As a seasoned crypto investor with a global perspective, I’ve had my fair share of navigating through the labyrinth of cryptocurrency taxation policies around the world. It’s fascinating to see how diverse these regulations are, from the strict US taxation laws that treat crypto like property, to the crypto-friendly European countries like Switzerland and Portugal.

As more and more cryptocurrencies find their place within today’s financial landscape, it’s important to remember that just as with traditional assets, they are also liable for taxation.

How does the taxation of cryptocurrencies differ across various nations as they grapple with this burgeoning and fast-evolving financial sector?

Table of Contents

Which countries require you to pay taxes on cryptocurrencies?

In the United States, it is simply impossible not to pay taxes — the authorities are very strict about this and tax almost everything, including digital assets.

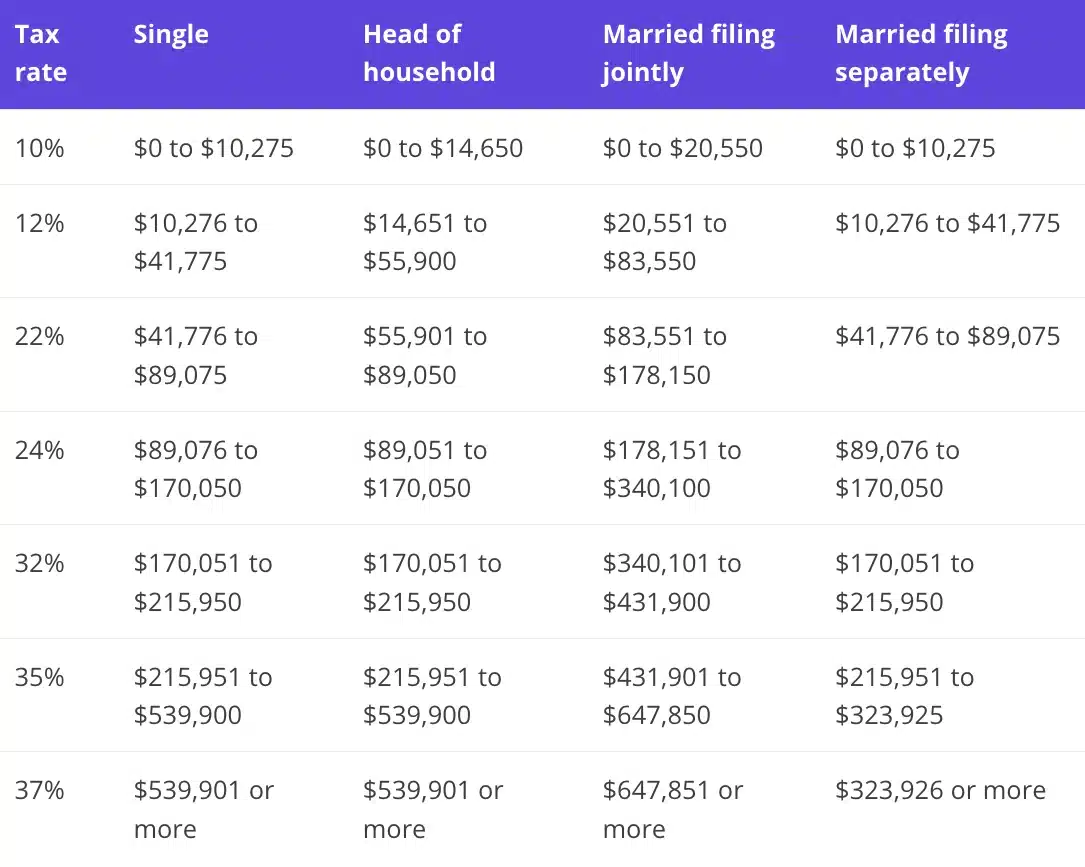

In simpler terms, since cryptocurrencies are considered as property rather than cash by the authorities, individuals need to pay capital gains taxes when they sell these digital assets. The tax rate could be either short-term or long-term capital gains tax, based on how long the asset has been held (less than a year or more).

