As a seasoned crypto investor with battle-scarred eyes and a heart full of scars from past encounters with scammers, I can’t help but feel a mix of frustration and amusement when faced with yet another elaborate phishing scheme like the one targeting World Liberty Financial’s WLFI token sale.

Fraudsters, taking advantage of the excitement about the Trump family-endorsed World Liberty Financial’s WLFI token offering, tricked investors by promoting misleading airdrops. These airdrops, however, were actually disguised as part of a larger phishing scheme.

On October 16th, swindlers orchestrated a complex scam, aiming to deceive investors interested in obtaining the governance token for the World Liberty Financial initiative. This project aspires to establish a unified marketplace where users can lend, borrow, and conduct transactions using stablecoins.

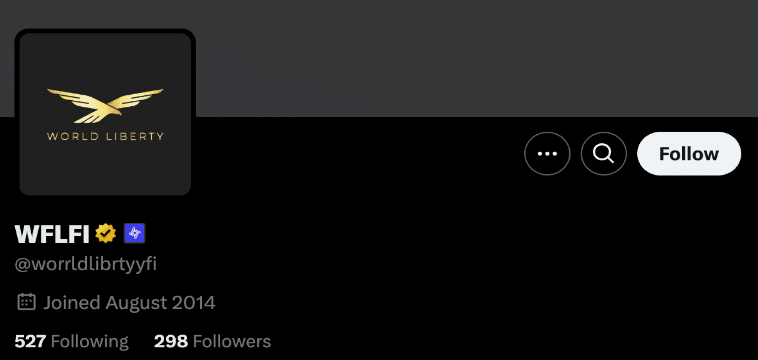

An X account controlled by scammers was seen promoting a fake WLFI airdrop to mislead users and redirect them to a phishing site that looked like a poorly made replica of the official WLF website. The account had been rebranded to closely mimic the real project, with subtle changes to the username that are easy to miss at first glance.

Interestingly, it’s ironic that the questionable account was adorned with a gold badge, symbolizing official verification for organizations, whereas the genuine World Liberty Financial initiative has not been granted this verification as of now.

Yesterday marked the debut of the public token sale for WLFI, where a total of 749.51 million tokens were already sold. At present, the sale continues, but it’s only accessible to non-U.S. citizens and accredited U.S. investors. Prior to launch, over 100,000 accredited U.S. investors were whitelisted for this exclusive opportunity.

The post suggested a temporary 1.5x boost on WLFI purchases during pre-sales, encouraging swift action from potential investors as the “offer” supposedly had an expiration date. However, it was later discovered that this limited-time deal was a ruse to lure users towards airdrop-worldliberty[.]com, where the fraudulent activity took place.

On sham websites, users are urged to link their cryptocurrency wallets. Subsequently, they’re asked to approve a harmful transaction, which ultimately gives attackers unrestricted access to those wallets. This method, referred to as “approval phishing,” has been extensively used by scammers in recent years and has resulted in billions of dollars in financial losses.

To persuade users who are unaware, the site explains that a signature is necessary to verify the ownership of the digital wallet before processing transactions.

As a researcher, I’ve observed an interesting mechanism in action: when attempting to link an empty digital wallet, users receive a message stating it’s ineligible for connection and are directed to either refill the wallet or connect one that already has funds. This strategic design highlights the complexity of this scam, as it effectively funnels the attackers towards wallets containing valuable assets.

Currently, while this text is being composed, swindlers were aggressively publicizing a deceptive site in connection with Donald Trump’s Republican presidential campaign posts, where he was endorsing World Liberty Financial. This misleading website was also being disseminated through multiple posts from the official World Liberty Financial account to expand the scam’s influence.

A surge in phishing scams

According to blockchain security firm CertiK, phishing attacks were the most damaging attack vector for Q3 2024, leading to losses upwards of $343 million.

Impersonations of genuine cryptocurrency projects using fake accounts are a prevalent method by which crypto investors unknowingly access phishing sites. Recently, cybersecurity firm SlowMist revealed that over 80% of comments under significant crypto project posts were scams, emphasizing the widespread use of these deceptive practices.

Not long ago, it’s been alleged that a wallet associated with crypto venture capital firm Continue Capital suffered a loss exceeding $35 million due to a phishing attack. Additionally, in late August, an individual holding DAI lost approximately $55 million worth of the stablecoin by executing a malicious transaction.

Read More

- 10 Most Anticipated Anime of 2025

- USD MXN PREDICTION

- Brent Oil Forecast

- Pi Network (PI) Price Prediction for 2025

- Silver Rate Forecast

- USD JPY PREDICTION

- USD CNY PREDICTION

- Gold Rate Forecast

- How to Watch 2025 NBA Draft Live Online Without Cable

- EUR CNY PREDICTION

2024-10-16 13:18