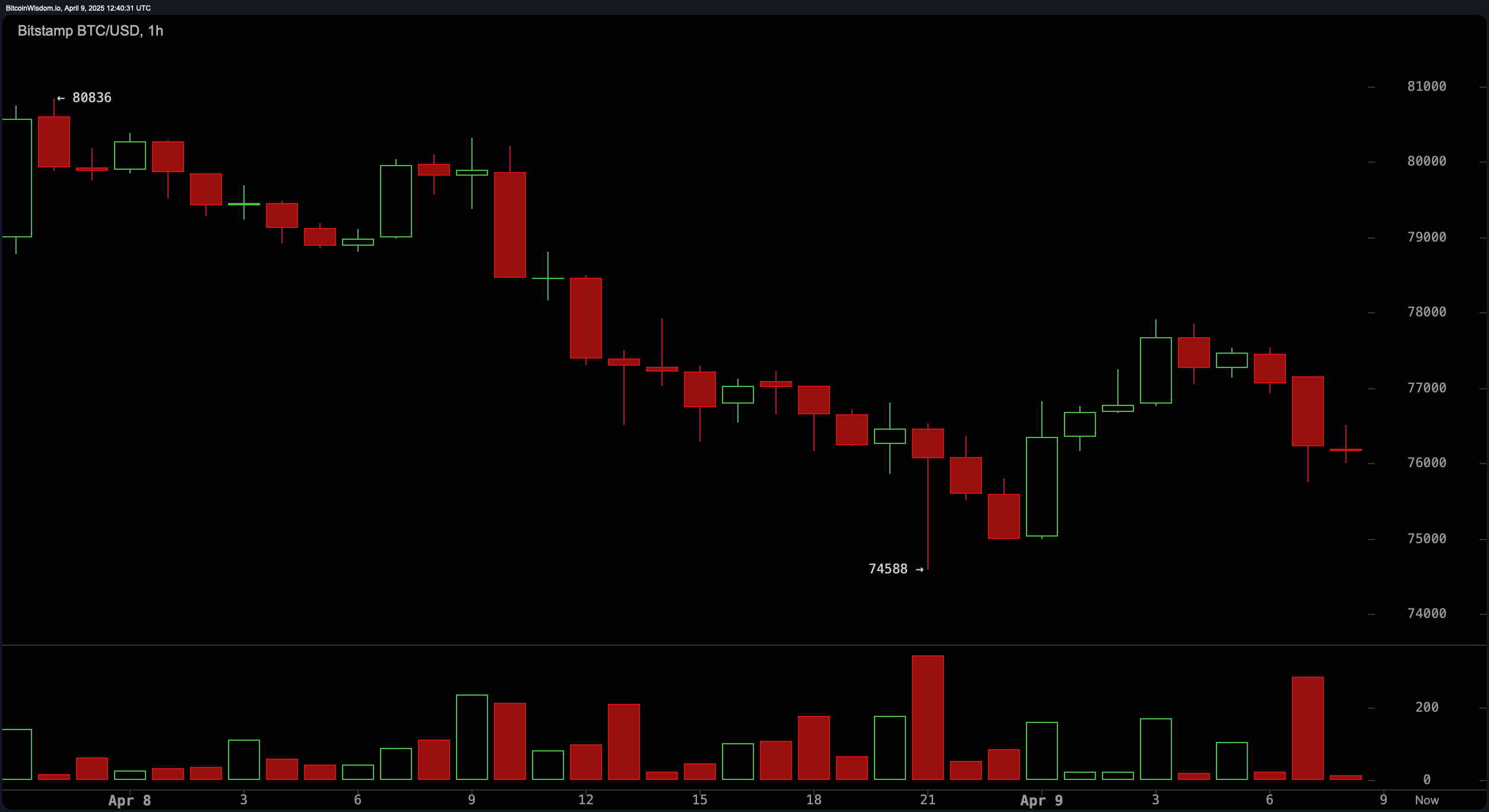

On a Wednesday that felt more like a cosmic joke, the total valuation of the global crypto circus nosedived nearly 5%, landing at a cool $2.42 trillion. And, dear Bitcoin—the rebellious rockstar of digital currency—decided to flirt with a low of $74,588 before clinging to the $76,000 threshold like it’s the last canapé at a cocktail party. 🤷♂️

Bitcoin Fumbles, Gold Grins Back

In the twilight hours, bitcoin opted for a clumsy salsa with the U.S. dollar, stumbling 4.7% and reaching a pitiful $74,588 around 9 p.m. on April 8. With a staggering $60.22 billion traded worldwide, by 8:15 a.m. ET on April 9, it had somehow been coaxed back to $76,300—almost as if it were that one friend who can’t resist coming back for dessert. 😏

In a twist of fate that would make any drama queen proud, only a few digital divas—LEO, FOUR, and IP—stuck to their guns amid the chaos, while NEAR took the hardest hit, falling 12.9%. Right on its heels, EOS dropped 12%, AB slipped 11.6%, and even the cheekily named FARTCOIN managed an 11.12% decline. Global crypto trading volume shrank to $136.33 billion, as if everyone collectively decided to hit snooze on their investments. Bitcoin still hogs a whopping 62.5% of the market, leaving ether to settle for a modest 7.3%.

Although BTC parades itself at $76,300 on most international platforms, South Korean exchange Upbit cheekily lists it at $77,871. Meanwhile, in the wild world of derivatives, a jaw-dropping $443.36 million in leveraged positions was liquidated on Wednesday. Out of that, $116 million came from over-enthusiastic bitcoin long positions, while ether long trades guzzled up $85.79 million. By mid-morning, 139,383 hapless traders had been shown the exit door, courtesy of coinglass.com.

As traders brace for further turbulence in U.S. equities and the ever-idiosyncratic moods of Treasury markets, gold quietly staged its own comeback. At the time of reporting, gold was up nearly 3%, now strutting at $3,064 per ounce—an upgrade from its less fortunate $3,000 status just a day earlier. Meanwhile, the ongoing theatrical spat between the U.S. and China shows no signs of an intermission. Grab your popcorn! 🍿

Read More

- 10 Most Anticipated Anime of 2025

- Pi Network (PI) Price Prediction for 2025

- USD MXN PREDICTION

- Silver Rate Forecast

- USD CNY PREDICTION

- Brent Oil Forecast

- How to Watch 2025 NBA Draft Live Online Without Cable

- Gold Rate Forecast

- USD JPY PREDICTION

- PUBG Mobile heads back to Riyadh for EWC 2025

2025-04-09 15:58