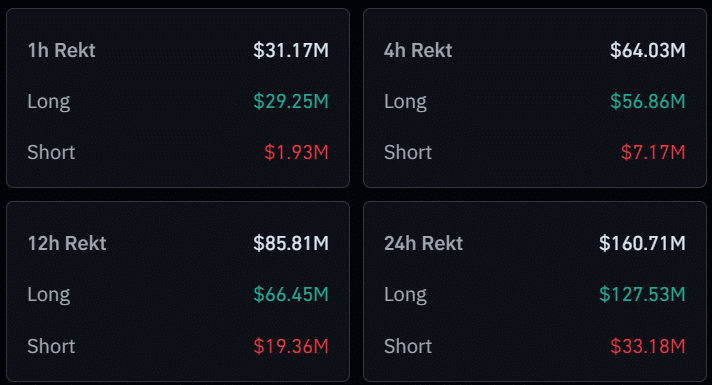

As a researcher with extensive experience in the cryptocurrency market, I find the recent trend of increased liquidations concerning. According to data from Coinglass, the total crypto liquidations have reached an alarming $160.71 million in the past 24 hours. The majority of these liquidations were long positions, worth approximately $127.53 million, indicating a significant market reversal.

The cryptocurrency ecosystem witnesses increased liquidations as the market weathers correction.

Based on information from Coinglass, approximately $127.53 million worth of long crypto positions have been liquidated in the last 24 hours, accounting for the majority of the total liquidations. The figure stands at around $160.71 million. With the market making a sudden reversal, these liquidations represent a significant shift.

Based on the data, a mere $33.18 million in value of various cryptocurrencies has been liquidated from bearish bets.

According to CoinGlass’s latest update, the worldwide crypto open interest has dropped by 2.95%, amounting to approximately $69.3 billion as I write this.

The leading crypto exchange, Binance, has recorded approximately $75.79 million worth of liquidations in the past day, placing it at the front of the pack. OKX, Bybit, and Huobi trail behind with around $53.91 million, $14.23 million, and $11.32 million in liquidations respectively.

As a crypto investor, I’ve noticed that the value of Ethereum (ETH) positions being forcedly sold off, or liquidated, amounted to an impressive $27.81 million in this recent market downturn. This figure overshadows Bitcoin’s (BTC) $20.36 million worth of liquidations during the same period.

A crypto.news article published on May 23 reveals that the proportion of Ethereum (ETH) to Bitcoin (BTC) held by traders has risen following the green light given in the US for spot Ethereum Exchange-Traded Funds (ETFs). It’s worth mentioning that before this approval, investors holding ETH permanently had amassed approximately 100,000 tokens on May 20.

As an analyst, I’d interpret the data as follows: In the last 24 hours, Notcoin (NOT) climbed up to the third position with a total liquidation volume of $6.2 million, according to Coinglass. Among these liquidations, short positions worth approximately $3.77 million were closed, while long positions amounting to around $2.43 million got liquidated. This significant price movement was triggered by a 29% surge in NOT’s value.

The decrease in crypto liquidations occurs concurrently with a 2% drop in the global market value to $2.66 trillion from $2.7 trillion over the last 24 hours, as indicated by CoinGecko’s data. Additionally, the daily trading volume has declined by 8%, now standing at approximately $86 billion.

With decreasing trading activity and open positions, larger cryptocurrencies may experience reduced price fluctuations.

Read More

- 10 Most Anticipated Anime of 2025

- Gold Rate Forecast

- Pi Network (PI) Price Prediction for 2025

- USD CNY PREDICTION

- USD MXN PREDICTION

- Silver Rate Forecast

- USD JPY PREDICTION

- EUR CNY PREDICTION

- Brent Oil Forecast

- Castle Duels tier list – Best Legendary and Epic cards

2024-05-30 11:14