As a seasoned researcher with years of experience in the dynamic world of cryptocurrencies, I find myself intrigued by the recent behavior of Ethereum (ETH). The Boxing Day retreat is nothing new to me, as it seems that even Santa’s gifts can’t shield the crypto market from occasional bearish trends.

Ethereum price retreated on Boxing Day as the gains made during the Santa Claus rally were erased.

Ethereum (ETH) token fell to $3,340, down by over 5.6% from its highest level this week. This retreat happened as a sea of red spread in the crypto industry, with the market cap of all coins falling to $3.29 million.

During the Christmas break, when many traders were absent from the market, Ethereum experienced a dip in a setting with reduced trading activity. According to CoinGecko statistics, the 24-hour trading volume dropped significantly, from $24 billion to $17.5 billion, marking the lowest volume in over a month.

The open interest for Ethereum’s futures contracts has been decreasing and recently hit a record low of $26 billion, which is a drop from the peak of $28 billion this month. A decreasing open interest indicates a decrease in demand among traders who deal with futures.

Although there are some challenging times in the Ethereum market, it’s worth noting some encouraging trends. According to DeFi Llama, the total value locked within its DeFi ecosystem has experienced a growth of approximately 5.50% over the past month. In contrast, the TVL for both Solana and Tron have seen a decline of more than 3% during this timeframe.

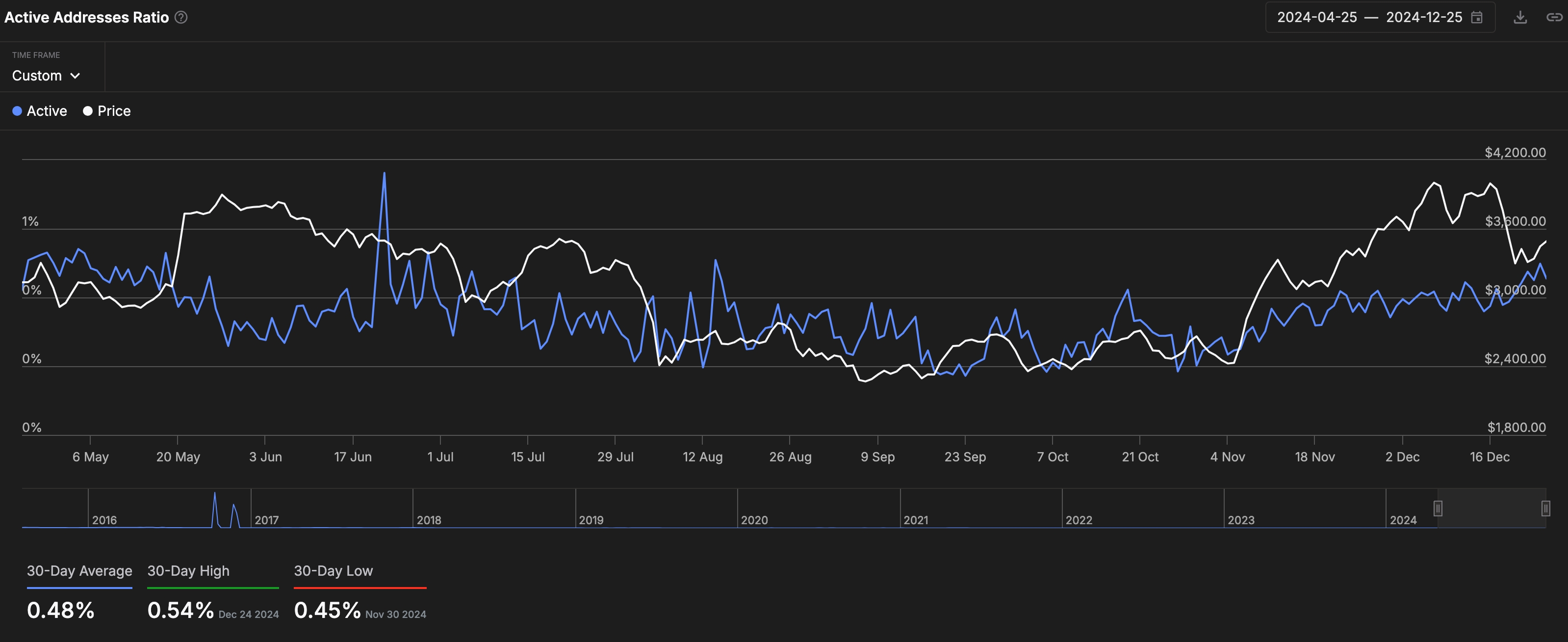

Over the past few months, the proportion of active Ethereum addresses relative to total balances has been steadily increasing. This ratio, which was at a low of 0.37% in October, has now reached 0.57%, its highest point since August. This significant metric measures the number of active addresses compared to the number of balances held. Currently, more than 927,000 Ethereum addresses are actively being used.

