In simpler terms, approximately $210 million in cryptocurrencies have been sold off due to market instability, and most of these sales were from investors holding long positions.

According to Coinglass’s crypto data, Bitcoin (BTC) has experienced a 4% decrease in value over the past day due to market instability. This downturn resulted in losses for approximately 92,300 traders, totaling around $210.26 million from both long and short positions.

Approximately $178.2 million worth of liquidations, mostly related to long positions, have taken place, while short positions accounted for about $32.05 million in liquidations. Long positions make up 84.7% of all the liquidated trades, leading to a quick shift from optimistic to pessimistic market sentiment as prices turn negative.

In addition, Bitcoin’s dip from its previous record-breaking price of $67,183 on April 23 has contributed to the current market turbulence. After reaching this height, Bitcoin underwent a significant correction, resulting in a 3.2% decrease by the end of the previous trading day.

The persistent bearish trend caused Bitcoin to drop below the notable price level of $64,000 today. The total value of all cryptocurrencies has decreased by 3.87% in the last 24 hours, amounting to $2.47 trillion, while altcoins have also entered a bearish phase.

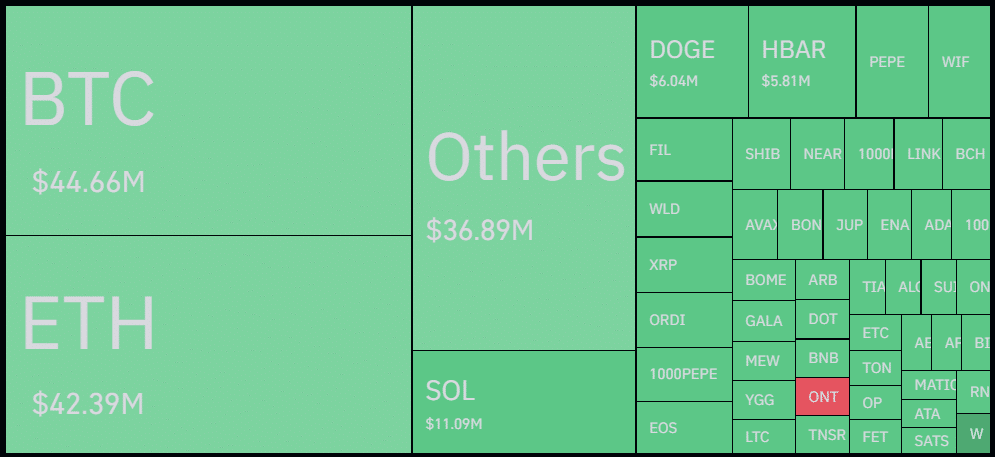

Bitcoin, as the leading cryptocurrency, experienced the greatest number of liquidated positions among all digital currencies in the past day, amounting to approximately $44.6 million.

On April 18, prior to the latest Bitcoin halving on April 20, there was a significant trend towards liquidating holdings across the cryptocurrency market, leading to a loss of approximately $247 million. However, this downturn was followed by renewed optimism sparked by the Bitcoin halving event, causing many traders to buy back into the market and take on new long positions during the subsequent recovery.

In contrast to the rise in bankruptcies, the derivatives market has experienced a significant uptick in activity. The daily trading volume has soared by 30% over the past 24 hours, amounting to $159 billion as of the latest update. This trend is attributable to a higher number of short positions being taken, resulting in a current long/short ratio of 0.7832.

Read More

- 10 Most Anticipated Anime of 2025

- USD MXN PREDICTION

- Pi Network (PI) Price Prediction for 2025

- Silver Rate Forecast

- Brent Oil Forecast

- USD JPY PREDICTION

- USD CNY PREDICTION

- How to Watch 2025 NBA Draft Live Online Without Cable

- Gold Rate Forecast

- Castle Duels tier list – Best Legendary and Epic cards

2024-04-25 12:52