Ah, the current crypto bloodbath, a veritable theater of despair, where investors, like desperate souls in a Dostoevskian novel, scramble to seek refuge in the arms of options, those fickle guardians of fortune.

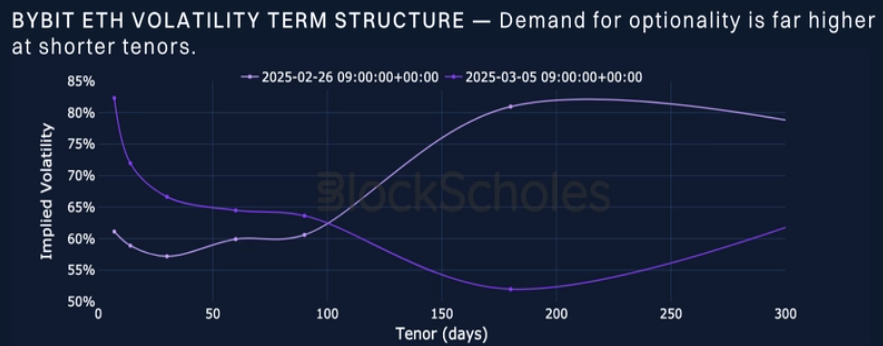

According to the esteemed Bybit X Block Scholes crypto derivatives analytics report—because who doesn’t love a good report?—the market’s descent into chaos has compelled these beleaguered investors to clutch at options as a means of hedging against the abyss of further losses. How poetic, yet tragically absurd!

When the illustrious Trump proclaimed the establishment of a crypto strategic reserve, a veritable cornucopia of Bitcoin (BTC), Ethereum (ETH), Ripple (XRP), Solana (SOL), and Cardano (ADA) was promised, sending prices soaring like a lark in spring. Yet, alas! The euphoria was but a fleeting mirage, as the specter of new tariffs on imported goods loomed large, casting a pall over the market and driving investors away from the treacherous waters of risk.

Thus, we find ourselves in a maelstrom of sudden price swings—first, the reserve news elevating crypto prices, only to be followed by the tariff news, which sent them plummeting into the depths of despair. Such is the nature of volatility, a cruel mistress that dances between the realms of realized and implied, leaving traders in a state of existential dread.

It is with a heavy heart that we observe traders gravitating towards put options, a clear indication of their bleak expectations for the near future. This sentiment echoes the predictions of many analysts, including the ever-astute Arthur Hayes, who recently lamented on X that Bitcoin may soon revisit the $78,000 threshold, with the ominous possibility of descending even further to $75,000. Oh, the humanity!

An ugly start to the week. Looks like $BTC will retest $78k. If it fails, $75k is next in the crosshairs. There are a lot of options OI struck $70-$75k, if we get into that range it will be violent.

— Arthur Hayes (@CryptoHayes) March 9, 2025

Read More

- 10 Most Anticipated Anime of 2025

- Silver Rate Forecast

- Pi Network (PI) Price Prediction for 2025

- USD CNY PREDICTION

- USD MXN PREDICTION

- Gold Rate Forecast

- Brent Oil Forecast

- USD JPY PREDICTION

- How to Watch 2025 NBA Draft Live Online Without Cable

- EUR CNY PREDICTION

2025-03-10 17:40