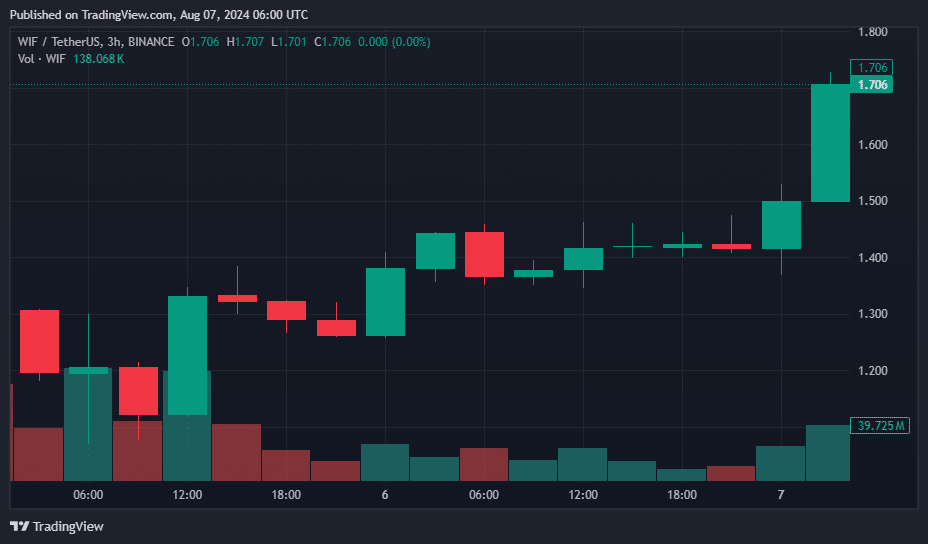

As a seasoned researcher with a knack for deciphering the intricacies of the cryptocurrency market, I find myself in awe of the dynamic nature of this digital frontier. The recent surge of Dogwifhat (WIF) by 20% within a day is an exciting development that has caught my attention. However, it’s essential to remember that even though WIF is currently up 18%, it’s still down 26.5% over the last 30 days and 64.8% from its all-time high.

In the past day, the meme token Dogwhaat (built on the Solana platform) surged by 20% due to Bitcoin‘s price rebounding to around $57,000.

As I write this, Dogecoin (WIF) continues to surge, currently trading at approximately $1.71 according to CoinGecko data. The day’s trading volume is holding steady around $935 million, and the market capitalization has climbed impressively to roughly $1.69 billion.

After the recent price hike, the meme coin based on dogs has moved into the 49th spot in terms of market capitalization among all cryptocurrencies. Yet, it’s important to note that WIF has experienced a decrease of 26.5% over the past 30 days and currently stands at 64.8% below its peak price of $44.85 reached on March 31.

Yesterday, a rise in the cost of WIF not only occurred but also caused its Relative Strength Index (RSI) to escalate. Initially at 26, suggesting it was oversold, the RSI has now climbed up to 42, which is considered the neutral zone.

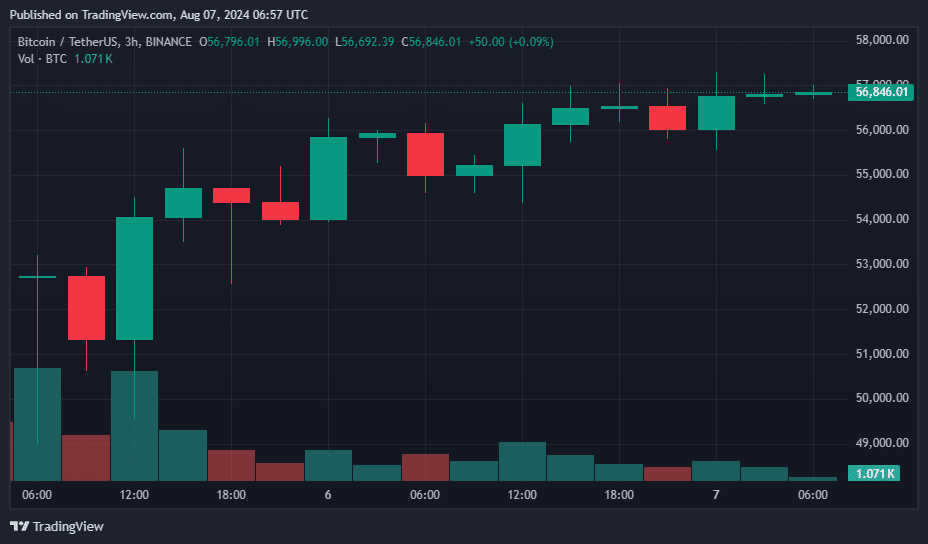

Over the same timeframe, a spike in WIF occurred after Bitcoin’s (BTC) price climbed by 3%. This climb pushed the crypto asset above $57,000, then settled at $56,874. The recent surge comes after the digital currency started the week on a downward trend.

On Wednesday morning during the European trading period, the overall value of the cryptocurrency market grew by around 1.5%, reaching a staggering $2.01 trillion in total.

Bitcoin’s latest price surge seems to align with a rise in the Fear & Greed Index to 43%, suggesting an overall neutral attitude among traders. However, in-depth analysis of on-chain data reveals that long-term Bitcoin investors have continued to purchase even amidst market volatility.

According to data from Santiment, large Bitcoin investors (referred to as whales) have bought over 30,000 BTC in the last two days, which equates to approximately $1.62 billion. This significant purchase trend has led to a decrease in the amount of Bitcoin available on centralized exchanges in recent times.

Based on data from Santiment, individuals who own between 10 and 1,000 Bitcoins collectively purchased approximately 30,000 Bitcoins as its price fell.

— Sergii Peleh (@PelehSergii) August 6, 2024

Over the last three days, U.S. Bitcoin ETFs have performed worse than Ethereum‘s ETFs. On August 6th, specifically on Tuesday, these U.S. Bitcoin ETFs experienced a total withdrawal of approximately $148 million, with Fidelity’s FBTC and Grayscale’s GBTC leading the way in this outflow.

Read More

- 10 Most Anticipated Anime of 2025

- USD CNY PREDICTION

- Pi Network (PI) Price Prediction for 2025

- Silver Rate Forecast

- Gold Rate Forecast

- USD MXN PREDICTION

- USD JPY PREDICTION

- Brent Oil Forecast

- EUR CNY PREDICTION

- Castle Duels tier list – Best Legendary and Epic cards

2024-08-07 10:31