As an analyst with over two decades of experience in the financial markets, I have witnessed numerous bull and bear cycles, and I must admit that the crypto space has added a unique twist to my career. The recent surge in Curve DAO (CRV) token is intriguing, particularly given its timing against the backdrop of a broader market correction.

For two days running, the price of Curve DAO tokens increased following a decision by developers to cut down on the emission rate.

The CRV token reached a peak of $0.3161, marking its highest point since July 15 and representing a 77% increase from its highest point on August 6. This surge came as Bitcoin (BTC) and other altcoins experienced a pullback. Some of the coins that struggled most on Tuesday were Sui (SUI), Dogewhatever (WIF), and Aptos (APT).

In a recent update on Curve DAO’s platform, it was highlighted that they are lowering their emissions. This is the fifth consecutive year of reductions for them. Originally, 274 million new CRV tokens were introduced in 2020; however, this number has now been significantly reduced to approximately 162.7 million.

Consequently, the overall amount of CRV available now stands at about 2.09 billion. Around 930 million of those tokens are currently secured within the platform as veCRV.

Developers are optimistic that the decrease might stimulate an increase in the worth of the CRV token, as its value has significantly decreased over the past few years. Its market cap reached a peak of $3.02 billion in 2020 but has since fallen to $369 million.

Curve Finance, a significant figure in the world of decentralized finance, has experienced a decrease in its market share over the last few years. As of now, it manages approximately $2 billion worth of assets spread across 17 different networks, including Ethereum, Arbitrum, Polygon, and Arbutrum. This once top-tier DeFi platform has slipped down to become the 14th largest in terms of size.

A significant decrease in assets, from approximately $23 billion, took place as the system encountered numerous difficulties. For instance, the system suffered a loss of around $70 million in a large-scale hack in 2023 and approximately $2.8 million in November 2020 due to an assault on its partnership with Yearn Finance.

1. “The token has experienced stress due to recent liquidations of major investors. In fact, its creator, Michael Egorov, was among those liquidated in June when the token’s value started dropping.”

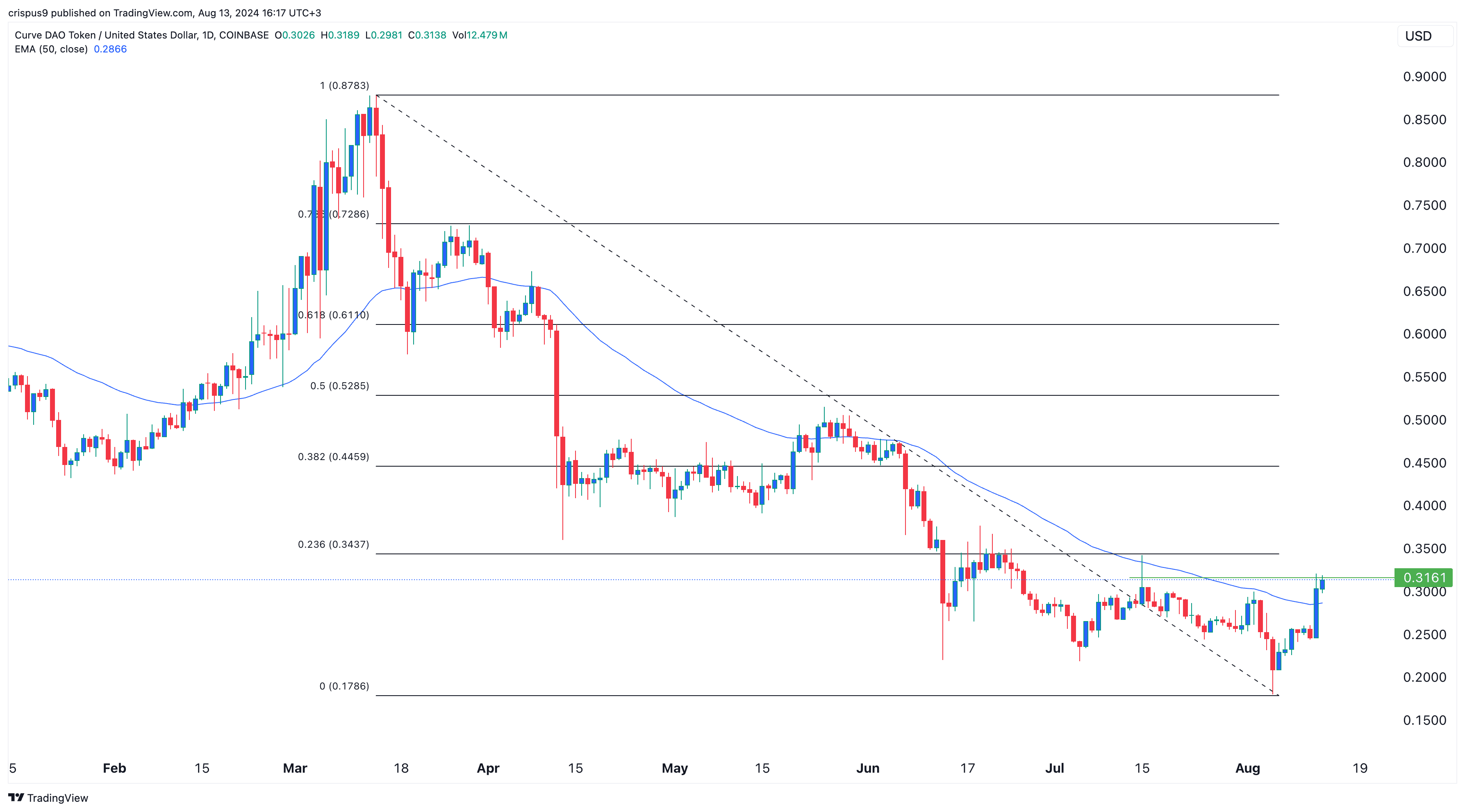

CRV token crossed the 50 EMA

Currently, the value of CRV tokens is significantly lower compared to its price a few months back. It reached an all-time high of $0.877 in March, but has since fallen more than 63%, now standing at approximately $0.3170.

The price of Curve DAO’s token has climbed over its 50-day moving average and is aiming for the 23.6% Fibonacci retracement mark. If it manages to surpass this level at approximately $0.2435, it could potentially increase toward the significant price point of $0.40, especially if Bitcoin and other digital currencies recover.

Read More

- 10 Most Anticipated Anime of 2025

- Gold Rate Forecast

- USD CNY PREDICTION

- Pi Network (PI) Price Prediction for 2025

- USD MXN PREDICTION

- Silver Rate Forecast

- USD JPY PREDICTION

- EUR CNY PREDICTION

- Brent Oil Forecast

- Castle Duels tier list – Best Legendary and Epic cards

2024-08-13 17:14