This article provides an analysis of MicroStrategy and Marathon Digital Holdings, two significant players in the crypto industry, focusing on their financial performance, market trends, and recent developments.

How does the price surge of Bitcoin and Ethereum influence the shares of cryptocurrency-associated companies, and is this bullish momentum expected to persist?

Table of Contents

In the past few weeks, there have been numerous signs of pessimism and market contraction within the cryptocurrency sphere. However, over the last day, this trend has taken a turn for the better.

Bitcoin’s price has broken through the $70,000 barrier and is now trading at approximately $71,000 as of May 21. On the other hand, Ethereum has experienced a remarkable surge, rising over 20% to trade above $3,700.

Eric Balchunas, a senior analyst at Bloomberg, recently boosted the likelihood of Ethereum ETF approval from 25% to 75% with a noteworthy announcement.

As a researcher, I’ve recently upgraded my estimation of the likelihood for the approval of a spot Ether Exchange-Traded Fund (ETF) to 75%, following new information suggesting a potential shift in stance from the Securities and Exchange Commission (SEC). This was previously assessed at only 25%. The increasing political nature of this issue has led to heightened anticipation, with many, including myself, preparing for a denied application. However, recent chatter indicates that the SEC could be reconsidering their position.

— Eric Balchunas (@EricBalchunas) May 20, 2024

Balchunas observed that the SEC seems to be expediting its decision-making procedure regarding ETFs, which could be a result of political influences and its historically conservative approach to these investment funds.

The bullish outlook is reinforced by the optimism amongst hashrate futures contract traders. According to analysts at Hashrate Index, there will be an uptick in hashprice within the following half-year. They anticipate a surge in Bitcoin’s transaction fees and continued price growth.

As a crypto investor, I’m excited to share some insights about the recent market trends for Hashrate and Hashprice.

— Hashrate Index 🟧⛏️ (@hashrateindex) May 21, 2024

Their latest statement on X (previously Twitter) expresses this viewpoint: The surge in Bitcoin’s value to $70,000 has significantly improved hashrate prices, as mentioned in their post, although the current hashprice remains comparatively low compared to past halving periods.

Due to the surge in cryptocurrencies’ value, stocks connected to crypto have experienced significant growth as well.

On May 20th, Coinbase (COIN) experienced a 9% increase, reaching a price of $225. Likewise, MicroStrategy (MSTR) saw a 9% rise, trading at $1,727, indicating that the optimistic sentiment in the cryptocurrency market is extending to stocks connected to the crypto industry.

Given the recent turn of events, let’s take a closer look at how these stocks have fared and what potential future outcomes may be.

What’s happening with Coinbase?

