As a seasoned cryptocurrency investor with over a decade of experience navigating market fluctuations and economic indicators, I can’t help but feel a familiar sense of anticipation amidst the current market downturn. The impending U.S. Consumer Price Index report has a knack for causing ripples in the crypto market, and history seems to be repeating itself.

As a researcher examining the cryptocurrency market, I’ve noticed hints that a correction might be imminent, just prior to the unveiling of the U.S. Consumer Price Index report.

Over the last day, the total value of all cryptocurrencies dropped by approximately 3.3%, currently standing at around $2.22 trillion, according to data from CoinGecko. The trading volume across the market has fluctuated between $80 billion and $87 billion, with bears still in control.

Currently, Bitcoin (BTC) has dipped beneath $61,000 and is being traded at approximately $60,800 as we speak. Earlier today, the top digital currency momentarily hit a daily low of around $60,300.

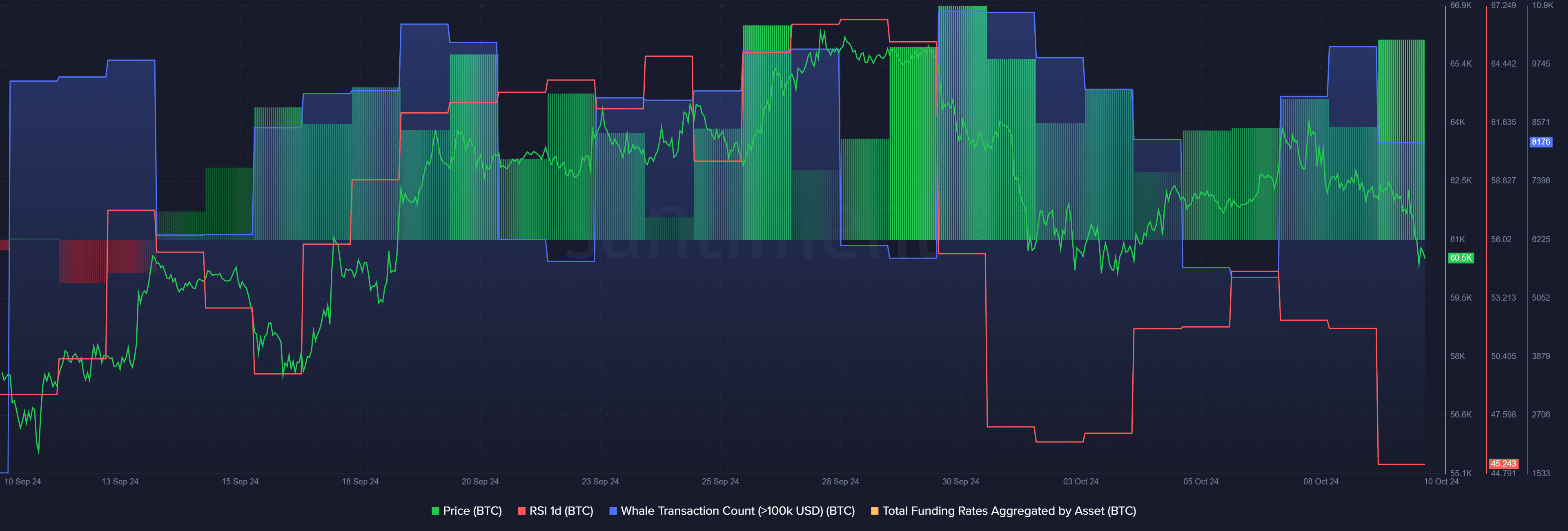

Based on Santiment’s data, the number of significant Bitcoin transactions made by large investors (whales) worth over $100,000 dropped from 10,098 to 8,176 within the last day. A decrease in such activity among whales often suggests a market trend towards apprehension or selling pressure from smaller traders.

In the last day, the funding rate for BTC significantly increased from 0.004% to 0.007%, indicating that there’s more betting on Bitcoin’s price rise rather than fall. But if Bitcoin drops below $60,000, it might lead to higher liquidations and potentially further adjustments in the market.

According to data from Santiment, Bitcoin’s Relative Strength Index stands at 45, indicating it’s presently in a neutral zone before today’s U.S. Consumer Price Index (CPI) report. This means that the RSI suggests Bitcoin is neither overbought nor oversold ahead of this significant economic event.

For August, the Consumer Price Index in the United States stood at 2.5%, a figure not observed since March 2021. Analysts predict it will fall to 2.3% next time around. This potential decrease might heighten the likelihood of another interest rate reduction during the Federal Open Markets Committee meeting scheduled for November 6 and 7.

One significant factor that boosted Bitcoin’s price past $64,000 last week was the positive U.S. jobs report. If American inflation decreases once more, it could generate a surge of optimism in financial markets, such as cryptocurrency.

Read More

- 10 Most Anticipated Anime of 2025

- USD CNY PREDICTION

- Pi Network (PI) Price Prediction for 2025

- Gold Rate Forecast

- USD MXN PREDICTION

- Silver Rate Forecast

- USD JPY PREDICTION

- EUR CNY PREDICTION

- Brent Oil Forecast

- Castle Duels tier list – Best Legendary and Epic cards

2024-10-10 10:49