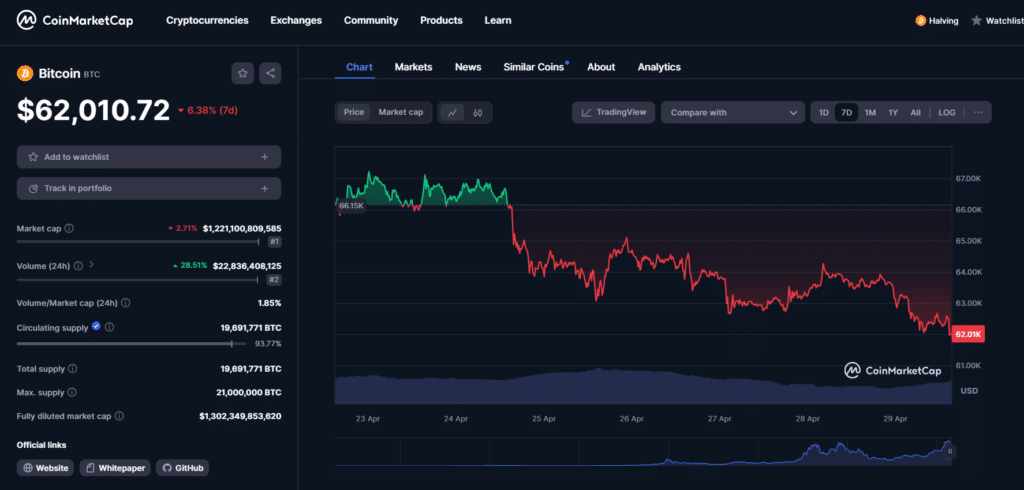

As a seasoned crypto investor with years of experience under my belt, I’ve seen my fair share of market volatility. Last week’s 5% drop in Bitcoin was nothing new to me, but the massive outflows from Bitcoin and Ethereum investment products were concerning.

Last week, as Bitcoin experienced a decline of over 5%, crypto investors proceeded with the withdrawal of their funds from various digital asset investment vehicles such as spot exchange-traded funds.

Based on the latest report from CoinShares, there was an outflow of approximately $435 million from digital asset investment products. This occurred concurrently with a 6% decrease in trading volume for ETFs. The total trading activity dropped significantly from around $18 billion two weeks prior to $11.8 billion last week.

Bitcoin (BTC) and Ethereum (ETH) accounted for the largest portions of exit transactions, totaling $451 million and $38 million respectively. The majority of these transactions, predominantly in Bitcoin, took place in the United States and were mainly linked to Grayscale’s converted GBTC ETF.

The loss of approximately $440 million in outflows from Grayscale’s Bitcoin ETF (GBTC) represents the smallest weekly withdrawal since March. Simultaneously, inflows into new spot Bitcoin ETFs provided by companies such as BlackRock and Fidelity experienced a decrease. With Bitcoin prices remaining stationary, a total of $126 million was the cumulative capital infusion into the 10 newly introduced spot Bitcoin ETFs.

From my perspective as a researcher studying the cryptocurrency market, I’ve observed that Ethereum outflows have historically corresponded with bearish sentiment towards Bitcoin. However, this trend appears to have opened up opportunities for investment in crypto altcoins by asset managers and individual investors alike.

“Various altcoins received significant investments, as traders opted for diverse portfolios containing a mix of popular coins like Solana, Litecoin, and Chainlink, in addition to others.”

CoinShares analysts

Approximately $9 million flowed into altcoin investment products, with Solana (SOL) securing the largest portion at around $4 million. Litecoin (LTC) came in second with approximately $3 million, while Chainlink (LINK) drew in about $2.8 million.

Read More

- 10 Most Anticipated Anime of 2025

- Gold Rate Forecast

- Pi Network (PI) Price Prediction for 2025

- USD CNY PREDICTION

- USD MXN PREDICTION

- Silver Rate Forecast

- USD JPY PREDICTION

- EUR CNY PREDICTION

- Brent Oil Forecast

- Castle Duels tier list – Best Legendary and Epic cards

2024-04-29 19:04