As an experienced analyst, I have closely monitored the Ethereum Name Service (ENS) market and its recent price movements. The token’s impressive 15.62% gain in the past 24 hours, pushing it above the $26 mark for the second time this month, is a noteworthy development. However, I am cautiously optimistic about these gains as data suggests ENS is overbought at this price point.

The Ethereum Name Service (ENS) has experienced significant growth, but recent data indicates that the token may be overbought at its current price level.

I’ve noticed an impressive 15.62% price increase for ENS in just the past 24 hours, with its current value sitting at $26.7 as I pen this down. This is actually the second instance this month that ENS has managed to break above the $26 threshold – a level not seen since early January 2022.

As an analyst, I would express it this way: The price increase notwithstanding, ENS has dropped a significant 69% since reaching its peak of $85.69 in November 2021.

After a surge in prices, the market capitalization of ENS reached a total value of $840 million, ranking it as the 82nd largest cryptocurrency. The asset’s daily trading volume experienced a 39% increase, now standing at approximately $227 million.

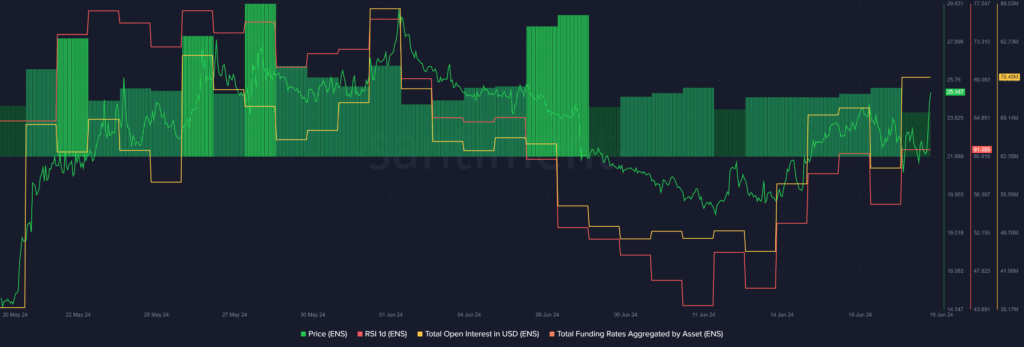

Based on Santiment’s data, the total open interest for ENS grew by 27% in just one day, escalating from $60.32 million to $76.45 million. This significant increase in open interest often results in heightened price volatility as more liquidations occur.

According to market intelligence data, the total funding rate for ENS, as depicted in the chart, decreased from 0.009% to 0.006% within the last 24 hours. A significant portion of this decrease can be attributed to an influx of new short positions, indicating that many traders have placed bets anticipating a drop in ENS’ price.

According to Santiment’s analysis, the Relative Strength Index (RSI) of the Enron Securities (ENS) asset is presently around 61. This implies that the asset has experienced some buying pressure and is considered slightly overbought. Large market players, commonly referred to as ‘whales,’ may attempt to manipulate the price by buying or selling in significant quantities.

For ENS to remain in the bullish zone, its RSI would need to cool down below the 50 mark.

Read More

- 10 Most Anticipated Anime of 2025

- USD MXN PREDICTION

- Pi Network (PI) Price Prediction for 2025

- Silver Rate Forecast

- USD CNY PREDICTION

- USD JPY PREDICTION

- Gold Rate Forecast

- Brent Oil Forecast

- How to Watch 2025 NBA Draft Live Online Without Cable

- Castle Duels tier list – Best Legendary and Epic cards

2024-06-19 10:16