As a long-term crypto investor with a keen interest in market trends and data analysis, I find the recent decline in trading volumes on centralized cryptocurrency exchanges quite concerning. The nearly 20% drop in June, marking the third consecutive month of decline, is a clear indication of stagnant markets and dwindling investor sentiment.

As a crypto investor, I’ve noticed that trading volumes on centralized exchanges took a dip by almost 20% in June. This is now the third straight month where we’ve seen a decrease in trading activity, reflecting a sluggish market atmosphere.

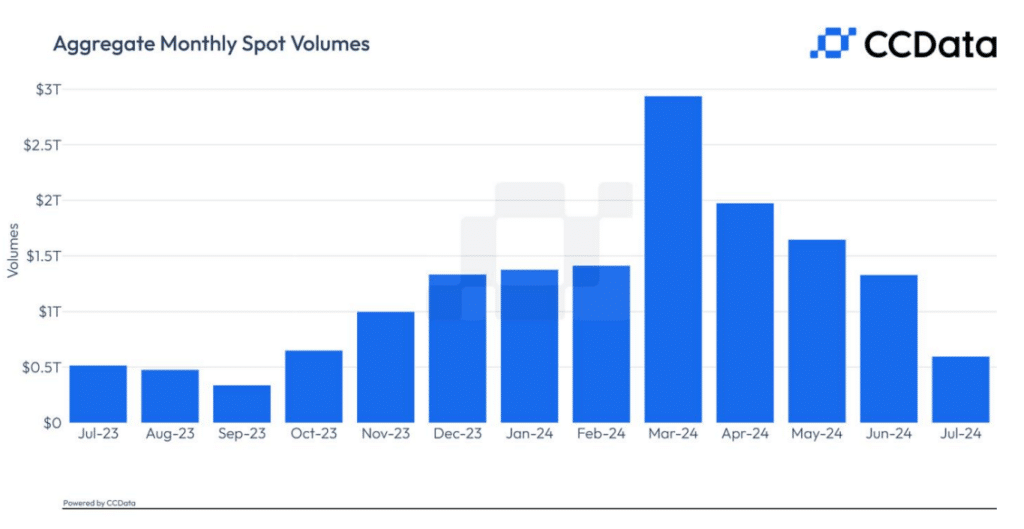

In June, the volume of cryptocurrency spot trading declined by 19.3%, amounting to $1.3 trillion, according to CCData. This represents a substantial drop from the record-breaking $2.9 trillion traded in March. Despite the prices’ struggle to move beyond the downtrend, traders seemed largely unaffected by this decrease.

The open interest on derivatives exchanges decreased by almost 10% in June, reaching approximately $47.1 billion. This significant drop can be attributed mainly to a series of liquidations initiated by the steep decline in crypto prices. According to CCData’s report, Coinbase experienced a substantial decrease in open interest of over 52%, totaling more than $18.2 million. Binance, on the other hand, retained the largest position among trading platforms with an open interest of $19.4 billion, experiencing only a 10% reduction.

The downturn became more pronounced due to apprehensions about further sales from the collapsed Mt. Gox exchange, which declared user refunds in July. Furthermore, the German government’s decision to sell a substantial portion of its Bitcoin holdings added to the market instability.

CCData

As an analyst at CCData, I’ve observed some promising trends in the market despite the challenging backdrop. Specifically, I’ve noticed that spot prices have risen significantly between the first and second halves of 2024. Additionally, trading volumes have experienced a substantial surge, reaching a total of $10.7 trillion, representing a 148% increase compared to the previous period.

According to crypto.news’ previous article, there were substantial decreases in trading activity on major South Korean cryptocurrency platforms such as Upbit, Bitfinex, and KuCoin. Specifically, Upbit experienced a 45% reduction, Bitfinex saw a decline of 38%, and trading volumes at KuCoin decreased by 32%. This downturn in trading came as investors withdrew their capital from the digital asset market and adopted pessimistic attitudes.

Despite the general decrease in trading activity, there has been consistent expansion in the area of stablecoin transfers. This trend underscores their increasing popularity among users. According to Token Terminal’s data, stablecoin transfers have surged more than 16-fold during the past four years and reached a peak of $1.68 trillion in Q2.

Read More

- 10 Most Anticipated Anime of 2025

- USD MXN PREDICTION

- Brent Oil Forecast

- Silver Rate Forecast

- Pi Network (PI) Price Prediction for 2025

- USD CNY PREDICTION

- USD JPY PREDICTION

- How to Watch 2025 NBA Draft Live Online Without Cable

- Gold Rate Forecast

- Castle Duels tier list – Best Legendary and Epic cards

2024-07-18 10:23