As a seasoned researcher and analyst with years of experience in the dynamic world of cryptocurrencies, I must admit that every significant transaction involving key figures like Jeffrey Wilcke can set off alarm bells. The recent transfer of 20,000 Ether by Wilcke to Kraken, worth approximately $75.2 million, has indeed raised eyebrows due to its potential implications for the Ethereum market.

The co-creator of Ethereum, Jeffrey Wilcke, recently moved approximately 75.2 million dollars’ worth of Ether to the digital asset exchange platform, Kraken. This move has sparked discussions and rumors about an upcoming adjustment in the cryptocurrency market.

According to blockchain records, Wilcke transferred 20,000 units of Ether (ETH) to the digital currency exchange Kraken, based in California. The reason behind Wilcke’s action remains unclear, but depositing funds into an exchange often indicates an intention to trade or sell.

Participants pointed out that on certain occasions, Wilcke’s previous trades seem to be followed by drops in the value of Ethereum.

For instance, on Jan. 6, 2021, Ethereum’s price fell after Wilcke deposited 15,000 ETH. Similarly, on Feb. 11 and Feb. 14, 2024, his movements of 4,300 ETH and 10,000 ETH, respectively, were followed by price drops. Despite the recent transaction, Wilcke still holds 106,006 ETH, valued at over $384 million, according to LookOnChain.

40 minutes ago, Ethereum co-founder Jeffrey Wilcke transferred 20,000 ETH (equivalent to approximately 75.2 million US dollars) to the exchange Kraken. As of now, he continues to own a total of 106,006 ETH, which is roughly equivalent to 384 million US dollars.

— Lookonchain (@lookonchain) November 28, 2024

Criticism has consistently been directed towards Ethereum leaders and institutions for either selling ETH or depositing it into exchange platforms. In early 2021, the foundation itself sold approximately 4,266 ETH, valued at more than $12 million, which sparked a wave of criticism from users who perceived this action as the foundation cashing in on its reserves for personal gain.

Critics accused a charitable organization of exploiting its Ethereum reserves, but ETH co-founder Vitalik Buterin explained that the organization sells small portions of its holdings to support projects and cover expenses.

In essence, the yearly report from the foundation disclosed that a significant portion of its funds is allocated towards bolstering the Ether network or incentivizing projects geared towards enhancing the forefront of the leading decentralized financial blockchain.

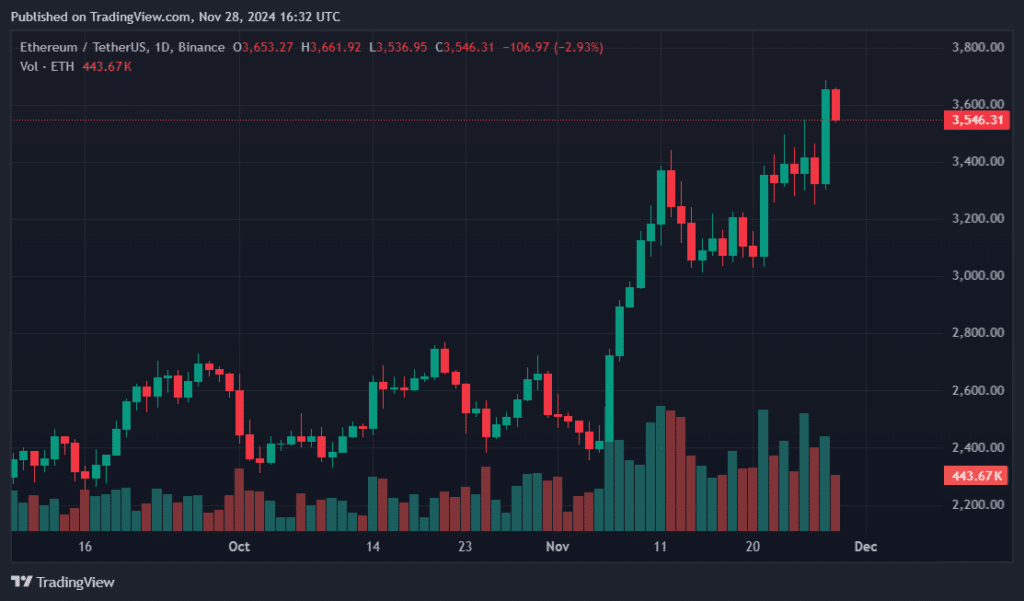

Following the U.S. general elections on November 6th, Ether’s price saw a surge, mirroring other cryptocurrencies. This surge contributed to the overall crypto market capitalization reaching $3.4 trillion. During this period, Ether increased to approximately $3,550. However, it was about 28% below its prior record high of $4,878.

Read More

- 10 Most Anticipated Anime of 2025

- USD MXN PREDICTION

- Silver Rate Forecast

- Pi Network (PI) Price Prediction for 2025

- USD CNY PREDICTION

- Brent Oil Forecast

- How to Watch 2025 NBA Draft Live Online Without Cable

- Gold Rate Forecast

- USD JPY PREDICTION

- PUBG Mobile heads back to Riyadh for EWC 2025

2024-11-28 19:52