Ethereum‘s Price Dance: Will It Break Free? 💃

Ah, Ethereum! The second jewel in the crypto crown, currently causing quite a stir, wouldn’t you agree? After a flamboyant surge of 14% – a veritable ballet for the bulls – it now teeters precariously at the edge of key resistance levels. Optimism abounds, naturally, as investors clutch their rubles and whisper sweet nothings of future riches. But let’s not get ahead of ourselves, shall we? This could all end in tears, like a poorly written opera. 🎭

The esteemed analyst Daan, a veritable Rasputin of the crypto world, has cast his gaze upon the charts and declared Ethereum to be trapped, like a soul in purgatory, between \$2,475 and \$2,735. A consolidation zone, he calls it. A battleground, more like! The price, like a lovesick fool, has repeatedly tested these boundaries. The \$2,735 mark, in particular, has been retested for the fourth time, a level that has played the role of both temptress and gatekeeper.

The price, in its infinite wisdom (or lack thereof), has swept both the highs and lows within this range, suggesting a period of indecision that could precede a move of great import. For the bulls to maintain their dominance, clearing this resistance is as crucial as a samovar is to a Russian winter. Failure to do so might invite renewed selling pressure, keeping the market on edge like a tightrope walker in a hurricane.

Ethereum finds itself at a most decisive juncture, a crossroads of epic proportions! After a surge that drew the attention of every Tom, Dick, and Ivan, the price has tested key thresholds, leaving market participants in a state of heightened anticipation. Sentiment is divided, naturally. Some analysts, blinded by the recent momentum, foresee a breakout to higher prices. Others, more cynical perhaps, predict an imminent correction, citing risks of overextension. And let’s not forget the global tensions and macroeconomic instability, those delightful ingredients that keep the financial markets as volatile as a Moscow nightclub on a Saturday night.

Daan, in his infinite wisdom, reiterates that Ethereum remains rangebound between approximately \$2,475 and \$2,735. Within this zone, the price has swept both the highs and lows, reflecting a period of consolidation. The \$2,735 level, that pesky psychological and technical barrier, has been retested for the fourth time. One begins to wonder if Ethereum is simply enjoying the view from up there. 🤔

According to Daan, this prolonged range play suggests that a breakout—either upward or downward—is imminent, likely triggering a substantial move. But he cautions against overcommitting to either bullish or bearish positions until such a breakout occurs. Over the past few weeks, traders have repeatedly bet on breakouts in both directions, only to be left “chopped up” like borscht in a blender. A most unpleasant fate, wouldn’t you agree?

This pattern of indecision has left many investors feeling rather like a chicken who has lost its head. With global economic uncertainties adding pressure, Ethereum’s next move hinges on whether bulls can decisively clear the \$2,735 resistance or if bears will capitalize on a potential reversal. Until clarity emerges, the market remains a battleground of competing forces, a veritable chess match between titans. ♟️