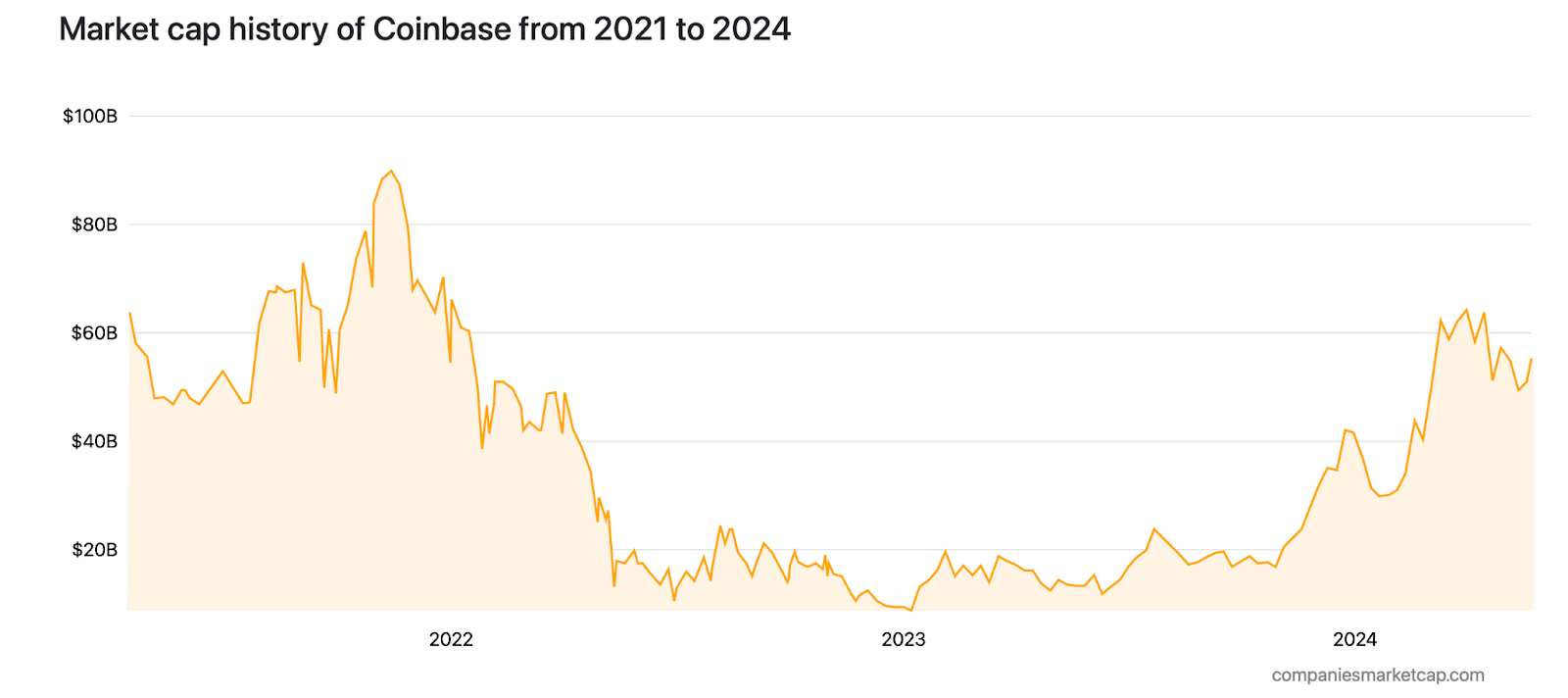

In contrast to recording a decline in revenue between the years 2021 and 2022, Coinbase holds a market capitalization of more than $55 billion, making it the 340th most valuable company globally as of May 2024.

As a researcher studying Coinbase’s stock performance, I’ve noticed an intriguing trend. In June 2022, the share price hit a rock-bottom of $47. However, just a year later, on May 20, the price soared to $225 – a staggering 378% increase from its previous low. Over the past twelve months, Coinbase’s stock has experienced an impressive rise of more than 268%. Furthermore, in the last six months alone, the price has climbed over 113%.

In the year 2023, Coinbase generated a revenue of $3.97 billion, representing a decline from the reported figure of $7.83 billion in the year 2021. Conversely, during the initial quarter of 2024, the company recorded an impressive surge in revenue, reaching a total of $1.6 billion – representing a significant 72% growth compared to the preceding quarter.

The significant increase in income and rising stock value can be attributed mainly to an uptick in transactions. This trend is fueled by the broad crypto market’s expansion and the implementation of crypto-friendly accounting regulations.

In Q1 2024, the corporation reported net earnings of $1.18 billion, equivalent to $4.40 per share. This represents a significant improvement over the previous year’s loss of $78.9 million, or 34 cents per share.

As a researcher examining Coinbase’s financial performance, I’ve identified three primary revenue streams during the recent quarter. Firstly, consumer transaction revenue amounted to $935 million. Secondly, total transaction revenue experienced significant growth, reaching nearly triple the amount at $1.08 billion. Lastly, subscription and services revenue contributed a substantial sum of $511 million to Coinbase’s earnings for the same period.

As an analyst, I can say that the surge in Bitcoin (BTC) and Ethereum (ETH) prices during the initial quarter of the year brought significant advantages to the company. Reaching new heights above $73,000 in March for Bitcoin, and undergoing its first major upgrade in over a year for Ethereum, sparked increased trading volumes and heightened demand for our services at Coinbase.

Expanding on this, Coinbase has emerged as a significant player in the institutional investment sector, following the SEC’s approval of the U.S. spot Bitcoin ETF. Numerous funds have selected Coinbase as their custodian, resulting in increased demand for the platform and its offerings.

