As a seasoned researcher who has navigated through numerous market cycles and witnessed the crypto rollercoaster firsthand, I find myself standing at the crossroads of cautious optimism and calculated risk-taking. The recent surge in the crypto market is undeniably captivating, with Bitcoin leading the charge and breaching new heights.

The attitude towards cryptocurrencies is undergoing a significant change, with top digital assets maintaining a strong upward trend.

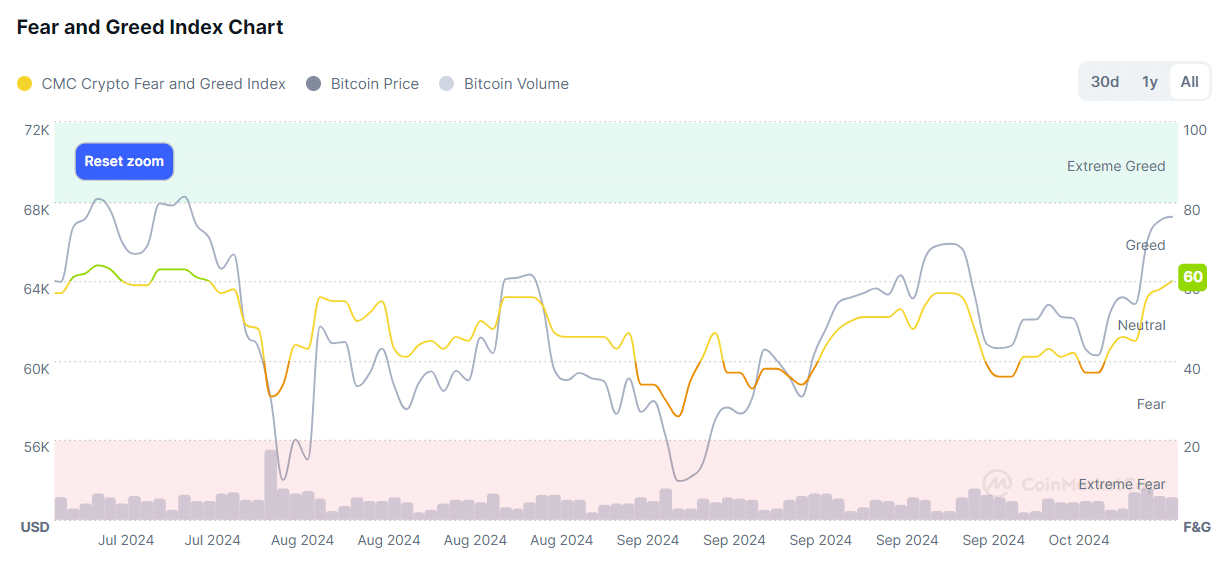

Based on information from CoinMarketCap, we find that the cryptocurrency Fear & Greed Index landed in the 60 range today, suggesting a moderately greedy market atmosphere.

For the first time in six weeks, the cryptocurrency market has reached a level of excessive optimism, last observed on July 31. A significant decline occurred early in August, following a drop in the Bitcoin (BTC) price that fell beneath the $54,000 threshold.

The upturn in the overall market was fueled by Bitcoin’s positive trend. Since October 10th, the price of Bitcoin has been consistently climbing, resulting in a 12% increase over the last week. On October 16th, Bitcoin even reached a two-month peak of $68,375.

In just the last day, Bitcoin has experienced a small adjustment but remains on an upward trend, currently valued at approximately $67,350 as we speak.

Based on statistics by IntoTheBlock, approximately 95% of Bitcoin owners are presently making a profit, around 3% are near their original investment amount, and about 2% are experiencing a loss.

Given the current situation, it’s quite typical for some investors to take their profits sooner rather than later, as there’s an influx of individuals who are currently in a profitable position.

Conversely, the count of daily profitable addresses dropped from 112,780 to 91,160 unique wallets during the period between Oct. 15 and 16. This decrease suggests that some investors may be holding out for a potential additional price increase rather than immediately cashing out their profits.

One significant factor driving Bitcoin’s price surge is the rising interest in U.S.-based Bitcoin spot exchange-traded funds (ETFs). According to a recent report from crypto.news, these investment products have experienced a net inflow of more than $1.6 billion over the past four days, with $458.5 million flowing in on October 16th alone.

Read More

- 10 Most Anticipated Anime of 2025

- Pi Network (PI) Price Prediction for 2025

- USD MXN PREDICTION

- Silver Rate Forecast

- Gold Rate Forecast

- USD CNY PREDICTION

- Brent Oil Forecast

- How to Watch 2025 NBA Draft Live Online Without Cable

- USD JPY PREDICTION

- PUBG Mobile heads back to Riyadh for EWC 2025

2024-10-17 10:46