As a seasoned financial analyst with extensive experience in the cryptocurrency market, I have witnessed numerous price fluctuations and trading volume trends over the years. The recent correlation between slumps in Bitcoin prices and reduced trading activity on centralized exchanges like Binance is not a new phenomenon to me.

Bitcoins prices and the overall value of the cryptocurrency market saw declines during periods when trading volume on exchanges such as Binance was low.

The WuBlockchain team disclosed that the trading volume for cryptocurrency spots on centralized exchanges decreased by approximately 17% compared to the previous month in June. Over the past 30 days, Bitcoin experienced a decline of roughly 5%, while the overall crypto market witnessed a loss of hundreds of billions during the same timeframe.

When capital withdrew from the digital asset market and investor attitudes turned pessimistic, trading volumes on several cryptocurrency exchanges, including Upbit, Bitfinex, and KuCoin, saw substantial drops. Specifically, Upbit experienced a decrease of 45%, Bitfinex had a fall of 38%, and KuCoin registered a decline of 32%.

In a recent shift, Binance witnessed a 22% decrease in spot trading volume, resulting in a comparable reduction of approximately 22% in total trades. Meanwhile, Coinbase experienced a 15% decline and consequently lost its second position in the global ranking. Bybit seized this opportunity, experiencing only a minor 1.6% drop in spot trading, thus surpassing Coinbase to claim the number two spot.

As a crypto investor, I found it intriguing to notice that while many exchanges experienced a decrease in spot trading activity, MEXC and HTX defied this trend with an impressive 13% and 7% increase in spot trading volumes, respectively. The report further revealed that the derivatives trading patterns echoed the decline in spot trading. Specifically, there was a substantial 19% monthly decrease in derivatives trading volumes.

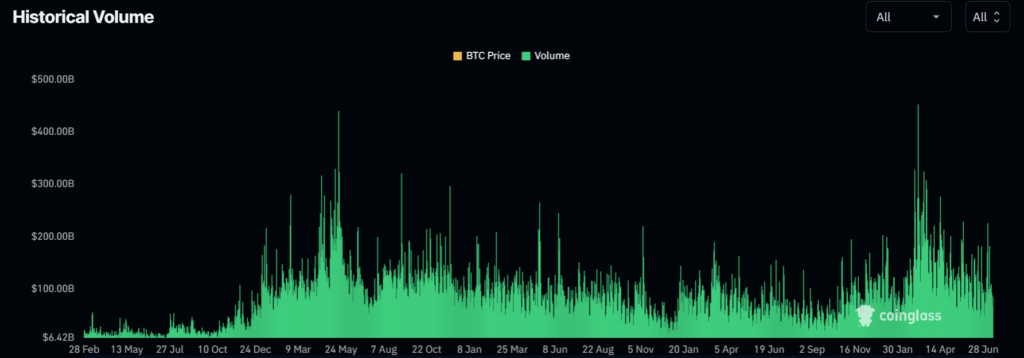

As a researcher, I’ve noticed that the trading volumes reported on Mondays have been part of a larger downward trend since around March, according to CoinGlass data. In fact, this decline has been ongoing for the past four months. The most significant trading activity this year occurred during Bitcoin’s rally to its all-time high of $73,738, highlighting Bitcoin’s influential role in shaping the digital asset market.

Read More

- 10 Most Anticipated Anime of 2025

- Gold Rate Forecast

- Pi Network (PI) Price Prediction for 2025

- USD CNY PREDICTION

- USD MXN PREDICTION

- Silver Rate Forecast

- USD JPY PREDICTION

- EUR CNY PREDICTION

- Brent Oil Forecast

- Castle Duels tier list – Best Legendary and Epic cards

2024-07-15 19:46