Microstrategy’s Bitcoin bet

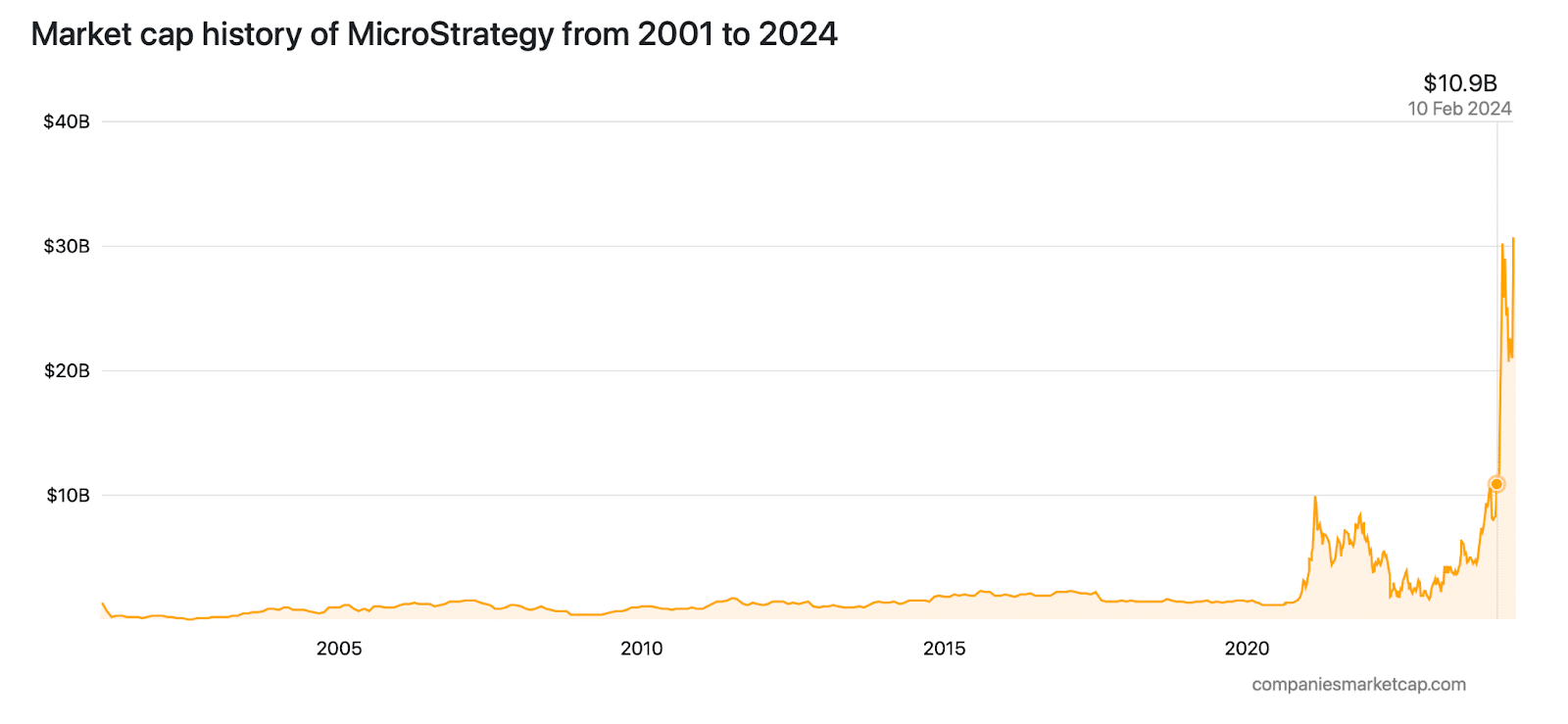

As a researcher studying the financial markets, I’ve observed that MicroStrategy, with a market capitalization ranking at 654th place globally in May 2024, has undergone significant changes in terms of its market value throughout the years.

As a researcher studying this company’s market capitalization trends, I’ve discovered an astounding growth between 2020 and 2024. The market cap soared from a modest $3.60 billion to a staggering $30.63 billion – that’s a mind-boggling increase of 750%. This expansion is even more noteworthy given the company experienced a significant downturn, with its market cap shrinking by 73.42% to hit a low of $1.63 billion by the end of 2022.

As a crypto investor looking back at Microstrategy’s (MSTR) stock performance from 2000 to 2020, I noticed an intriguing narrative in the company’s share price. During this period, MSTR’s stock price showed little movement, mostly staying within the $100 to $150 range without any significant surges.

Starting in 2020, the company’s stock price has experienced consistent growth. Over the past five years, it surged by more than 1180%, and within just the previous year, it saw nearly a 500% increase. Currently, the share price stands at $1,727 as of May 20th.

As a researcher examining MicroStrategy’s financial performance, I’ve noticed some variability in the company’s revenue figures. In the year 2023, MicroStrategy reported a revenue of $0.48 billion, which marked a decline from the $0.51 billion recorded in 2021. A similar pattern was observed in 2022, where revenue decreased to $0.49 billion from $0.51 billion in the previous year.

The P/E ratio of MicroStrategy is an important figure to consider, currently reported as 200.144 based on recent financial data. This represents a significant jump from the negative 1.09 ratio recorded at the end of last year.

