As a researcher with a background in finance and experience in following the cryptocurrency market closely, I find myself intrigued by the ongoing price action of Bitcoin. The recent tight trading range has been accompanied by bullish predictions from industry experts, who foresee significant price growth in the coming months.

Over the past several weeks, Bitcoin‘s price has stayed fairly stable within a narrow band. It reached a high of $71,935 last week, only to encounter significant opposition at that level. By Thursday, the cryptocurrency had dropped to $68,000, representing an approximately 8% decrease from its highest mark achieved in 2021.

Analysts are bullish on Bitcoin

Bitcoin’s price is gaining favor among cryptocurrency specialists. In April, Cathie Wood of Ark Invest raised her future estimate to $3.8 million, placing her among the most optimistic figures in this sector.

Lately, Michael Novogratz, the wealthy founder of Galaxy Digital, predicted that Bitcoin’s value would reach approximately $100,000 by the end of this year.

In a recent post on the X forum, cryptocurrency analyst CryptoCon predicted that the value of the coin would reach $91,539 by the end of the year.

As a researcher studying the Bitcoin market, I’ve noticed that a significant target of $91,539 remains untouched and unaltered. Reaching this level is my next objective, taking some time to get there at the third stage of the Magic bands. Eventually, with patience and persistence, I will make progress towards it.

— CryptoCon (@CryptoCon_) June 12, 2024

According to Robert Kiyosaki from “Rich Dad, Poor Dad,” Bitcoin is predicted to reach a price of $350,000 by the end of the next summer.

By August 25, 2024, Bitcoin’s value may reach $350,000. This isn’t a falsehood; it’s a forecast, an estimate, or a hopeful expectation. It could be considered an attempt to lure unsuspecting individuals, but it’s not a lie because predictions about the future aren’t inherently untruthful. I personally desire and anticipate that Bitcoin will reach $350,000 by then.

— Robert Kiyosaki (@theRealKiyosaki) June 5, 2024

The bullish case for Bitcoin

As an analyst, I have observed that several positive factors are driving the bullish sentiment in Bitcoin. One such catalyst is the increasing adoption by institutions. The impressive performance of Bitcoin ETFs is a clear indication of this trend. With over 880,000 coins worth more than $60 billion under management, these funds represent a significant institutional investment in Bitcoin. Furthermore, MicroStrategy’s intent to acquire even more Bitcoins adds to the growing institutional demand for this digital currency.

Secondly, the expansion of Bitcoin’s supply has come to a halt following the latest halving. Numerous Bitcoin mining corporations have announced significant decreases in output. For instance, CleanSpark extracted 417 coins in May, which is a decrease from the 721 coins they mined in April.

In May, Riot Platforms extracted 215 coins, a decrease from the 375 coins they obtained in April. On the other hand, Marathon Digital yielded 616 coins last month, which is lower than the 850 coins they produced in April.

Concurrently, the quantity of Bitcoin held in exchanges has declined noticeably over the past few months. This trend, which involves increasing demand coupled with decreasing supply, may indicate further price growth for the digital currency.

As an analyst, I’ve observed that the regulatory landscape in the United States has grown more transparent recently. This development might encourage financial institutions such as JPMorgan and Goldman Sachs to enter the custody solutions market.

As an analyst, I would put it this way: From my perspective, Bitcoin appears to be a more attractive currency choice than the US dollar given its increasing supply and the escalating public debt in the United States. In contrast to the USD, which has a sole issuer and theoretically unlimited supply, Bitcoin operates on a decentralized network with a predetermined maximum limit of 21 million coins.

Bitcoin price forecast

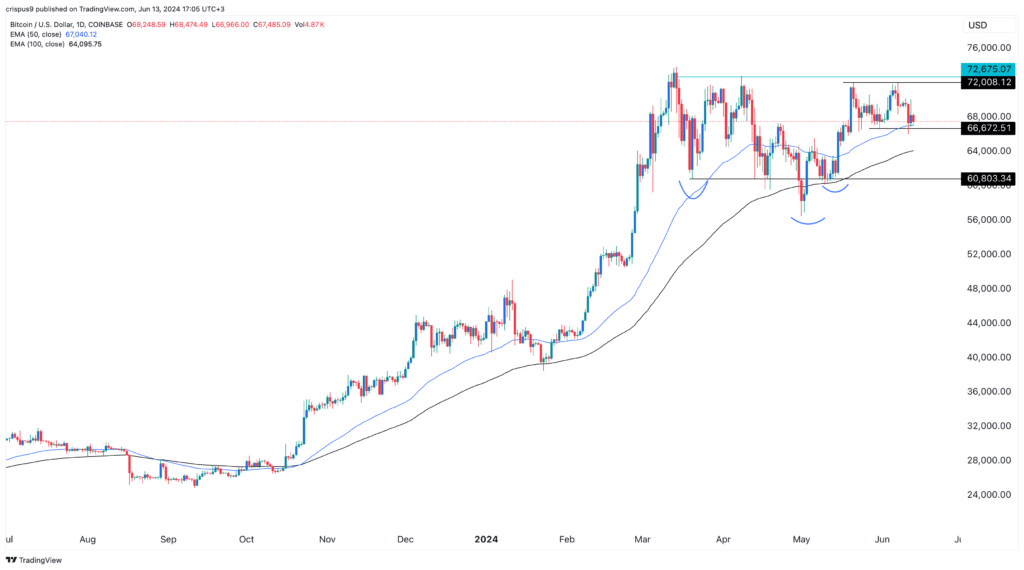

BTC daily chart

The Bitcoin daily chart presents contrasting indications. On the optimistic note, the cryptocurrency persistently hovers above the 50-day and 100-day Exponential Moving Averages (EMAs). Additionally, it appears to have formed an inverse head and shoulders pattern, which is often seen as a bullish signal. If Bitcoin manages to surpass its yearly high, this pattern could lead to a significant price increase – potentially reaching $80,000.

From a different perspective, Bitcoin has developed a double-top formation with a peak price of $72,000. In technical analysis, this is a common bearish indicator in the market. If the price falls below the pattern’s neckline at $66,672 and experiences increased volume during the decline, it could signal further decreases towards the level of $60,800 (the low from March 20th).

Read More

- 10 Most Anticipated Anime of 2025

- Brent Oil Forecast

- USD MXN PREDICTION

- Silver Rate Forecast

- PUBG Mobile heads back to Riyadh for EWC 2025

- Gold Rate Forecast

- Grimguard Tactics tier list – Ranking the main classes

- Pi Network (PI) Price Prediction for 2025

- Castle Duels tier list – Best Legendary and Epic cards

- How to Watch 2025 NBA Draft Live Online Without Cable

2024-06-13 17:32