metric piqued my interest.

Coinbase, a well-known cryptocurrency exchange, has introduced a fresh metric called the “h-index” to rectify distortions in measuring on-chain adoption that arise due to airdrops’ influence.

As a crypto investor, I’m excited to share that Coinbase, the publicly traded U.S.-based cryptocurrency exchange where I often make my trades, has introduced a new metric to give us a clearer picture of blockchain network adoption. Known for its innovative work on Base, a layer-2 solution for Ethereum, Coinbase is taking steps to ensure the accuracy of this important measure. By addressing distortions resulting from airdrop activities and Sybil attacks, we can trust that this new metric truly reflects the level of engagement and adoption within the blockchain community.

As a crypto investor, I’ve noticed that recent investments in blockchain infrastructure have resulted in an abundance of blockspace. This surplus has significantly reduced transaction costs and attracted a flood of new decentralized applications. However, this development comes with its own set of challenges. With the increasing number of applications being launched, it has become increasingly difficult for analysts to accurately assess ecosystem adoption.

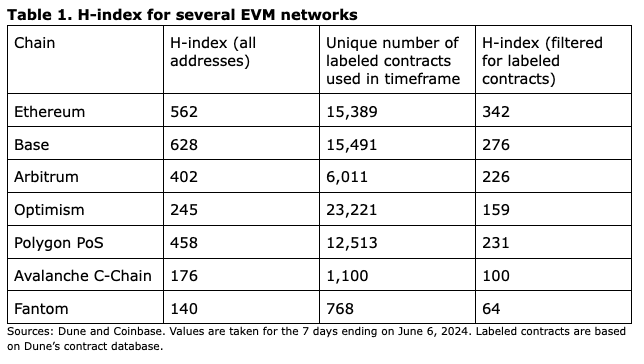

Traditional network metrics such as total transactions or daily active addresses can be skewed by Sybil attacks and airdrop activities, Coinbase says. To address this issue, Coinbase proposes a new metric called the h-index, which balances the depth and breadth of onchain adoption. The h-index counts the number of addresses receiving transactions from at least that same number of unique sending addresses.

Put simply, having an h-index of 100 implies that this entity has engaged in transactions with a total of 100 distinct recipients, each of whom has transacted with the entity from at least 100 separate senders within a specified duration.

Coinbase

Based on Coinbase’s analysis, the Ethereum and Binance Smart Chain networks showed the greatest extent of user engagement during the week ending June 6, with Ethereum leading the way. Arbitrum and Polygon followed closely behind in terms of widespread activity.

Recognizing its limitations, Coinbase asserts that the h-index provides unique insights into the comparison of cryptocurrency chain adoption. By minimizing the impact of Sybil influence and evaluating expansion in a comprehensive manner, the h-index offers valuable new perspectives.

Coinbase acknowledged that obstacles persist, such as varying execution conditions in blockchains leading to distinct transaction structures and data interpretations. Moreover, the impact of exchange or other smart contract wallets on the figures cannot be disregarded, according to their admission.

As a network analyst, I’ve come across a phenomenon called Sybil attacks in the crypto industry. In simple terms, a malicious actor creates multiple fake identities or nodes under their control to manipulate a network’s metrics and data. By generating numerous false accounts or addresses, they can artificially inflate transaction volumes or user activity. The ultimate goal is to distort the perception of genuine network usage and adoption.

Read More

- 10 Most Anticipated Anime of 2025

- Gold Rate Forecast

- USD CNY PREDICTION

- Pi Network (PI) Price Prediction for 2025

- USD MXN PREDICTION

- USD JPY PREDICTION

- Silver Rate Forecast

- EUR CNY PREDICTION

- Brent Oil Forecast

- Castle Duels tier list – Best Legendary and Epic cards

2024-06-07 18:58