As a seasoned researcher with years of experience in the cryptocurrency market, I find myself intrigued by the latest developments surrounding Ethena (ENA). The recent sell-off by Arthur Hayes, the co-founder and former CEO of BitMEX, has raised some eyebrows, but it’s important to remember that even whales need to cash out sometimes.

On December 12th, Ethena saw a reversal of some of its previous growth, as data from the blockchain suggested that Arthur Hayes had been offloading his holdings.

The price of the Ethena token (ENA) dipped to $1.10, falling from a peak of $1.2240 during the day. This represents a decrease of more than 16% compared to its highest point this month.

According to data from Nansen, it appears that Hayes, the ex-CEO of BitMEX and one of its co-founders, transferred approximately 7 million tokens valued at around $8.47 million over to Binance. Transferring cryptocurrency from a personal wallet is often an indication that a crypto investor might be looking to offload their holdings.

As reported by Arkham, Hayes currently holds approximately 7.19 million ENA tokens, valued at more than $8.5 million. Additionally, his investment portfolio encompasses Ethereum (ETH), Wilder World, Pendle (PENDLE), and Ethena Staked USDe.

A few days after Donald Trump’s World Liberty Finance purchased 741,687 ENA tokens worth $823,000, Ethena has proposed a more extensive partnership with WLFI. This potential collaboration could involve the integration of sUSDe in the forthcoming Decentralized Finance platform developed by WLFI.

As a cryptocurrency analyst, I am thrilled to report that the value locked within Ethena’s ecosystem, primarily in the form of USDe stablecoin, surpassed $6 billion for the first time. This significant growth has catapulted it into third place among stablecoins in the crypto market, trailing only Tether and USD Coin.

The primary reason for the growth of USDe is its substantial return rate. As stated on their website, USDe’s stablecoin provides a yield of approximately 12%, significantly more than the returns offered by U.S. government bonds or most dividend-focused ETFs.

It appears that Polymarket users are confident that the USDe stablecoin will maintain its dollar parity throughout this year. As indicated by the site, the likelihood of the coin dropping below 90 cents is relatively high. In fact, the chances of it losing its peg were nearly 20% back in May, with analysts drawing comparisons to Terra.

Besides launching USDtb, a fresh stablecoin supported by the prominent asset manager BlackRock that manages over $11.5 trillion in assets, Ethena has also made this move.

Technicals suggest more Ethena price gains

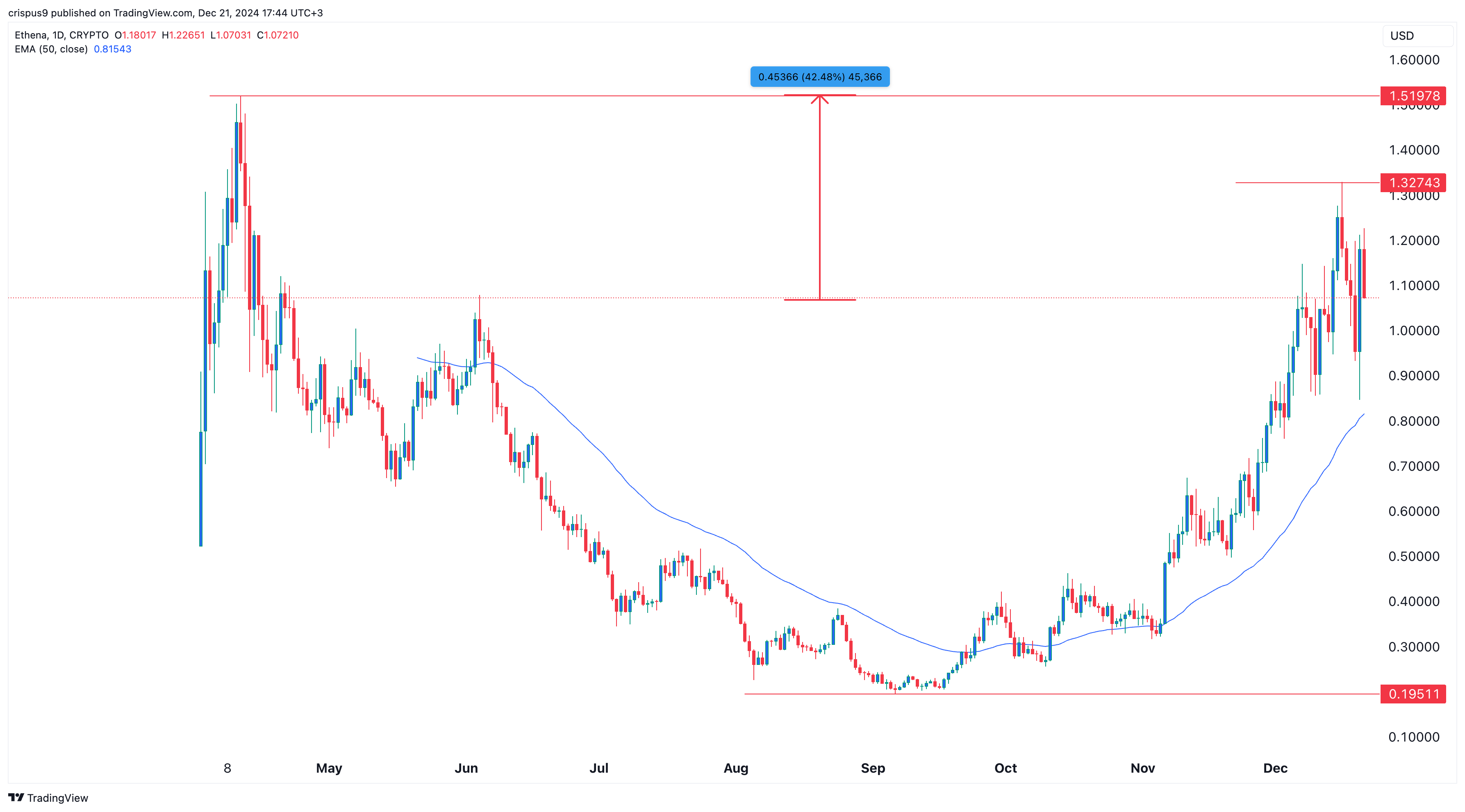

daily graph indicates that ENA’s lowest point was at $0.1951 in September, but it has surged by an impressive 445% to its current price of $1.0825. The coin now sits above the 50-day average and the significant milestone of $1.00.

Indications point towards the development of a cup and handle chart formation, with its peak at approximately $1.5197. If this month’s high of $1.3275 is surpassed, it will significantly boost the probability of the price reaching the projected level of $1.5197, which represents an approximate 42% increase from the current position.

Read More

- 10 Most Anticipated Anime of 2025

- USD CNY PREDICTION

- Pi Network (PI) Price Prediction for 2025

- Silver Rate Forecast

- Gold Rate Forecast

- USD MXN PREDICTION

- USD JPY PREDICTION

- Brent Oil Forecast

- EUR CNY PREDICTION

- How to Watch 2025 NBA Draft Live Online Without Cable

2024-12-21 18:46