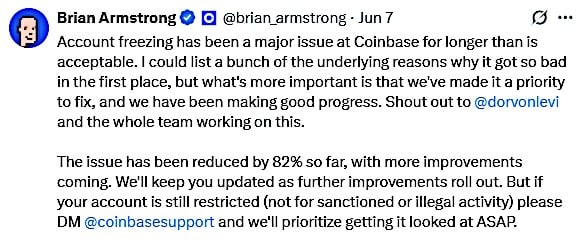

When Brian Armstrong, the illustrious CEO of Coinbase, confessed on X this week that account freezing has been “a major issue for longer than is acceptable,” it wasn’t just a corporate mea culpa; it was a stark admission of a crisis that has left thousands of users in a crypto purgatory, locked out of millions in assets. 🤦♂️

Coinbase CEO Brian Armstrong on X, looking as guilty as a cat caught with the canary.

The Unsettling Reality Behind Coinbase’s “Fraud Prevention”

The numbers tell a tale of woe. Users aren’t being locked out for suspicious activity; they’re being punished for behaving exactly as legitimate crypto investors should. 🤔

Consider this: A 10-year Coinbase customer, @v1nm4n, had their entire account frozen for a week after attempting to send a mere $10 worth of cryptocurrency. Not $10,000. Ten dollars. The restriction didn’t just affect that transaction; it locked down all their assets. Or take Eric Conner, co-founder of EthHub, whose account was frozen simply for using a VPN to access his account. In December 2024, his public complaint triggered an avalanche of similar stories from users who had been locked out for months or even years. The pattern is clear: Coinbase’s algorithm-driven “fraud prevention” system has been treating normal crypto activities as criminal behavior. 🕵️♂️

The VPN Trap: How Privacy Protection Became a Red Flag

Here’s where it gets particularly troubling for privacy-conscious crypto users. Coinbase’s risk models automatically flag VPN usage, despite VPNs being standard security practice for many crypto investors. Scott Shapiro, Coinbase’s product director, defended this policy last December by claiming VPNs are “always used by miscreants.” This reveals a fundamental misunderstanding of legitimate crypto security practices and suggests the exchange views user privacy as inherently suspicious. In Coinbase’s quest to expand globally (as it obviously does), it will need to get its corporate head around the fact that lots of people, in many countries, have to use a VPN to access any website that is crypto related. 🌍🔒

For crypto investors who value privacy and security, core principles of cryptocurrency itself, this creates an impossible choice: sacrifice your privacy or risk having your account frozen indefinitely. This is a point raised by another Coinbase ‘lock out’ Michael Chen – “Please save me from this endless thread of emails I’ve been on stretching back months and months just constantly being asked to upload my most sensitive personal data into some random drives.” Chen’s comment is particularly pertinent, given Coinbase’s recent privacy ‘dump’ where its own customer service staff sold private customer information to criminal gangs. 🚨

Why Long-Term HODLers Are Particularly Vulnerable

The data reveals that account tenure provides zero protection from arbitrary restrictions. In fact, established users might be at higher risk during periods of increased activity. One documented case involved a user whose daily ACH limits were raised from $250 to $5,000, only to have their account frozen for “fraud prevention” after they used those newly approved limits. The logic is baffling: Why raise limits if using them triggers a freeze? This pattern suggests Coinbase’s systems are poorly integrated, with different departments applying conflicting rules that trap users in algorithmic contradictions. 🤯

An Attempted Fix

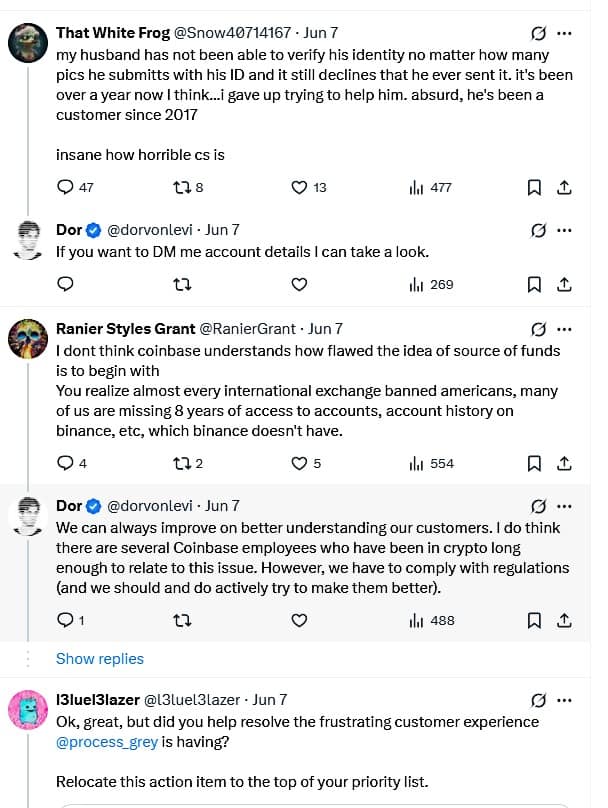

In the last couple of months, the frozen account issues have seen Coinbase hire a frozen account czar @dorvonlevi. After nine weeks on the job, he says, “there’s so much more for us to do to get to a great state” (full credit for honesty). Mr. Levi claims Coinbase has “reduced the frequency of account locks by ~82% so far, and new changes are currently rolling out that will bring further reductions.” Despite this, the issue continues for many, as Levi’s X thread clearly shows. 📊

Coinbase Frozen Account Czar Brian Dorvon Levi on X, still grappling with the chaos.

What This Means for Your Crypto Investment Strategy

The Coinbase account freezing crisis exposes fundamental flaws in how centralized exchanges must prioritize legal compliance over customer rights. But it also reveals three critical investment considerations:

1. Diversification Risk Beyond Portfolios Keeping all your crypto on a single exchange, even the largest US exchange, creates unnecessary single points of failure. The “not your keys, not your crypto” principle isn’t just philosophical; it’s practical risk management. 🗝️

Regulatory Compliance vs. User Rights

Coinbase’s problems reflect broader tensions in the crypto industry between regulatory compliance and user experience. Exchanges face intense pressure from regulators to implement stringent anti-money laundering (AML) and know-your-customer (KYC) procedures. The issues at Coinbase are common across the sector – and demonstrate how regulatory fear can lead to algorithmic overreach that punishes legitimate users. 🚓🚫

The Investment Verdict

If true, Coinbase’s 82% reduction in unnecessary account restrictions is a good start, but it’s a solution to a problem that arguably should never have existed at this scale. For crypto investors, the question isn’t whether Coinbase has improved; it’s whether you’re comfortable trusting your assets to a platform with a documented history of this type of issue. Smart crypto investors will evaluate exchanges not just on fees and features, but on their track record of respecting user rights and maintaining accessible customer service. 📊💼

Read More

- 10 Most Anticipated Anime of 2025

- Silver Rate Forecast

- Pi Network (PI) Price Prediction for 2025

- USD MXN PREDICTION

- Gold Rate Forecast

- USD CNY PREDICTION

- Brent Oil Forecast

- How to Watch 2025 NBA Draft Live Online Without Cable

- USD JPY PREDICTION

- PUBG Mobile heads back to Riyadh for EWC 2025

2025-06-11 09:10