As a researcher with extensive experience in the cryptocurrency market, I find the recent price surge following the U.S. Consumer Price Index (CPI) report to be an intriguing development. The 3.4% increase in the CPI from the previous month seems to have triggered a strong positive reaction from Bitcoin and altcoins.

After the publication of the U.S. Consumer Price Index (CPI) report, the total value of all cryptocurrencies in circulation has experienced significant growth.

Significantly, the Consumer Price Index (CPI) in the United States rose by 3.4% year-over-year as of April, according to crypto.news’ latest update. Previously, in March, the CPI stood at a 3.7% increase.

As a crypto investor, I’ve noticed some significant price jumps in Bitcoin (BTC) and various top altcoins following the latest Consumer Price Index (CPI) report. According to CoinGecko, the overall cryptocurrency market capitalization has risen by approximately 5.7% within the past 24 hours, reaching a current value of around $2.51 trillion – a figure not seen since April 23rd.

The global crypto daily trading volume witnessed a 40% rally, surpassing the $100 billion zone.

I’ve analyzed the cryptocurrency market and found that Bitcoin, the front-runner, experienced a 6.7% growth over the last 24 hours, reaching a trading price of $65,980 at this moment. Notably, it had previously reached $66,000 earlier today. Additionally, Bitcoin’s market capitalization exceeded $1.3 trillion for the first time in the past three weeks.

The BTC daily trading volume also increased by 72%, reaching $43.3 billion.

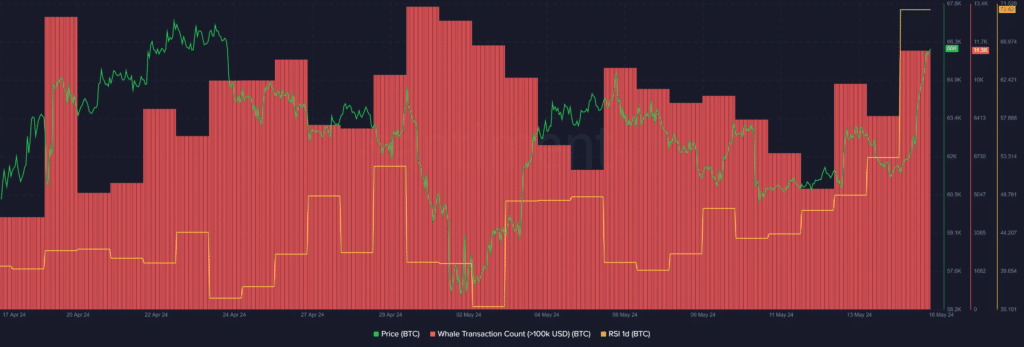

Based on data obtained from Santiment, I discovered that there was a significant increase of approximately 33.8% in the number of Bitcoin whale transactions worth over $100,000 within the past day. This surge brought the total count of such transactions up from 8,520 to 11,397.

As an analyst, I’ve observed a notable combination of escalating trading volumes and enhanced whale activities in the market. This trend suggests that significant price fluctuations and unexpected price swings are likely to occur.

Over the last 24 hours, the Bitcoin Relative Strength Index (RSI) increased from 53 to 70. This implies that Bitcoin is currently overvalued according to this technical indicator. When RSI values are below 50, Bitcoin’s price may be primed for a steady increase.

Read More

- 10 Most Anticipated Anime of 2025

- USD MXN PREDICTION

- Brent Oil Forecast

- Pi Network (PI) Price Prediction for 2025

- Silver Rate Forecast

- USD JPY PREDICTION

- USD CNY PREDICTION

- How to Watch 2025 NBA Draft Live Online Without Cable

- Gold Rate Forecast

- Castle Duels tier list – Best Legendary and Epic cards

2024-05-16 11:14