As a seasoned crypto investor with over a decade of experience navigating the tumultuous waters of digital assets, I find myself both encouraged and apprehensive about the latest developments in Bitcoin ETFs. The surge in exchange-traded funds this August is undeniably impressive, but the recent outflows from Bitcoin ETFs have left me with a sense of déjà vu – a rollercoaster ride that seems all too familiar.

In contrast to the general trend, exchange-traded funds saw increased trading activity in August; however, Bitcoin exchange-traded funds experienced significant withdrawals as the month came to a close.

In August, there seemed to be an unquenchable demand for exchange-traded funds, even though it’s usually a quiet period financially during the summer months.

Based on data from BlackRock, there was a significant increase in investments amounting to approximately $129.7 billion during the previous month. This suggests that the dynamic industry is poised to surpass its annual record of $1.3 trillion, which it set back in 2021.

The introduction of Bitcoin Exchange-Traded Funds (ETFs) in January has turned into quite an achievement, as recent data reveals that approximately 4.58% of the total market capitalization of Bitcoin is now owned by significant U.S. funds.

Currently, BlackRock’s iShares Bitcoin Trust boasts the largest management among its peers, overseeing a total of approximately $20.56 billion in assets.

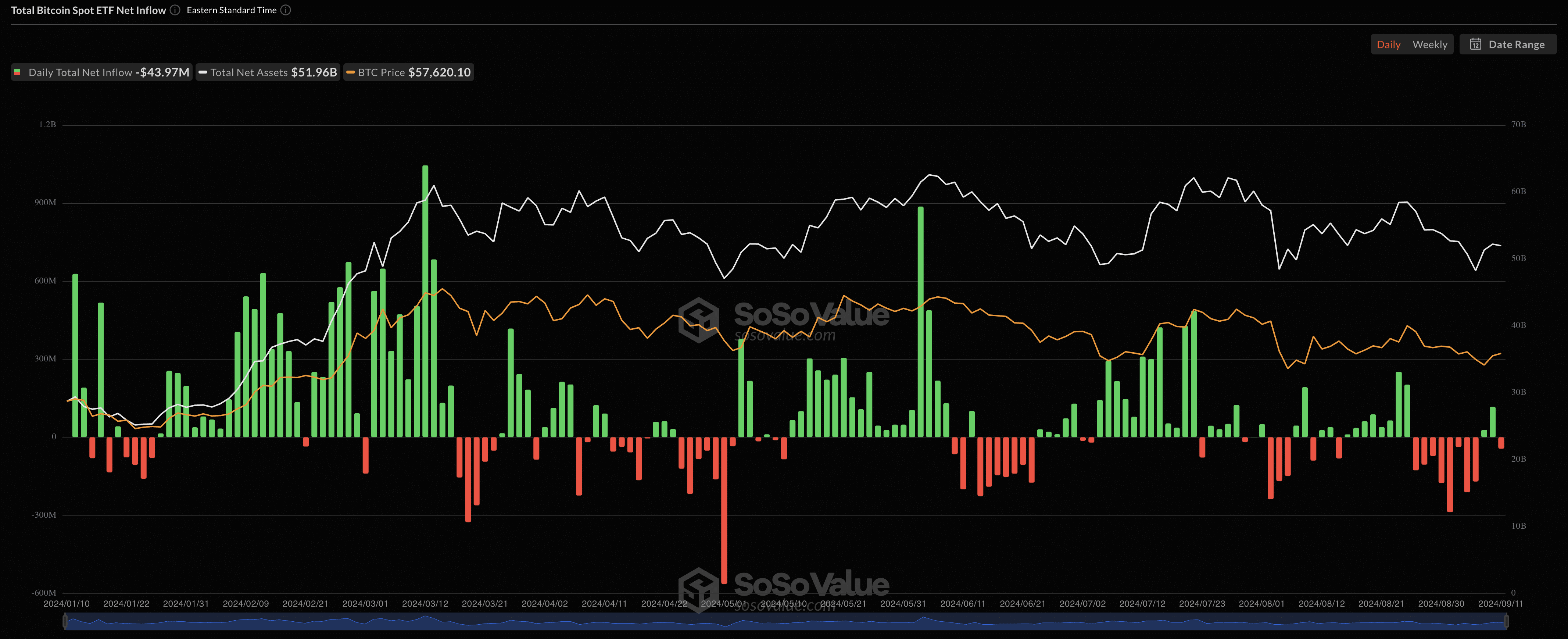

However, Bitcoin Exchange-Traded Funds (ETFs) have experienced significant fluctuations over the past few weeks, as they’ve seen eight straight days of withdrawals between August 27 and September 6.

