As a seasoned crypto investor, I’ve seen my fair share of market fluctuations and have learned to keep an eye on both Bitcoin (BTC) and altcoins. The recent surge in daily trading volumes and overall crypto market cap has been quite intriguing.

On Monday, the combined value and trading activity of cryptocurrencies surged, leading to increased prices for numerous alternative coins.

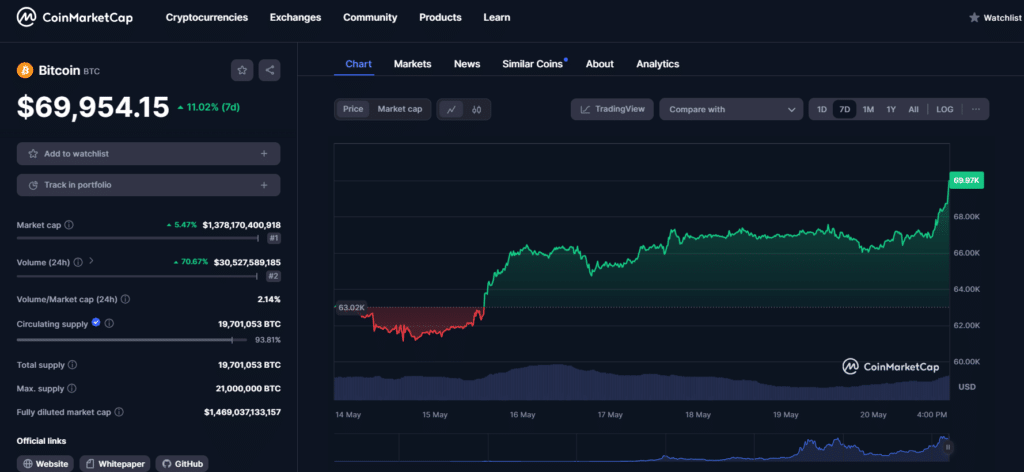

As a researcher studying the cryptocurrency market, I discovered an intriguing correlation between trading volumes and total market capitalization. According to CoinMarketCap data, there was a striking 55% surge in daily trading volumes, which in turn led to a notable 5% increase in the entire crypto market cap, pushing it above $2.5 trillion. This development came on the heels of last week’s robust demand for Bitcoin (BTC) spot ETFs. The resulting ripple effect saw BTC rallying by over 11% and reaching a new peak price of $69,900.

As a crypto investor, I’ve noticed that altcoins often deliver larger percentage gains than Bitcoin due to their smaller market caps and heightened volatility. In fact, among the top 100 cryptocurrencies, eight of them have seen returns of at least 10%.

According to CoinMarketCap, Pyth Network (PYTH) experienced the most significant price growth of the day with a 20.7% increase. Pendle (PENDLE) came in second place with a 19.7% surge, and Beam (BEAM) saw a notable gain of 17.2%. Injective (INJ) rounded out the top four with a 14.3% price hike.

Five cryptocurrencies – Theta Network (THETA), Bittorent (TAO), SEI, and Sui (SUI) – experienced significant gains, with each coin increasing by over 10%. Their respective positions in the rankings are fifth, sixth, seventh, and eighth.

Top altcoin bounces ahead of ETF decision

Ethereum‘s (ETH) top altcoin price increased by 9% in value. The token underwent volatile price movements in the past few hours, yet investors might exercise caution as anticipated SEC rulings on proposed ETH spot exchange-traded funds (ETFs) in the United States approach.

As a cryptocurrency market analyst, I’d like to share some insights based on recent developments. According to crypto.news, the Securities and Exchange Commission (SEC) is expected to make decisions on at least two proposed exchange-traded funds (ETFs) that are Ethereum-based this week. The outcome of these decisions could significantly impact market sentiment towards Ethereum. A positive ruling could lead to increased demand for Ethereum, potentially pushing its price higher. Conversely, a rejection could result in decreased investor confidence and potentially trigger a selloff. Keep an eye on the SEC’s announcement for any potential market reactions.

Read More

- Pi Network (PI) Price Prediction for 2025

- Gold Rate Forecast

- USD CNY PREDICTION

- 10 Most Anticipated Anime of 2025

- USD MXN PREDICTION

- Silver Rate Forecast

- EUR CNY PREDICTION

- USD JPY PREDICTION

- Brent Oil Forecast

- Capcom has revealed the full Monster Hunter Wilds version 1.011 update patch notes

2024-05-20 23:02