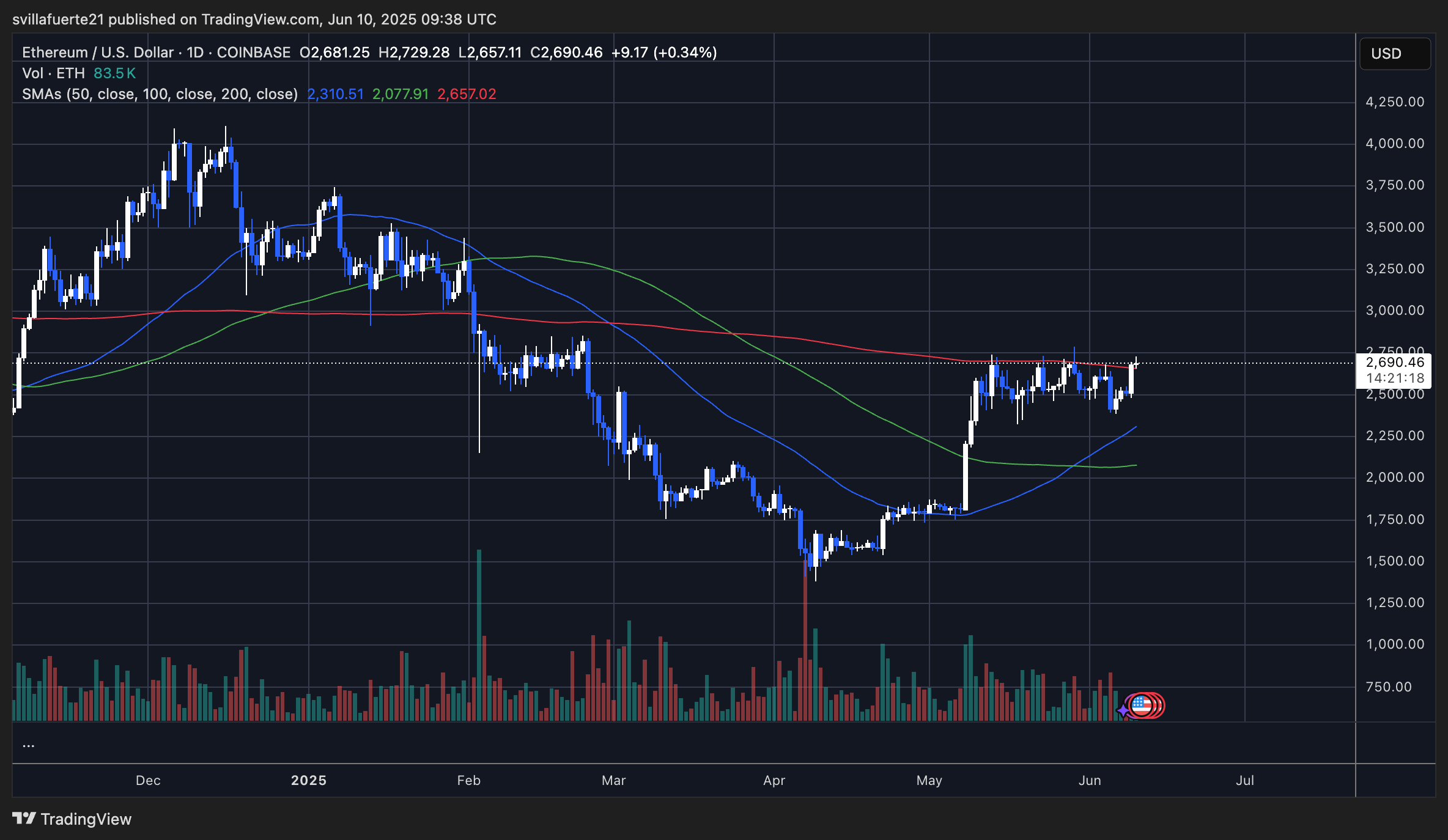

Currently, Ethereum is dawdling around \$2,690.46 on the 1-day chart, following a period of consolidation after a rather sharp decline. After finding support near \$1,750 in April, ETH formed a tentative ascending triangle pattern, with recent price action testing key moving averages. The 50-day SMA (\$2,310.51) and 100-day SMA (\$2,077.91) have been breached upward, while the 200-day SMA (\$2,657.01) remains a critical resistance, aligning with the current price zone.

This move suggests short-term resilience, setting the stage for a potential test of the \$2,750 resistance, a level retested four times since early 2025. A decisive daily close above \$2,750, supported by rising volume, could pave the way for a push toward \$3,000. The chart reveals rising lows since April, indicating accumulation and renewed buyer interest, particularly around the \$2,500-\$2,600 range. Increasing volume during recent upticks adds credibility to the breakout attempt, reducing the likelihood of a false move.

Should ETH manage to hold above \$2,500, the trend leans bullish. However, a rejection at \$2,750 might drive the price back to the \$2,250-\$2,400 support zone. The market remains rangebound between \$2,475 and \$2,735, per analyst Daan’s insights, with a breakout likely to trigger a significant move. All eyes are on whether ETH can clear \$2,750 to confirm upward momentum. The suspense is thicker than pea soup in a Siberian blizzard! 🥶

Read More

- 10 Most Anticipated Anime of 2025

- USD MXN PREDICTION

- Brent Oil Forecast

- Silver Rate Forecast

- Pi Network (PI) Price Prediction for 2025

- USD JPY PREDICTION

- USD CNY PREDICTION

- How to Watch 2025 NBA Draft Live Online Without Cable

- Gold Rate Forecast

- Castle Duels tier list – Best Legendary and Epic cards

2025-06-11 00:06