As a researcher studying the financial markets, I’ve noticed that MicroStrategy’s high Price-to-Earnings (P/E) ratio suggests investors are eager to pay a premium for the company’s earnings. This could be due to its impressive performance and promising growth prospects. Nonetheless, investing in high P/E stocks like MicroStrategy involves substantial risks.

I, as an analyst, would rephrase it this way: One significant reason for MicroStrategy’s recent prosperity is its large stash of bitcoin. The corporation holds a total of 214,400 bitcoins as of Q1 2024, which translates to a staggering valuation of around $15.26 billion, based on the current market price on May 21.

With an average purchase price of $35,180 per Bitcoin, these holdings have yielded approximately $7.76 billion in paper profits for MicroStrategy.

MicroStrategy’s inclusion in the MSCI World Index serves as evidence of its significant role within the global stock market.

As a crypto investor, I’d put it this way: The MSCI World Index is a comprehensive equity market representation of around 3,000 companies from 23 developed and 24 emerging economies. With MicroStrategy being part of this index, it indicates an increasing trend towards Bitcoin integration in conventional investment portfolios.

What’s the largest BTC miner up to?

Marathon Digital Holdings, with a market capitalization ranking it as the 2,379th most valuable company worldwide as of May 2024, has displayed significant price fluctuations throughout its corporate history.

As a crypto investor looking back on the company’s performance between 2020 and 2024, I’ve noticed an astonishing growth in its market capitalization. Starting from a modest $0.85 billion in 2020, it reached impressive heights of $6.09 billion by 2024, representing a staggering 616% increase. However, this growth wasn’t without its ups and downs. In the midst of this progression, there was a significant setback in 2022 when the market cap took a hit, dropping a steep 88.15%.

The financial story of Marathon is intriguing as told by its revenue growth. In the year 2023, the company reported a revenue of $0.38 billion. This represents a significant jump from the $0.11 billion earned in 2022 and a notable improvement over the $0.15 billion revenue in 2021.

Although Marathon has made strides forward, it has encountered obstacles, as indicated by its present negative P/E ratio of 5.16 (vs. a negative 0.55 in late 2022).

The reasons for a company’s low P/E ratio may include issues with operations, unforeseen equipment malfunctions, the need for transmission line upkeep, and weather conditions adversely affecting its mining operations.

Over the past five years, Marathon’s stock has experienced remarkable growth, rising by an impressive 617%. Additionally, within the last year, there has been a significant increase of around 121% in the share price.

During the first week of May, Marathon’s stock became part of the S&P Global index, marking an essential achievement for the company. Nevertheless, Marathon encountered operational issues in the first quarter of 2024, producing just 2,811 Bitcoins – a significant decrease of 34% compared to the preceding quarter.

Marathon’s first-quarter earnings per share came in at $1.26, surpassing analysts’ expectations of a mere cent. Yet, it’s important to note that this number was influenced by two significant factors: the implementation of new FASB fair value accounting rules and the surge in bitcoin prices, which added complexity when comparing these results against forecasts.

Despite facing numerous obstacles, the firm continues to express optimism about its prospects, holding fast to its goal of reaching 50 exahash per second (EH/s) by 2024 and expecting further expansion in 2025.

What to expect next?

The future of the crypto market largely hinges on its performance in the coming months.

If the market keeps rising, crypto-stocks are likely to experience positive repercussions. On the other hand, market declines could negatively affect these stocks.

I, as an analyst, observe a bullish trend in the cryptocurrency market at present. Bitcoin is trading comfortably above the $70,000 mark, while Ethereum has experienced a significant price increase, surging past the $3,700 threshold.

One important aspect to keep an eye on is the prospect of an Ethereum Exchange-Traded Fund (ETF) gaining approval. Such approval would serve as a powerful bullish indicator, potentially leading to higher prices and increased investment not only in Ethereum but also in associated cryptocurrency and stock markets.

Although there’s reason for hope, be mindful of potential risks. The crypto market is infamous for its volatility, capable of producing unexpected swings that could result in significant financial setbacks.

To successfully navigate the complexities and unpredictability of investments, it’s crucial to expand your investment portfolio and establish a well-thought-out risk management plan. Adhere strictly to the fundamental principle of investing: never risk more money than you are prepared to potentially lose.

Read More

- 10 Most Anticipated Anime of 2025

- Gold Rate Forecast

- Pi Network (PI) Price Prediction for 2025

- USD CNY PREDICTION

- USD MXN PREDICTION

- USD JPY PREDICTION

- Silver Rate Forecast

- EUR CNY PREDICTION

- Brent Oil Forecast

- Castle Duels tier list – Best Legendary and Epic cards

2024-05-21 20:17