Just when you thought the weekend couldn’t get any worse, the cryptocurrency market decided to pull a fast one on traders. Early Friday, Bitcoin plummeted below $104,000 and Ethereum slid by over 10%, triggering a staggering $1.1 billion in leveraged liquidations within the past 24 hours. 😱

The sharp decline was sparked by Israeli airstrikes on Iran, amplifying global geopolitical tensions and driving a classic “risk-off” sentiment among investors. 💣

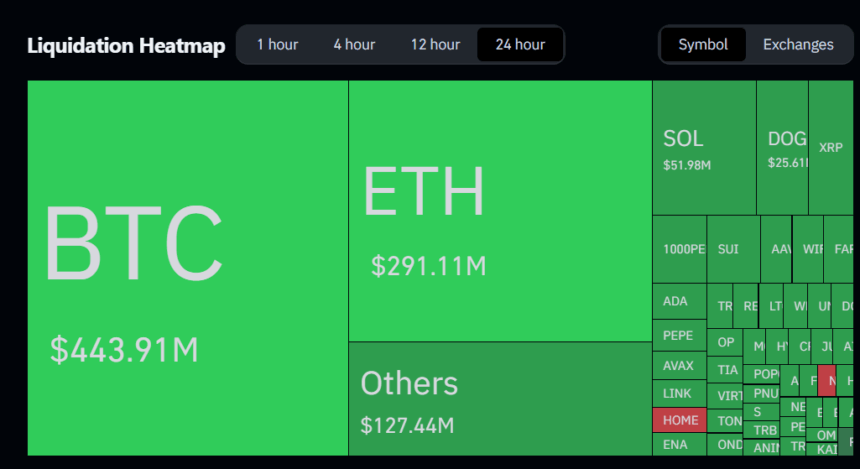

According to Coinglass data, Bitcoin-backed leveraged perpetuals have seen the wiping out of nearly $444 million, in which $422 million was accounted for by long positions and approximately $22 million by short positions. Ethereum perpetuals have also recorded notable liquidation, totaling $291 million, which includes $245 million in long positions and $45 million in shorts. Other leading altcoins have also seen significant flushes following these two leaders. 📉

Historically, such geopolitical instability has pushed investors toward traditional safe havens like gold and U.S. Treasuries, a trend reinforced by a 2022 National Bureau of Economic Research study linking conflict zones to 15-20% volatility spikes in cryptocurrency prices. However, this time, Bitcoin, often dubbed “digital gold,” failed to retain its safe-haven narrative, dropping to key support near $103,000, while Ethereum saw its month-long rally take a sharp reversal. 😲

Market analysts observed a spike in trading volumes and noted that the Moving Average Convergence Divergence (MACD) is signaling oversold conditions, though no immediate reversal is evident. Caroline Mauron, co-founder of Orbit Markets, remarked, “Crypto is reacting negatively to the Israel-Iran strikes, in line with major risk assets. We expect technical support around $101,000, but geopolitical news will dominate short-term price action.” 💭

Meanwhile, ETF net outflows for Bitcoin and a shift toward defensive altcoins suggest traders are adopting a wait-and-see approach, pending clearer macro signals. 🕵️♂️

Read More

- 10 Most Anticipated Anime of 2025

- Brent Oil Forecast

- Silver Rate Forecast

- USD MXN PREDICTION

- PUBG Mobile heads back to Riyadh for EWC 2025

- Grimguard Tactics tier list – Ranking the main classes

- Gold Rate Forecast

- Pi Network (PI) Price Prediction for 2025

- Castle Duels tier list – Best Legendary and Epic cards

- How to Watch 2025 NBA Draft Live Online Without Cable

2025-06-13 09:59