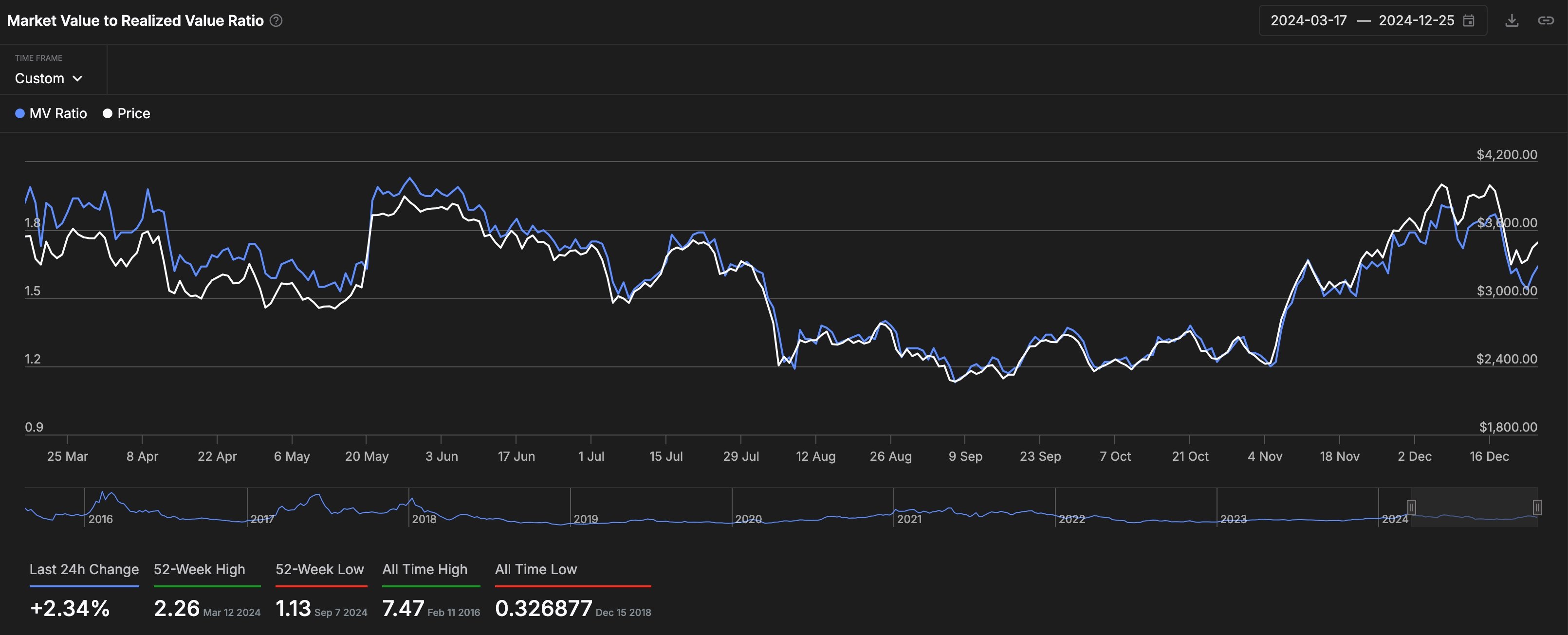

In the past day, it’s been observed that Ethereum’s Market Value to Realized Value score increased by 2.35%, reaching 1.64. This significant metric helps determine if a cryptocurrency is overpriced or underpriced. When this MVRVA ratio is below 3.8, it suggests the asset may be relatively undervalued.

Ethereum price analysis

The daily graph indicates that the Ethereum price briefly formed a minor double-top structure around $4,095, which subsequently saw a significant bearish collapse. However, it later recovered and attempted to revisit the pattern’s support line at $3,500, marking its lowest point on December 3.

On Christmas Day, ETH displayed a modest doji candlestick formation. A doji, characterized by a tiny body and extended upper and lower wicks, is generally interpreted as a bearish indicator. Additionally, Ethereum has recently shaped a bearish pennant chart pattern.

Consequently, it seems that the value of the coin is expected to experience a downtrend, potentially dipping 10% below its current price and reaching around $2,700 (the psychological $3,000 mark).

Read More

- 10 Most Anticipated Anime of 2025

- Gold Rate Forecast

- USD CNY PREDICTION

- Pi Network (PI) Price Prediction for 2025

- USD MXN PREDICTION

- USD JPY PREDICTION

- Silver Rate Forecast

- EUR CNY PREDICTION

- Brent Oil Forecast

- Castle Duels tier list – Best Legendary and Epic cards

2024-12-26 20:06