As Bitcoin, the largest global cryptocurrency, plummeted to record lows at around $52,598.70, certain pessimists suggested that it might continue dropping beneath $50,000 for an extended period.

Stepping back for a broader perspective, it’s clear that uncertainties about the health of the U.S. economy have contributed to the lackluster performance of Bitcoin ETFs in recent times.

Despite the fact that inflation has dropped to nearly the Federal Reserve’s goal of 2%, which is 2.5%, weak job growth is causing concern among some traders who fear a potential economic recession might be approaching.

It remains uncertain if Federal Reserve Chair Jerome Powell will lower interest rates, as both the Bank of England and the European Central Bank have previously done so, with their decisions taking effect this coming week.

Based on the CME FedWatch Tool, a tool that monitors opinions among traders dealing with interest rates, it’s estimated that there’s approximately an 85% likelihood of a reduction in interest rates by 0.25% on September 18.

As an analyst, I’m observing a group of individuals who anticipate the U.S. Federal Reserve to take additional measures beyond the current plan. They foresee a potential decrease in interest rates by 0.5 percentage points.

Up until now, Powell has been very careful about taking action, emphasizing the need for additional evidence showing that inflation is being managed effectively. However, certain analysts are beginning to worry that this reduction might have come too late.

This situation might explain the current fatigue prevalent in the cryptocurrency market, as the Fear & Greed Index stands at 37, signifying apprehension among investors.

However, the more significant query that arises now is: What can we anticipate for Bitcoin ETFs for the remainder of the year, and are there any patterns from the first part of the year that we should consider?

Who’s buying Bitcoin ETFs?

It’s possible to contend that the assumption that Bitcoin Exchange-Traded Fund (ETF) inflows would consistently rise, without any downward movement or deviations, has been unrealistic or biased.

However, it’s reasonable to encounter setbacks, considering the novelty of Bitcoin as an investment option. It’s no surprise that some investors might hesitate due to its high volatility.

Jim Bianco, head of Bianco Research, recently provided insights on the performance of Bitcoin Exchange-Traded Funds (ETFs) that track its current market value, starting from January.

Recently, his findings indicate a significant decrease in the rate at which funds are flowing in. Initially, these inflows amounted to $12 billion collectively across all Bitcoin Exchange-Traded Funds within the first two months. However, this figure dropped to approximately $4 billion over the subsequent six months.

On Friday when Bitcoin dropped to a low of $52,900, its owners collectively faced an unprecedented $2.2 billion in potential losses.

1/8 update on Bitcoin Exchange-Traded Funds (ETFs) summary:

— Jim Bianco (@biancoresearch) September 8, 2024

While BTC ETFs have been touted as an avenue for institutional investors and high net worth individuals to finally gain exposure to crypto’s price swings without owning the asset directly, Bianco argues that “small tourist online retail” represents their biggest audience.

As a researcher, I’ve observed that the typical trade size for these Exchange-Traded Funds (ETFs) averages at around $12,000. This figure, although significant, represents only a small portion compared to the trades regularly observed in other ETF sectors.

Moreover, Bianco suggests that only about 15% of the demand for Bitcoin ETFs originates from conventional financial institutions, indicating that there’s still a significant amount of effort required in this area.

He wrote on X that it may take another four years for momentum to pick up — and institutional investors may need further convincing before they decide to start allocating funds:

The initial eight months of Spot BTC trading have made clear that the idea “build it (Spot BTC ETFs), and the boomers will follow” was never valid. Instead, more patience and a few additional periods (including some winters) might be required, along with significant advancements in development, before any substantial progress can be seen.

Read More

- 10 Most Anticipated Anime of 2025

- Gold Rate Forecast

- Pi Network (PI) Price Prediction for 2025

- USD MXN PREDICTION

- USD CNY PREDICTION

- Silver Rate Forecast

- USD JPY PREDICTION

- EUR CNY PREDICTION

- Brent Oil Forecast

- Castle Duels tier list – Best Legendary and Epic cards

2024-09-13 14:19