As a long-term crypto investor with experience in the market, I have followed the developments surrounding Tether (USDT) with great interest and caution. The latest allegations against Tether, as reported by Consumers’ Research and Eleanor Terrett, are concerning. However, it is essential to consider multiple perspectives before making a definitive judgment.

As a researcher investigating financial news, I came across an intriguing allegation levied against Tether through an advertisement displayed in Times Square, New York. The advertisement suggested that Tether was involved in corrupt practices and facilitated illegal activities.

I came across a tweet from Fox News journalist Eleanor Terrett where she shared a picture of a large billboard situated in Times Square. She pointed out that this was part of a promotional effort by the non-profit organization Consumers’ Research.

A new digital billboard in Times Square, New York City, currently displays an accusation against Tether, the world’s largest stablecoin, of involvement in corruption.

— Eleanor Terrett (@EleanorTerrett) June 18, 2024

Will Hild, the executive director of the organization, drew a stark comparison between Tether and the defunct FTX exchange. In his view, Tether operates like a “Ponzi scheme,” carrying the risk of substantial financial consequences for its investors down the line.

In 2023, Hield pointed out that among all stablecoins, USDT issued by Tether was reportedly the most frequently utilized in questionable transactions. Additionally, he voiced concerns over Tether’s insufficient transparency and absence of regular public audits.

Does Tether help terrorists and human traffickers?

As a researcher, I’ve come across some concerning allegations made by Consumers’ Research in their recent declaration. They claim that Tether has enabled illicit activities and found ways to bypass international sanctions.

The organization has initiated a high-profile crusade warning the public about potential connections between Tether and suspected terrorist groups or human trafficking rings, allegedly utilizing USDT stablecoins in their illicit activities.

Alongside allegations that Tether has utilized USDT for funding terrorist activities and bypassing international sanctions, Consumer’s Research asserts that Tether is reluctant to provide the necessary evidence demonstrating they have ample reserves backing their stablecoins.

As a researcher delving into the intricacies of Tether’s operations, I’ve come across some concerning aspects that merit closer scrutiny. For over a decade, this stablecoin provider has steadfastly declined to undergo an audit, which raises eyebrows in the financial community. Moreover, there have been persistent allegations linking Tether transactions to illicit activities, such as terrorism financing and drug and human trafficking. These findings call for further investigation and transparency from Tether.

Will Hild, Consumers’ Research Executive Director

UN report on money laundering

In January, a report from the United Nations Office on Drugs and Crime revealed that criminals in Southeast Asia have been increasingly utilizing Tether (USDT) for money laundering activities.

As a researcher, I’ve come across an intriguing revelation from an agency spokesperson to the Financial Times. They revealed that criminals have ingeniously developed a sophisticated banking system using novel technologies. Moreover, the surge of unregulated online casinos and crypto assets has significantly bolstered the criminal network in the region.

As a crypto investor, I’ve noticed the rapid advancement of the global regulatory landscape for crypto-assets. The UN shares my concern and acknowledges the need to keep pace with this evolution. They understand that staying behind could result in missing out on important developments within the sector.

Tether’s reps issued a statement later in response to the UNODC report, expressing their disappointment with the agency’s methodology and the bias in its examination.

“We’re displeased that the UN specifically called out USDT for its part in illegal activities, without acknowledging its significant contributions to boosting economies in developing countries.”

Tether representatives

The firm strongly advocated for collaboration with law enforcement bodies, such as the FBI and the U.S. Secret Service. Additionally, Tether expressed that due to its blockchain structure, USDT is an unsuitable option for engaging in illicit activities. This point is underscored by the numerous account suspensions implemented by the company.

As a crypto investor, I’d put it this way: In summary, Tether reached out to the UN, inviting them for open discussions. The company remains committed to promoting financial clarity and transparency in our industry.

The questionable experience of tether founders and Wall Street control

Four individuals with limited financial background oversaw the management of Tether as of February 2023, according to reports from The Wall Street Journal based on financial records.

Based on media reports, Giancarlo Devasini, who used to be a plastic surgeon, owned the largest shareholding in 2018.

Approximately 30% of the company’s shares were allocated equally between two individuals: Jean-Louis van der Velde, a former electronics importer, and Stuart Hoegner, a gambler. However, due to the Bitfinex crypto exchange hack, an additional 13% of the shares belonged to the largest client, Christopher Harborne. The identity of the person or persons who owned the remaining 14% of the company’s shares remains undisclosed.

I came across another intriguing piece of news that very same month. The Wall Street Journal disclosed this information, revealing that Cantor Fitzgerald, a renowned U.S. investment firm, manages an impressive $39 billion worth of Tether bonds on behalf of the stablecoin issuer. This arrangement reportedly started back in 2021.

As an analyst, I’ve observed that a significant portion of Tether’s reserves is controlled by a single entity. This finding underscores the readiness of Wall Street institutions to overlook the questionable histories of cryptocurrency companies in order to handle vast sums of assets worth billions of dollars.

Questionable solvency

In May, the Deutsche Bank Expert Team released their findings on the stablecoin market after conducting a study. They identified potential drawbacks associated with this asset class and pointed out the opacity issues surrounding Tether.

