As a seasoned analyst with over two decades of experience in the financial markets, I have witnessed countless market cycles and their unique dynamics. The recent surge in centralized exchange (CEX) volumes despite the declining crypto prices last month is indeed intriguing.

Although cryptocurrency prices decreased during the past month, there was a surge in activity on centralized exchanges instead.

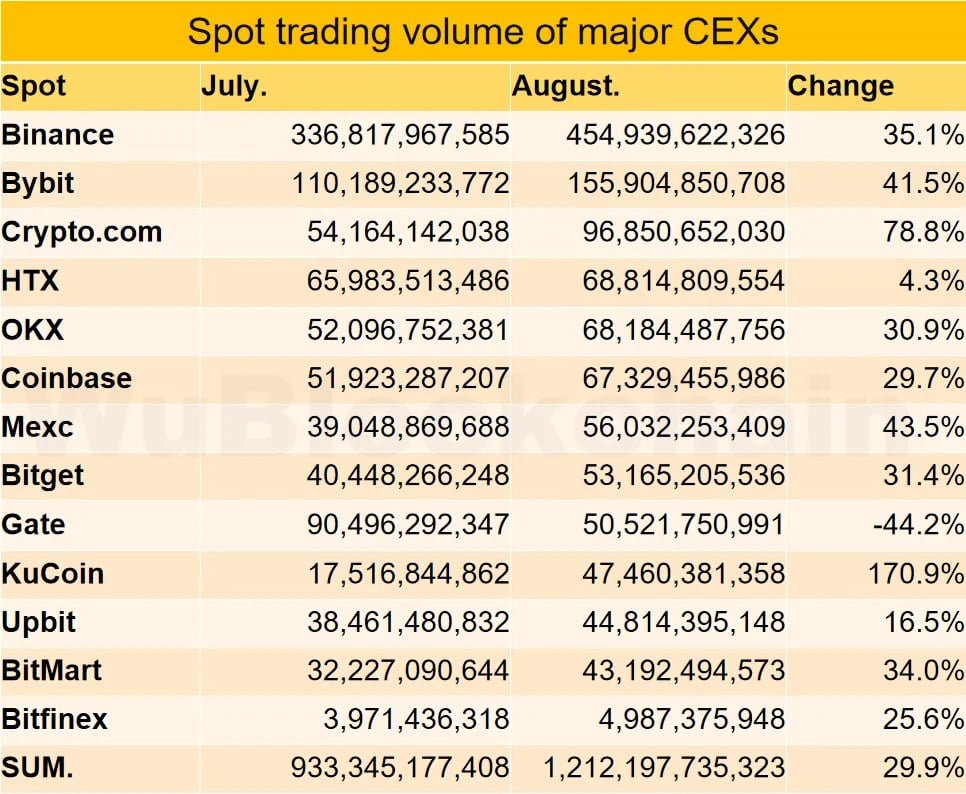

As a researcher delving into the world of cryptocurrencies, I’ve observed an intriguing trend: despite Bitcoin (BTC) and other digital assets experiencing a significant downturn in August, data from centralized exchanges revealed a 30% month-on-month increase. This finding challenges the usual bearish sentiment associated with August in the crypto market. However, it’s important to note that lower prices don’t always equate to reduced trading activity, as the data clearly demonstrates.

Among the leading centralized exchanges (CEX), Binance and Bybit showed significant growth of approximately 35% and 41% respectively. On the other hand, KuCoin, Crypto.com, and MEXC surpassed their larger counterparts, as spot trading volumes spiked by 171%, 79%, and 44% on these platforms. This surge in activity suggests a shift of assets and blockchain-based value among investors.

Simultaneously, Gate experienced a 44% drop in activity, whereas HTX, supported by Justin Sun, and South Korea’s Upbit registered the smallest growths in trading volumes.

Why CEX volume jumped when price slumped

Following crypto.news’ recent update, I noticed that last month saw massive Bitcoin withdrawals from prominent exchanges such as Binance and Coinbase, with billions in outflows. This could be interpreted as a positive indicator, suggesting that investors are taking their profits or holding onto their cryptocurrency assets off the exchange, potentially signaling a bullish trend.

An increase in trading volume on CEX platforms suggests that digital asset investors are hopeful. If there are no unexpected shifts or unfavorable economic data, U.S. Federal Reserve officials might implement interest rate reductions by the end of this month.

As a crypto investor, I might say: With lower interest rates, there’s an increased temptation for me to borrow funds more freely and potentially increase my investments in various assets, given that my risk tolerance seems to be growing along with the falling costs of borrowing money.

CoinBureau CEO Nic Puckrin told crypto.news via email that the increased liquidity could lead to price progression for Bitcoin and other cryptocurrencies. Puckrin added that Bitcoin will likely lead the way, while altcoins like Ethereum (ETH) continue to underperform relative to BTC. Bitcoin whales entered an accumulation spree ahead of the expected Fed rate cuts.

I would say that the current market is positioned for a soft September. I expect Bitcoin to continue trading in a range bound fashion for the coming few weeks. Altcoins are likely to fall relative to Bitcoin therefore leading to an increase in Bitcoin dominance.

Read More

- 10 Most Anticipated Anime of 2025

- Gold Rate Forecast

- Grimguard Tactics tier list – Ranking the main classes

- USD MXN PREDICTION

- Castle Duels tier list – Best Legendary and Epic cards

- PUBG Mobile heads back to Riyadh for EWC 2025

- Silver Rate Forecast

- Brent Oil Forecast

- USD CNY PREDICTION

- How to Watch 2025 NBA Draft Live Online Without Cable

2024-09-10 18:38