As an experienced financial analyst, I find Bluefin’s decision to launch its native token BLUE on the Sui blockchain intriguing. The introduction of a governance token is a common trend among decentralized finance (DeFi) projects, enabling community members to have a say in the development and decision-making process of the protocol.

As a cryptocurrency market analyst, I’m excited to share that Bluefin, the decentralized crypto exchange, has announced its intentions to introduce their native token, named BLUE, onto the Sui blockchain.

Bluefin, a derivatives exchange with an order book system and backing from Polychain Capital, intends to launch its governance token, named BLUE. This token will allow the community to influence the evolution of Bluefin’s Sui-based protocol. According to a blog post published on Thursday, BLUE token holders will be granted the ability to suggest and vote on significant protocol modifications. Individuals aiming to propose a change must amass at least 10,000,000 BLUE in voting power.

The Bluefin team shared that the influence of your vote depends on how many tokens you choose to commit to a particular proposal. The discourse around proposals initiates in a forum setting, and subsequently, there is an official vote conducted on the Bluefin Governance platform using the blockchain.

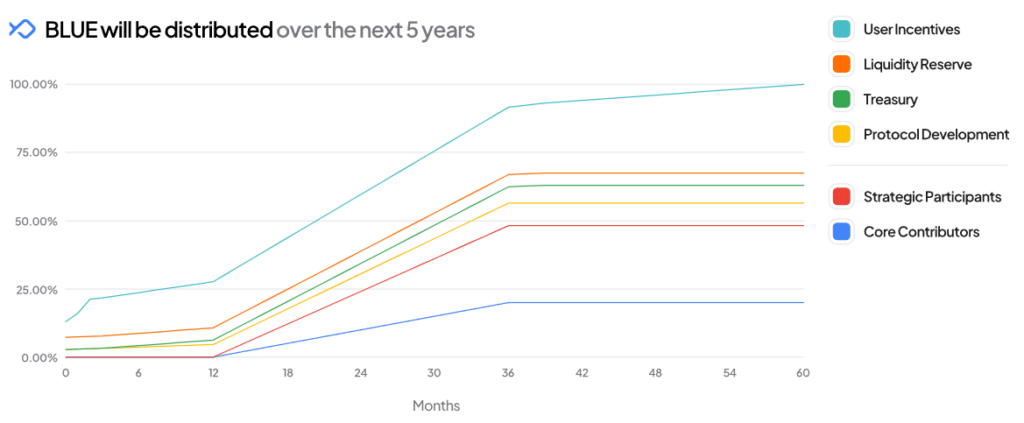

Approximately half of the BLUE tokens will be dedicated to fostering ecosystem growth, with this portion becoming accessible after a five-year period. This allocation encompasses several key components: 32.5% will be set aside for user incentives, 8.5% will support protocol development, 6.5% will bolster the treasury, and a further 4.5% will contribute to the liquidity reserve.

Approximately 28% of the allocation is earmarked for “strategic partners,” which will be distributed among investors through private transactions and advisors, subject to a three-year vesting schedule. The remaining 20% is designated as “core distribution” and similarly vests over a three-year period. According to the tokenomics, BLUE will have a total supply of one billion tokens, with an initial circulating supply of one hundred sixteen million tokens.

Bluefin announces that TrailOfBits has conducted thorough audits on every smart contract linked to the Blue token. This gives investors confidence that there have been no security breaches in Bluefin’s system since the inception of the protocol.

Bluefin was established in 2020 by Rabeel Jawaid, Ahmad Jawaid, Nikodem Grzesiak, and Zabi Mohebzada. As of now, the company has secured around $30 million in funding, as indicated by data from PitchBook. Notable investors, such as Polychain Capital, Brevan Howard Digital, Wintermute, Alliance DAO, and Bixin Ventures, have provided financial backing to Bluefin.

Read More

- 10 Most Anticipated Anime of 2025

- Gold Rate Forecast

- Pi Network (PI) Price Prediction for 2025

- USD MXN PREDICTION

- USD CNY PREDICTION

- Silver Rate Forecast

- USD JPY PREDICTION

- EUR CNY PREDICTION

- Brent Oil Forecast

- Castle Duels tier list – Best Legendary and Epic cards

2024-06-27 16:40