Based on an analysis of over 330 distinct assets, it was determined that nearly half (49%) of stablecoins disappear within a timespan of 8 to 10 years. The primary reason for this is the volatile nature of the cryptocurrency market, leading to instability and potential loss of their pegged value to currencies like the US dollar or Euro.

Experts noted the downfall of stablecoin TerraUSD (TUSD) in the year 2022. This collapse was attributed to the deceitful actions of Terraform Labs and its founder Do Kwon, leading investors to sustain losses exceeding $40 billion.

The financial stability of Tether was deemed uncertain due to its dominant position in the stablecoin market. If USDT were to experience instability, the repercussions could be particularly significant.

Tether disagreed with Deutsche Bank’s findings in their report. The representatives from Tether argued that the report was unclear and failed to provide solid evidence. Moreover, they pointed out that the report contained imprecise statements instead of thorough analysis.

Deutsche Bank analysts reportedly warned company representatives about potential issues in the stablecoin market, yet they didn’t share concrete evidence to back up their concerns.

As a researcher investigating Deutsche Bank’s involvement in the financial industry, I cannot help but raise concerns when considering the bank’s past record of regulatory infringements and penalties. This history casts doubt upon its credibility when it comes to critiquing other institutions within the sector.

Tether reports continue to shine

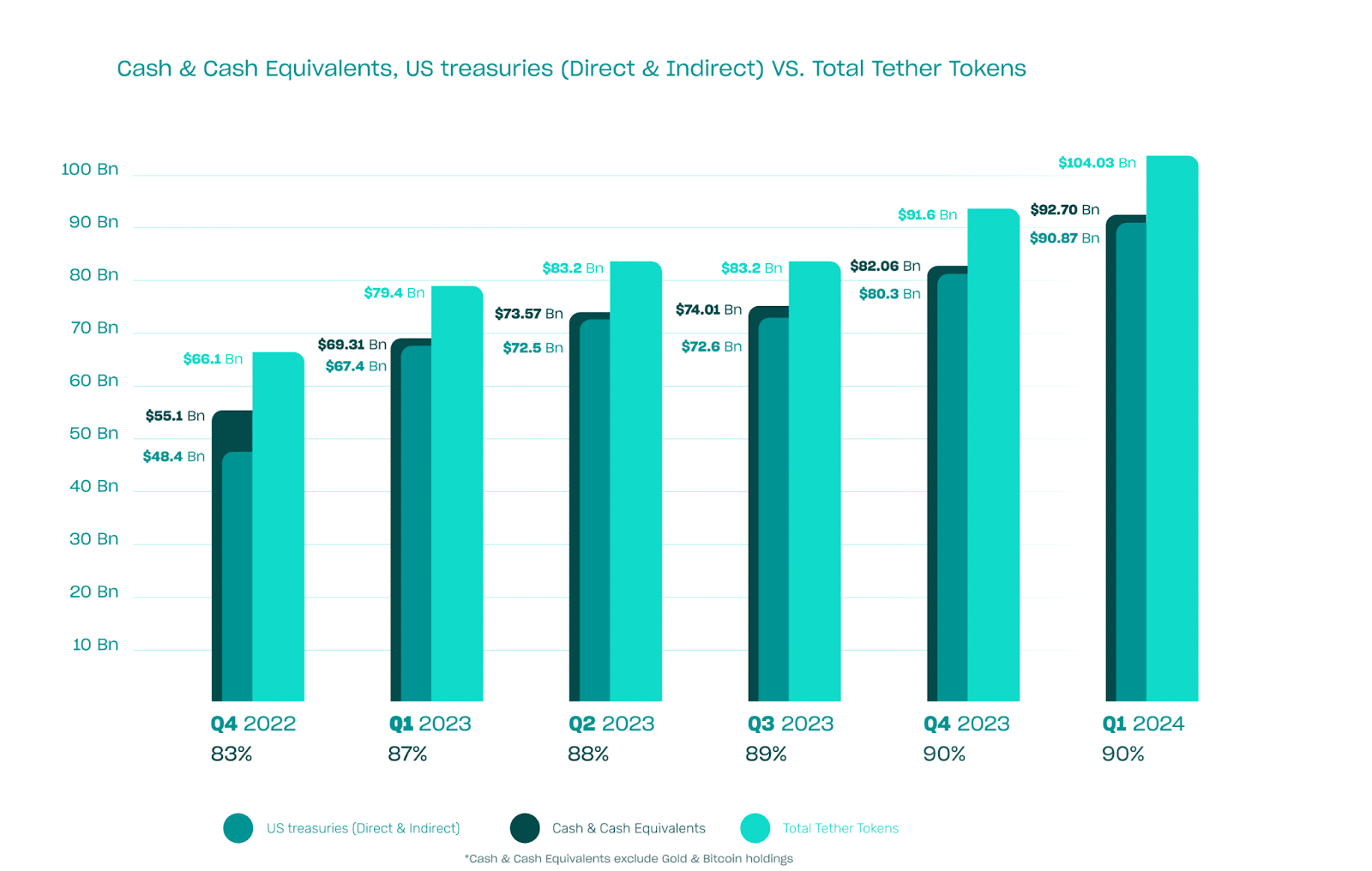

As an analyst, I’ve examined the recent report from the firm amidst various accusations, particularly concerning the transparency of their reserve holdings. Surprisingly enough, they claim that approximately 90% of the USDT stablecoin’s backing comes from cash and its equivalents. Simultaneously, there was a significant increase in the asset’s supply volume by $12.5 billion within the first quarter of 2024.

