As a seasoned researcher with a decade of experience in the volatile and unpredictable world of cryptocurrencies, I’ve seen more than my fair share of market highs and lows. The current downturn in the crypto markets, particularly Bitcoin (BTC), is no exception. However, this time around, there seems to be a silver lining amidst the storm – a shift towards patience and resilience among long-term investors.

During this significant market decline for cryptocurrencies, long-term investors seem to be maintaining their holdings more and more, according to experts’ opinions.

Bitcoin (BTC) is currently facing one of the most substantial declines in this phase, yet recent findings indicate a transition towards a more steadfast and deliberate group of investors. As per a Glassnode report dated August 13, the market has been undergoing its “most considerable downtrend of the cycle,” triggered by a prolonged spell of cautious distribution among investors.

In spite of difficult circumstances, an increasing number of long-term investors choose to keep their possessions instead of disposing them, suggesting a change in investing habits towards maintaining or “holding on” to their investments.

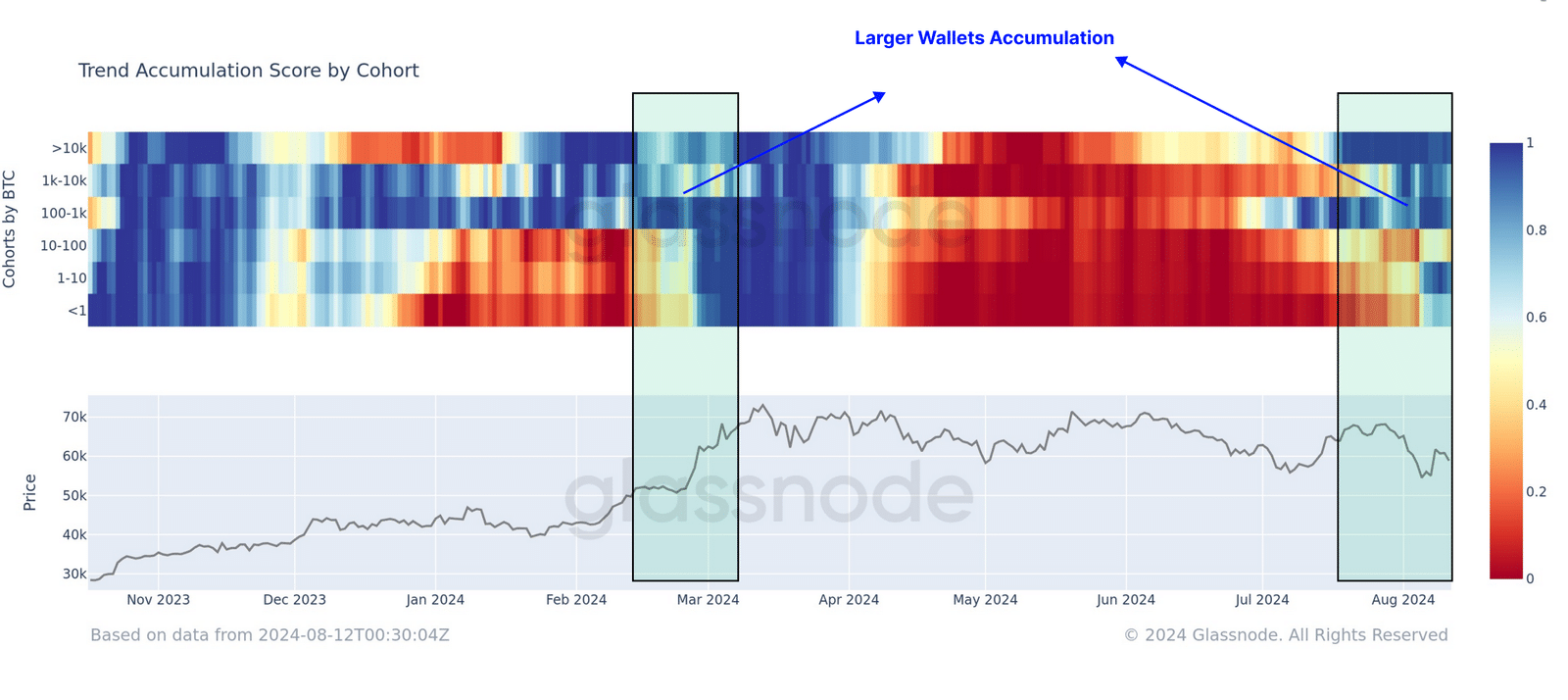

The Market-Wide Accumulation Pattern Score, which evaluates buying trends across the market, has peaked at its maximum value of 1.0, signifying that the market is once again leaning towards accumulation. According to Glassnode, this group of investors has now shifted back to a strategy known as “HODLing,” moving approximately 374,000 Bitcoin into Long-Term Holder (LTH) status over the past three months.

Bitcoin’s price holds strong despite sell-offs

In spite of significant reductions in Bitcoin ownership between April and July, its current market value persistently surpasses the average purchase price for active investors, suggesting that the market remains robust, as reported by a blockchain analysis company.

