As a seasoned crypto investor with a few battle scars from past market corrections, I’ve learned to keep a cool head during volatile times like these. The recent dip in digital asset prices presented an opportunity for me and many others to deploy capital into token-based funds. The net inflows of $441 million last week were a testament to this trend, with American investors leading the charge.

Crypto investors took advantage of lowered digital asset prices to invest in token-based funds situated on the blockchain.

Last week, digital asset investment funds experienced a net inflow of approximately $441 million, as indicated by a recent report from CoinShares. This occurred after the market underwent a significant downturn followed by a recovery.

James Butterfill, the research head at Coinshares, stated that American investors seized the opportunity presented by lower prices, investing approximately $384 million in digital asset investment products based in Wall Street. Notably, Hong Kong, Switzerland, and Canada also experienced modest capital infusions. Among all investments, Bitcoin accounted for a significant 90%, while investors additionally allocated funds to altcoins.

Crypto dip extends

As a researcher studying the virtual currency market, I’ve observed a significant shift in sentiment over the past week. The industry as a whole saw a decline of over 9%, bringing the total market value down to approximately $2 trillion. Notably, market heavyweights Bitcoin (BTC) and Ethereum (ETH) both dipped to their lowest points in two months, reaching prices of around $30,000 and $1,800 respectively.

Bitcoin dropped below the $54,000 mark on Mount Gox concerns and German selling pressure, but later bounced back above $58,000. On the other hand, Ethereum slid under $3,000. The altcoin market capitalization decreased by up to 15% according to TradingView last week, while most altcoins have declined by approximately 80% since before Bitcoin’s halving event.

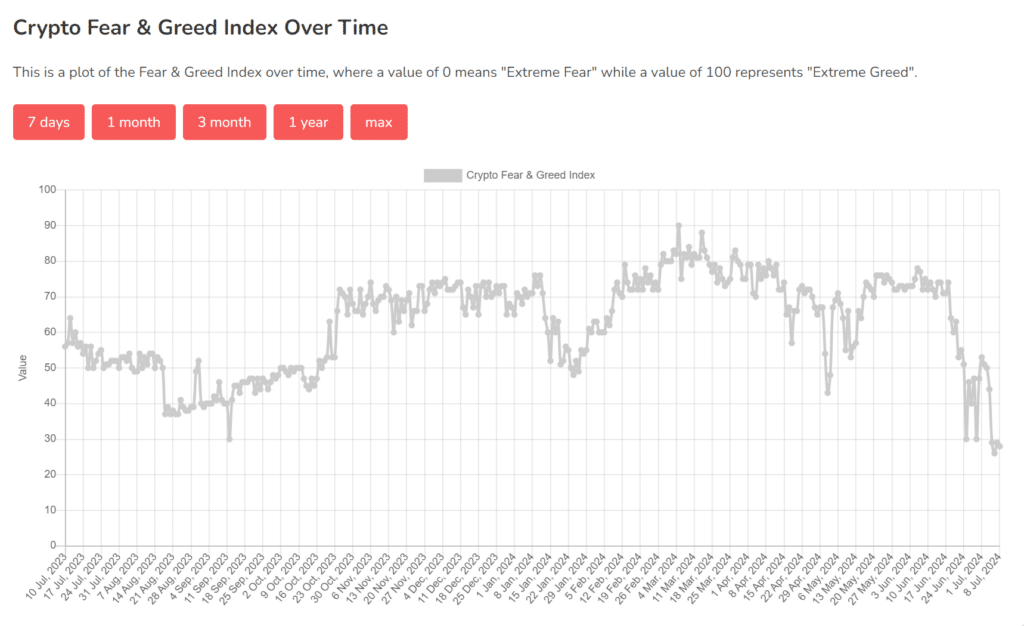

I observed a 4% surge in the markets on Monday as traders seized opportunities for higher returns. However, the overall bearish sentiment across markets remained dominant, leading to losses in cryptocurrencies once again. The “fear & greed” index for crypto reached a low of 28 – its lowest point since last September.

The overall value of digital assets increased by nearly 3% before experiencing another decline due to market instability and Bitcoin-related concerns. In contrast, the stock prices of blockchain companies continued to decrease. According to Butterfill’s report, mining entities and other web3 companies have seen a total withdrawal of approximately $556 million in investments since the beginning of the year.

Read More

- 10 Most Anticipated Anime of 2025

- USD CNY PREDICTION

- Pi Network (PI) Price Prediction for 2025

- Silver Rate Forecast

- Gold Rate Forecast

- USD MXN PREDICTION

- USD JPY PREDICTION

- Brent Oil Forecast

- EUR CNY PREDICTION

- How to Watch 2025 NBA Draft Live Online Without Cable

2024-07-08 17:54