In the United Kingdom, the scenario is quite similar – just like other financial assets, cryptocurrencies are subjected to Capital Gains Tax (CGT). When an individual’s earnings from cryptocurrency transactions surpass a specific amount, they are required to submit a tax return and settle the applicable tax.

In Australia, the Tax Office considers cryptocurrencies as property. This means that if an investor makes a profit by selling their digital tokens, they are obligated to pay capital gains tax. However, it’s worth noting that certain transactions using cryptocurrency may not be subject to taxation if the total value of goods or services purchased does not surpass $10,000.

In summary, Europe stands out as a frontrunner in this area, and Switzerland specifically is at the forefront: Residents of this nation have the unique ability to settle both everyday transactions and tax payments using cryptocurrencies. The Swiss Federal Tax Administration clarifies this practice.

Should an employee receive their wages or additional benefits as digital payment tokens, these will be considered taxable as earnings from employment and should be listed on their payroll documentation.

Why do some countries not have to pay taxes on cryptocurrencies?

Multiple nations are incentivizing cryptocurrency usage because it’s not subject to compulsory taxation – this strategy aims to entice investment and foster the development of cryptocurrency ventures.

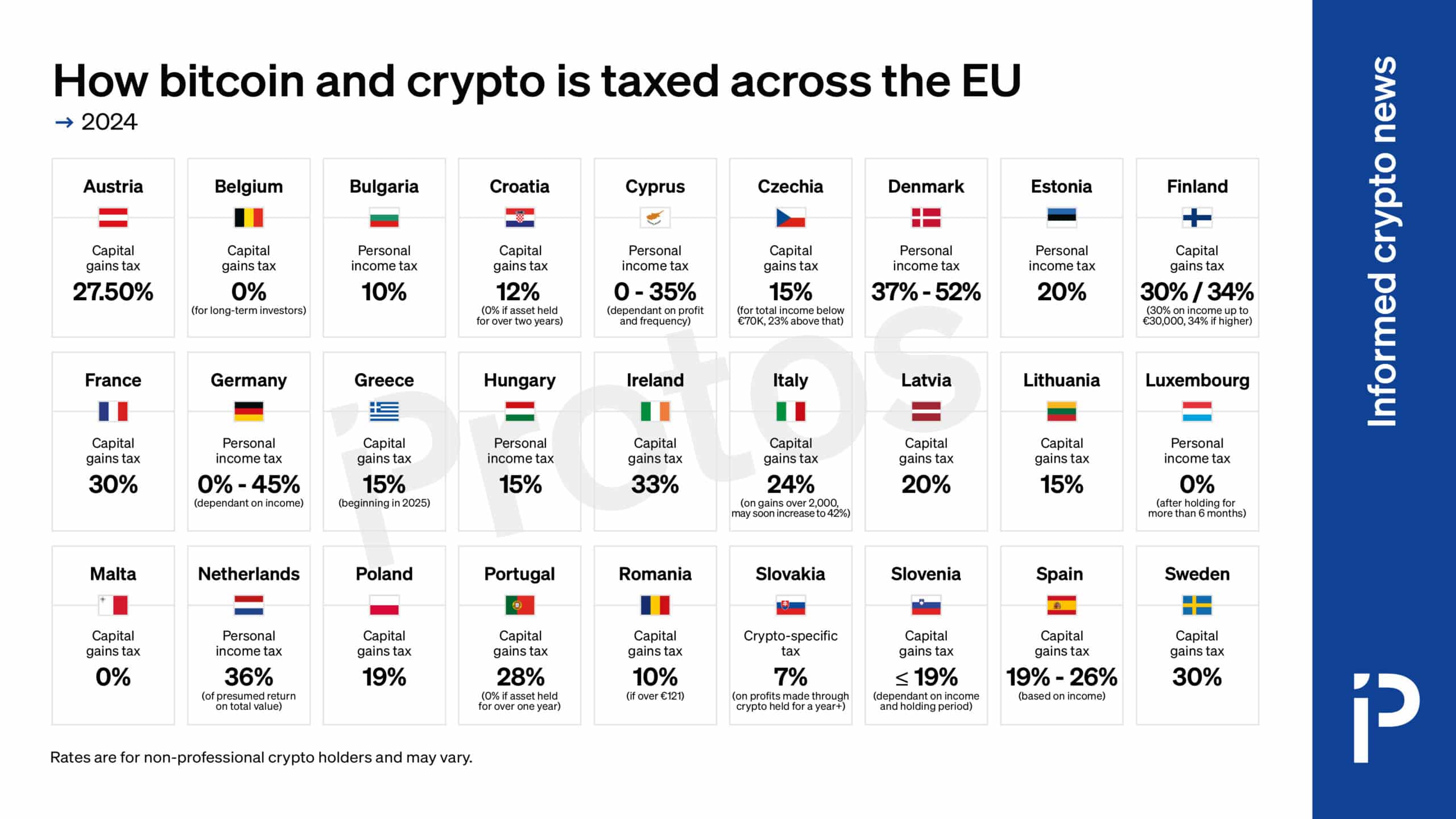

In Portugal, residents are now among a select group who do not have to pay taxes on earnings generated through cryptocurrency trading, with some caveats. These exemptions do not apply if cryptocurrencies are utilized within professional pursuits or commercial enterprises.

In Germany, if you hold cryptocurrency for more than one year and then sell it, you won’t have to pay taxes on that sale. This encourages long-term investments in digital currencies. However, if you sell the cryptocurrency within a year, the profit from the sale will be taxed as capital gains.

Malta is actively nurturing its cryptocurrency sector and provides advantageous tax structures. Cryptocurrencies are subject to taxation only when they’re traded or swapped for traditional currencies; otherwise, there’s no tax obligation.