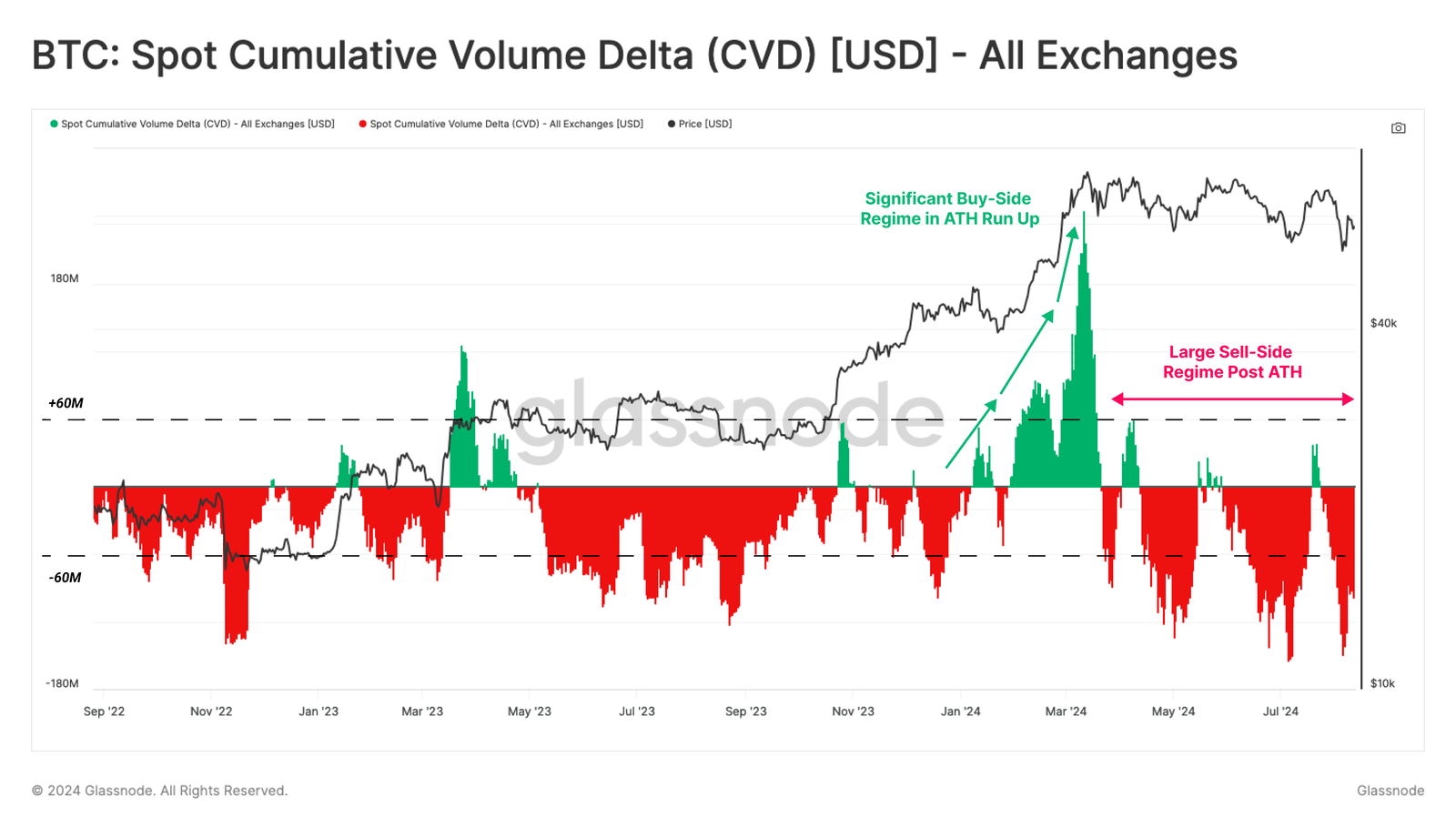

1. The report further indicates that the modified Total Volume Change (Spot Cumulative Volume Delta) has shown a downward trend, suggesting continuous net selling from traders. Interestingly, despite this, the Long-Term Holder Sell Pressure Ratio is at a “reduced level” compared to historical market peaks. This suggests that the amount of profit-taking by long-term holders is “relatively modest in comparison to past market cycles,” according to Glassnode.

The team further explained that they are anticipating a rise in prices before they intensify their distribution efforts, according to their statement.

As Bitcoin’s value remains roughly at $60,000, it seems that investors are adopting a wait-and-see approach, preferring to make changes in their holdings once prices rise further. This patient, long-term perspective is suggested by Glassnode’s analysis, despite the continued fluctuations in Bitcoin’s value.

Read More

- 10 Most Anticipated Anime of 2025

- Gold Rate Forecast

- Pi Network (PI) Price Prediction for 2025

- USD MXN PREDICTION

- USD CNY PREDICTION

- Silver Rate Forecast

- USD JPY PREDICTION

- EUR CNY PREDICTION

- Brent Oil Forecast

- Castle Duels tier list – Best Legendary and Epic cards

2024-08-13 16:46