As a seasoned analyst with over two decades of experience in the financial markets, I’ve seen my fair share of market ebbs and flows. The current state of Ethereum is a stark reminder of the unpredictable nature of the crypto market. Ether’s sell-off is indeed accelerating, and if we look at the technical indicators, it seems there’s more downside to come.

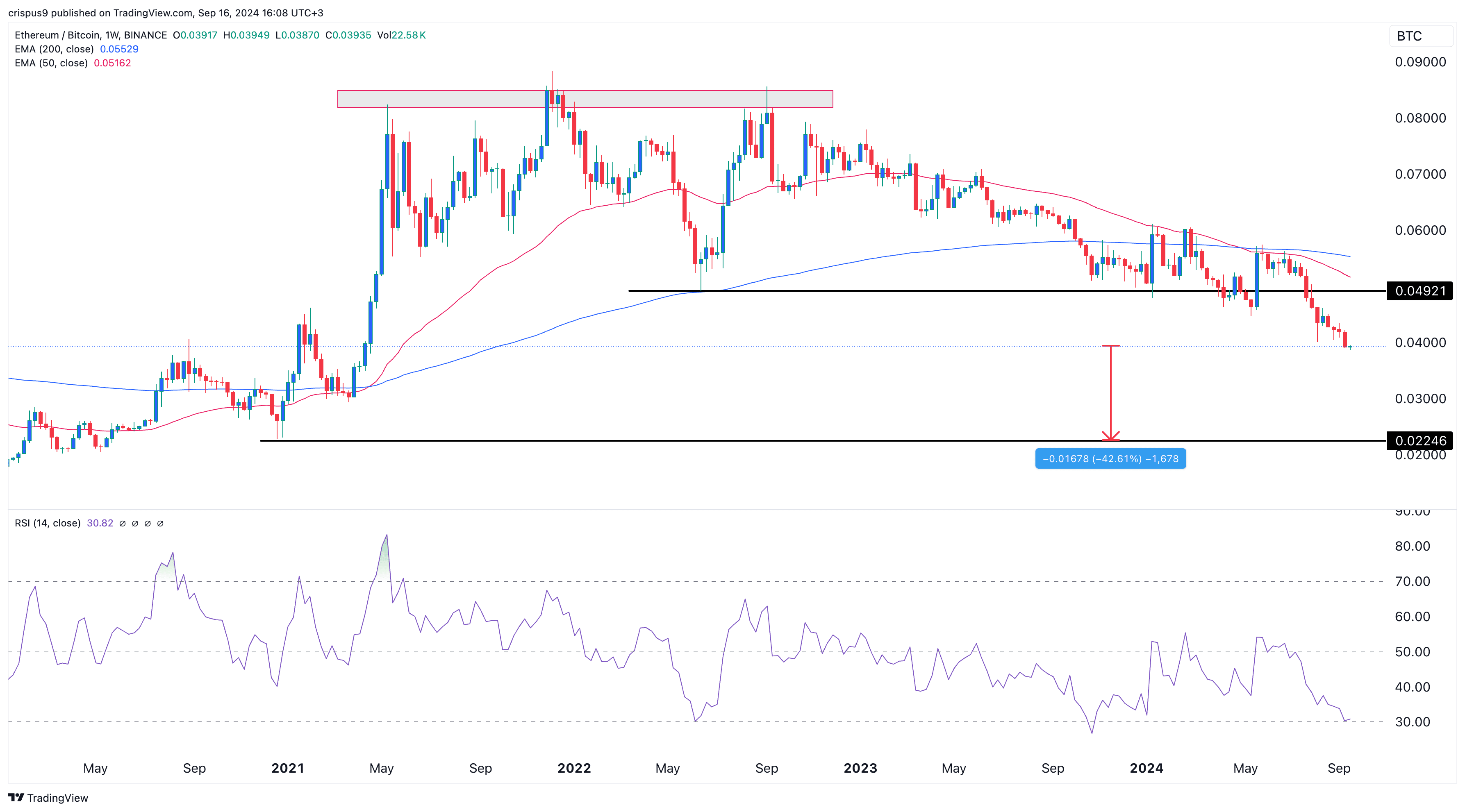

Ethereum‘s value relative to Bitcoin kept plummeting, reaching a record low not seen since April of last year. This downward trend has resulted in a decline of more than 55% from its peak in 2021.