In Q1 2024, the firm announced exceptional earnings of $4.52 billion, with a significant portion, around $1 billion, attributable to income derived from U.S. Treasury bonds. Simultaneously, Tether boosted its excess reserves by an additional $1 billion in the same period. This substantial reserve fund surpassed the company’s liabilities by a considerable margin, totaling over $6.3 billion.

Who to believe?

During its history, Tether has repeatedly been subjected to allegations concerning unclear reserve holdings, facilitating money laundering and terroristic financing.

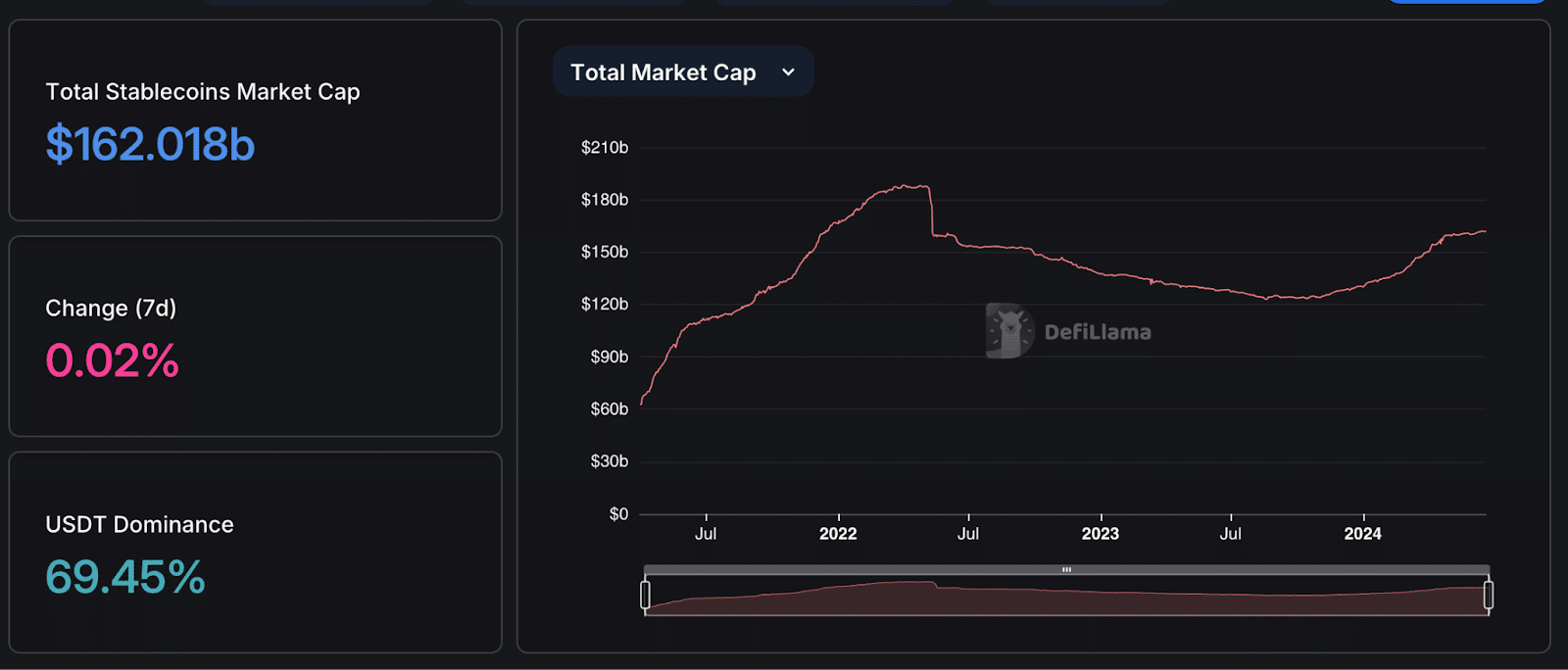

Despite facing numerous criticisms, USDT maintains its position as the dominant stablecoin, boasting over 69% market control and a substantial market capitalization of $162 billion.

Despite facing allegations of untransparency in its operations, Tether persists in holding a leading role and staying financially stable, with profits consistently breaking records.

Read More

- 10 Most Anticipated Anime of 2025

- Gold Rate Forecast

- Pi Network (PI) Price Prediction for 2025

- USD MXN PREDICTION

- USD CNY PREDICTION

- Silver Rate Forecast

- USD JPY PREDICTION

- EUR CNY PREDICTION

- Brent Oil Forecast

- Castle Duels tier list – Best Legendary and Epic cards

2024-06-20 18:56