In some regions, I’ve observed that cryptocurrencies are prohibited, thereby exempting individuals from tax liability associated with these digital assets.

Countries where cryptocurrencies are banned

One of the globally recognized nations, China, prohibits the use of cryptocurrencies. In 2021, all transactions related to cryptocurrencies became illegal, leading to increased enforcement against mining activities. Consequently, this move has caused substantial difficulties for investors and crypto-related businesses within its borders.

In Algeria, engaging in activities like trading or mining with cryptocurrencies is completely forbidden. This North African nation does not permit any kind of cryptocurrency transactions, be it exchanges or sales. As a result, conducting these operations within Algeria’s borders is impossible.

In my role as an analyst, I can share that various nations, predominantly in the Middle East and North Africa (MENA) and Asia regions, have imposed restrictions on cryptocurrencies. For instance, countries like Morocco, Pakistan, and Indonesia are among those that have taken such measures.

Why do some countries not pay taxes on cryptocurrency?

Beyond considering bans and investment appeal, certain nations don’t impose taxes on cryptocurrencies because their governments haven’t established regulations for digital assets as of yet.

As a researcher exploring the regulatory landscape of Japan’s cryptocurrency market, I find that while Bitcoin (BTC) and other digital currencies are legally recognized as a means of exchange, the finer points of their regulation remain under development. The nation has established some guidelines for crypto exchanges, yet there exists a noticeable void in the legislative framework when it comes to certain taxation aspects.

In Nepal, while there’s no explicit ban on cryptocurrencies, due to the lack of clear regulations, they essentially function as if they were prohibited. As the government hasn’t established laws to govern these digital assets yet, they exist in a sort of legal limbo.

What’s next for cryptocurrency taxation?

