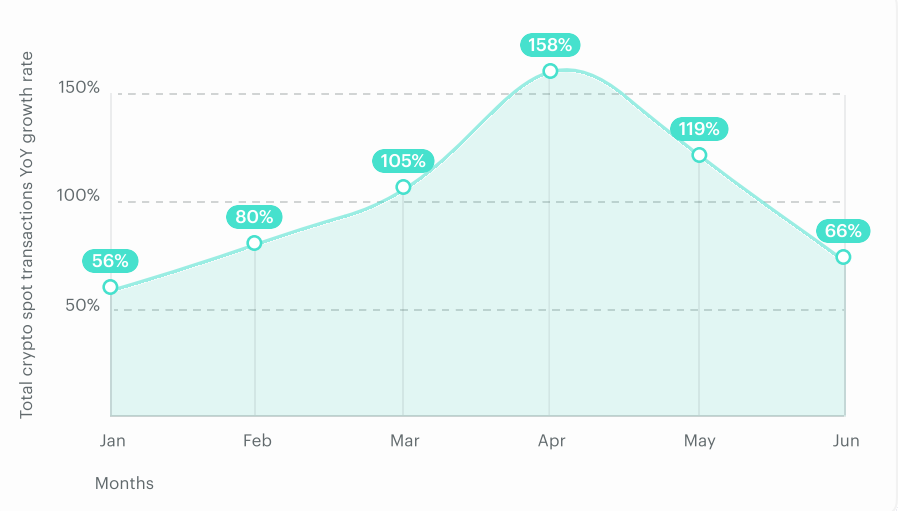

As a seasoned researcher with extensive experience in the digital asset market, I have witnessed the explosive growth of institutional demand for crypto OTC services and enterprise offerings over the past year. The data from Finery Markets is particularly noteworthy, showing an incredible 95% increase in institutional spot transaction volume year-over-year during the first half of 2024. This surge was further accentuated by a staggering 158% rise in April alone.

As a seasoned crypto investor, I’ve noticed a significant increase in institutional interest for over-the-counter (OTC) crypto services and other enterprise solutions. This surge in demand can be attributed to rising digital asset prices and the recent entry of Wall Street into the cryptocurrency market. Institutional investors are increasingly recognizing the potential value in crypto assets, leading them to seek specialized services that cater to their unique needs.

Based on Finery Markets’ findings, there was a roughly 95% increase in institutional Over-the-Counter (OTC) spot transactions during the first half of 2024 compared to the same period the previous year. This conclusion was drawn from analyzing data from over two million trades carried out through various channels such as brokers, OTC desks, and hedge funds.

As an analyst, I’ve observed a significant surge in our performance during the second quarter of this year. The volume experienced a substantial expansion, reaching a 110% increase compared to the same period last year. Remarkably, we even hit a high point with a 158% growth rate in April.

Bitcoin rally spurred Institutional crypto interest

During that period, Bitcoin (BTC) exchange-traded funds (ETFs) had been actively traded for more than three months, while Bitcoin reached a new peak price in March. Similarly, Ethereum (ETH) ETFs sparked anticipation within the cryptocurrency community as potential next steps for institutional investors on Wall Street.

As a financial analyst specializing in the cryptocurrency market, I believe that the all-time high charge of Bitcoin (BTC) and the inflow of spot Exchange Traded Funds (ETFs) have likely sparked significant institutional interest in crypto products. Looking ahead, we anticipate further developments along these lines, as it usually takes Traditional Finance (TradFi) institutions up to nine months to fully embrace new offerings in this arena.

It seems that the demand for blockchain-digital assets is increasing, as indicated by a 50% rise in the volume of trades between different cryptocurrencies compared to last year. On the other hand, the trading activity between cryptocurrencies and traditional fiat currencies has decreased by 12% since the beginning of the year.

The data shows that investors have continued to invest in the emerging industry, even amidst recent market turbulence and fluctuating short-term prices. Additionally, stablecoins have gained significant traction, as reported by Finergy Markets. The usage of fiat-backed tokens such as Tether’s USDT has nearly tripled in terms of transaction volume when compared to the previous year.

Ethereum ATH inevitable

As a capital markets analyst, I’ve observed that Ethereum’s price behavior has historically mirrored Bitcoin’s following significant events, such as the approval of spot Bitcoin Exchange-Traded Funds (ETFs). Based on this trend, we anticipate Ethereum may experience similar price surges once an Ethereum spot ETF is approved.

As a crypto investor, I’m keeping a close eye on the developments regarding Ether ETFs. The buzz is that institutions are gearing up for the launch of these funds before summer ends. Gary Gensler, the chairman of the U.S. Securities and Exchange Commission, hinted at this possibility during a recent Congressional hearing. Moreover, industry veterans like Eric Balchuns predict that spot Ethereum ETFs could debut as early as next week. In anticipation of this major move, Ethereum trading volumes have seen a significant surge of around 32%.

Read More

- Gold Rate Forecast

- Pi Network (PI) Price Prediction for 2025

- USD CNY PREDICTION

- Silver Rate Forecast

- 10 Most Anticipated Anime of 2025

- USD MXN PREDICTION

- Brent Oil Forecast

- EUR CNY PREDICTION

- Hero Tale best builds – One for melee, one for ranged characters

- Capcom has revealed the full Monster Hunter Wilds version 1.011 update patch notes

2024-07-17 16:48