As a seasoned researcher with a decade of market analysis under my belt, I’ve seen my fair share of bull and bear markets, crypto or otherwise. The latest report from Coinbase Research is a stark reminder that the crypto market remains heavily influenced by macroeconomic events, a trend that has intensified in recent times.

Experts from Coinbase’s Research team anticipate that broader economic forces will shape the cryptocurrency market over the coming weeks, as they see no immediate triggers or significant events likely to occur.

It seems the cryptocurrency market is heavily influenced by large-scale economic occurrences, as suggested by a recent study from Coinbase Research. This research suggests that the market’s dependence on broader economic events has grown stronger, and at present, there are no apparent triggers foreseen to change this pattern.

According to a research report published on August 9, Coinbase’s analysts associated the Bank of Japan’s recent interest rate increase with the reversal of yen carry trades, which had significant effects on global financial markets. Furthermore, the report emphasized that the growing unrest in the Middle East has left several investors feeling jittery about geopolitics, with specific worries revolving around potential disruptions to oil supply.

Crypto remains dependent on macro factors

The report also indicates that an extensive liquidation incident occurred on August 4, causing more turmoil in the crypto market. This event resulted in the elimination of over $1 billion worth of perpetual contracts within a day, marking the largest such occurrence since March.

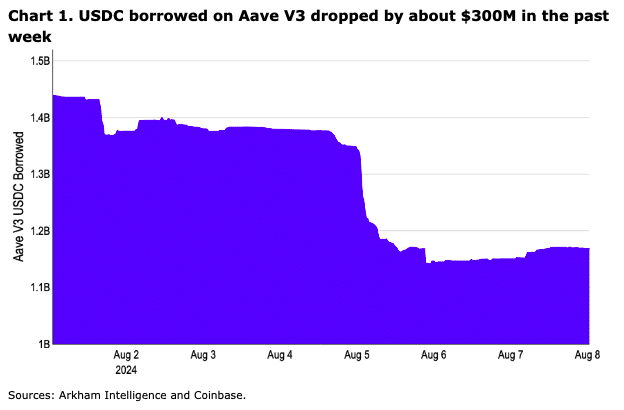

Despite the market becoming cleaner following this large-scale selloff, liquidity remains tight due to decreased leverage in cryptocurrency spot markets. The amount of stablecoin loans has significantly dropped, according to analysts at Coinbase Research. They believe that as there are no unique factors expected to stimulate the crypto market in the coming weeks, macroeconomic trends could have a stronger influence.

As a crypto investor, I’m gearing up for the third quarter with a cautious stance, anticipating that global economic conditions will continue shaping the prices of cryptocurrencies, particularly as we await the release of upcoming U.S. inflation figures. These numbers could significantly influence market sentiments, so it’s essential to stay informed and adapt accordingly.

While not all experts agree on this point, Grayscale Research posits an alternative view. They argue that if the U.S. economy manages to achieve a ‘soft landing’ without slipping into a recession, token valuations could bounce back. In fact, they propose that Bitcoin (BTC) might even revisit its previous record high this year under such circumstances.

Read More

- 10 Most Anticipated Anime of 2025

- USD CNY PREDICTION

- Pi Network (PI) Price Prediction for 2025

- Silver Rate Forecast

- Gold Rate Forecast

- USD MXN PREDICTION

- USD JPY PREDICTION

- Brent Oil Forecast

- EUR CNY PREDICTION

- How to Watch 2025 NBA Draft Live Online Without Cable

2024-08-09 16:38