As a seasoned analyst with over two decades of experience in the financial markets, I must admit that the surge in crypto trading volume this July has caught my attention. Having witnessed the rise and fall of various asset classes, the resilience of cryptocurrencies is truly remarkable.

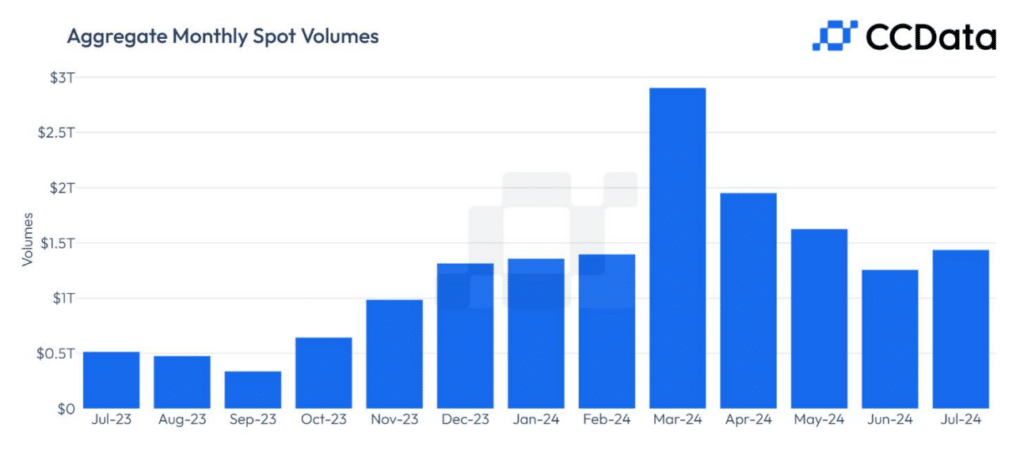

In July, the trading volume of cryptocurrencies significantly rose by 19%, reaching a staggering $4.94 trillion. This was the first monthly increase after a four-month period, as reported by CCData.

During July, the trading volumes for cryptocurrencies on centralized exchanges increased by 19% to reach a total of $4.94 trillion. This is the first rise recorded in the past four months, as indicated by the latest report from CCData. The increase in volume is believed to be due to the launch of spot Ethereum exchange-traded funds in the U.S. and favorable statements about Bitcoin made by influential figures in the U.S., particularly at the Bitcoin conference held in Nashville, Tennessee.

As an analyst, I’ve observed a remarkable surge in trading activities on centralized exchanges. Specifically, spot trading volumes have escalated by 14.3% to reach an impressive $1.44 trillion, while derivatives trading volumes have experienced a more substantial increase of 21%, amounting to $3.50 trillion. Notably, this growth has catapulted the derivatives market share to an unprecedented high of 70.9%. This level is the highest it’s been since December 2023.

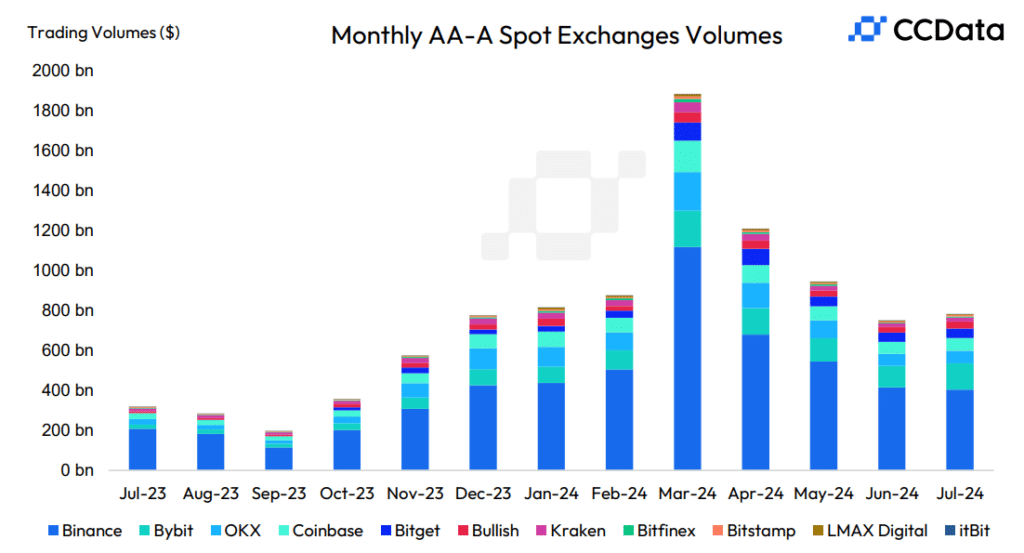

According to CCData, Bybit stood out as one of the top performers in July, seeing an almost 23% rise in its spot trading volume to reach approximately $132 billion. This significant surge in activity placed the third-highest monthly volume ever recorded by the exchange. As a result, Bybit managed to attain a record market share of 9.18%, solidifying its status as the second-largest spot exchange.

Even though there was a decrease, Binance managed to maintain its status as the leading spot exchange, holding a 28.1% market share. However, this is a drop of 4.9% compared to the preceding month, according to the data in the report.

In the world of derivatives, Binance continued its lead with a 43.5% market portion, trailed closely by OKX at 19% and Bybit with 15.1%. The report also points out a substantial surge in volatility around early August, resulting in one of the highest daily spot trading volumes since May 2021. This period was marked by China’s ban on Bitcoin (BTC) mining, which caused ripples throughout global markets.

Read More

- 10 Most Anticipated Anime of 2025

- Brent Oil Forecast

- USD MXN PREDICTION

- Silver Rate Forecast

- PUBG Mobile heads back to Riyadh for EWC 2025

- Grimguard Tactics tier list – Ranking the main classes

- Gold Rate Forecast

- Pi Network (PI) Price Prediction for 2025

- How to Watch 2025 NBA Draft Live Online Without Cable

- Castle Duels tier list – Best Legendary and Epic cards

2024-08-08 13:48