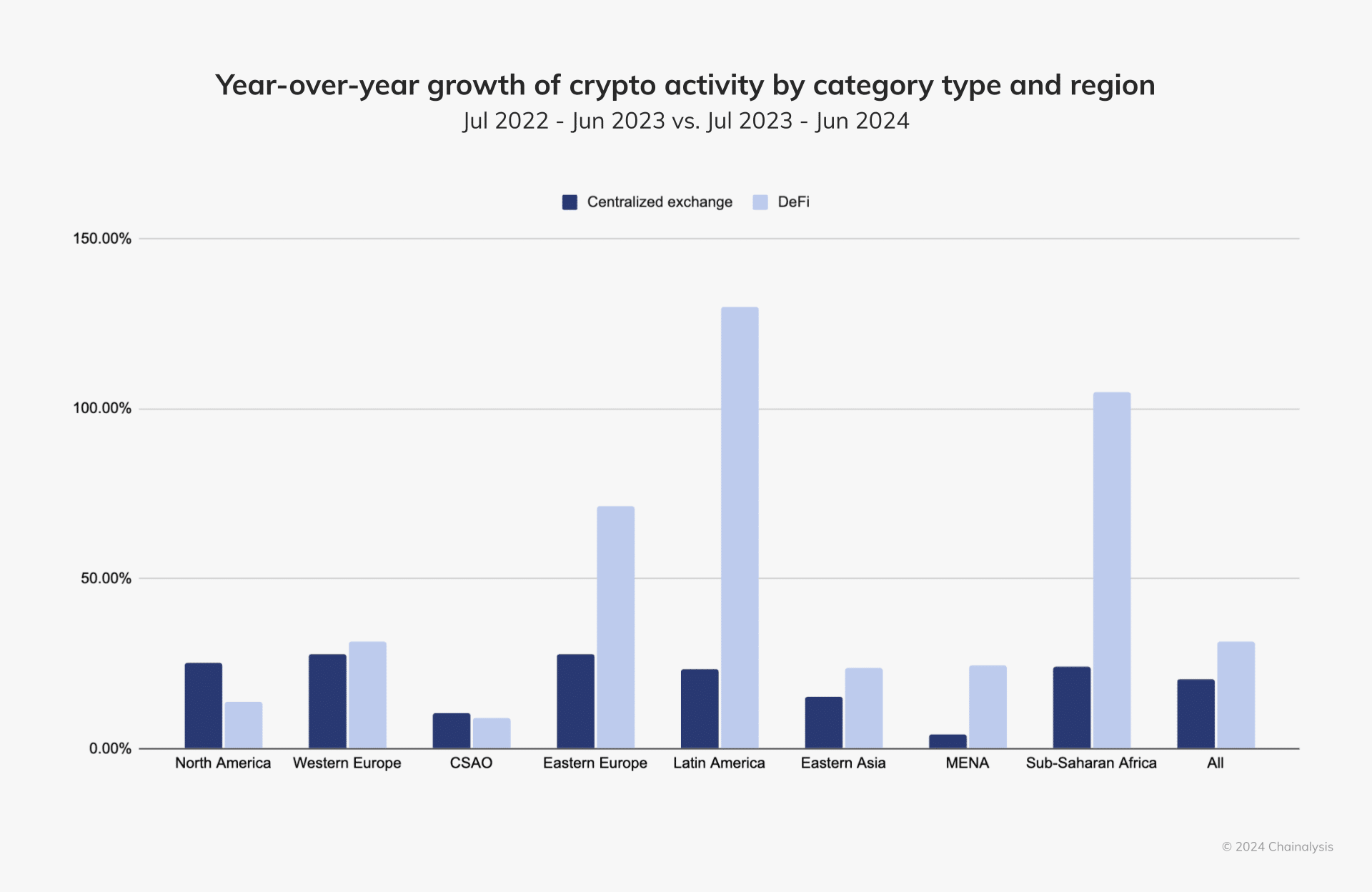

The way governments handle taxes on cryptocurrencies can differ significantly from one country to another, resulting in diverse regulatory measures concerning these digital assets. Some nations are proactive in creating tax laws and regulations for cryptocurrencies, whereas others find themselves in a legal gray area regarding them, and certain countries even prohibit their usage. Despite this complexity, Chainalysis reports that the use of cryptocurrency is expanding worldwide.

The taxation of cryptocurrencies is expected to become more transparent and regulated over time, offering a sense of security for investors and market players. But remember that these changes might not happen evenly across all regions or political climates.

Read More

- USD MXN PREDICTION

- 10 Most Anticipated Anime of 2025

- Pi Network (PI) Price Prediction for 2025

- How to Watch 2025 NBA Draft Live Online Without Cable

- Silver Rate Forecast

- USD JPY PREDICTION

- USD CNY PREDICTION

- Brent Oil Forecast

- Gold Rate Forecast

- Grimguard Tactics tier list – Ranking the main classes

2024-12-24 21:12