Ether’s sell-off is accelerating

Ethereum (ETH) was trading at 0.039 BTC, down by 24% this year and by 35% from the year-to-date high. It has also dropped against other cryptocurrencies like Solana (SOL), Binance Coin (BNB), and Tron (TRX).

In US dollars, the coin has declined consistently for four months straight, currently hovering around $2,300 – a level not seen since February, marking its lowest point during this period.

The significant decrease in Ethereum’s value might be attributable to a lackluster participation from institutional investors, who have predominantly stayed clear of Ether exchange-traded funds (ETFs). Statistics demonstrate that these Ether ETFs have experienced net withdrawals amounting to approximately $581 million. At present, they manage roughly $6.62 billion in assets, which is significantly lower compared to Bitcoin spot funds, which boast over $54 billion and have witnessed net increases of $18 billion.

The decrease in Ether can be attributed, in part, to recent sell-offs by both the Ethereum Foundation and its founder, Vitalik Buterin. Buterin liquidated tokens valued at approximately $2.2 million, while the foundation offloaded 350,000 coins.

20 minutes ago, a digital wallet linked to VitalikButerin’s Ethereum address (vitalik.eth) exchanged 190 Ether for approximately 441,971 USD Coin (USDC).

— Lookonchain (@lookonchain) September 11, 2024

Primarily, it’s worth noting that there’s a growing apprehension about Ethereum potentially ceding its market dominance to second-layer networks such as Base, Arbitrum, Polygon, and Blast. These networks are renowned for their faster transaction speeds and lower fees compared to Ethereum.

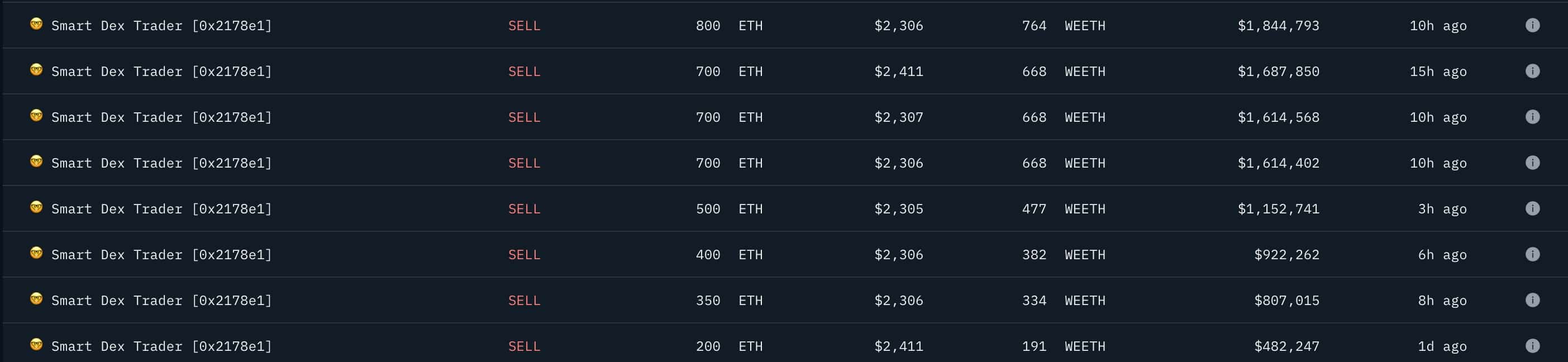

Furthermore, it appears that several experienced investors are offloading the cryptocurrency. For instance, a single investor dumped approximately $10 million worth of ETH within the past day, as illustrated below.

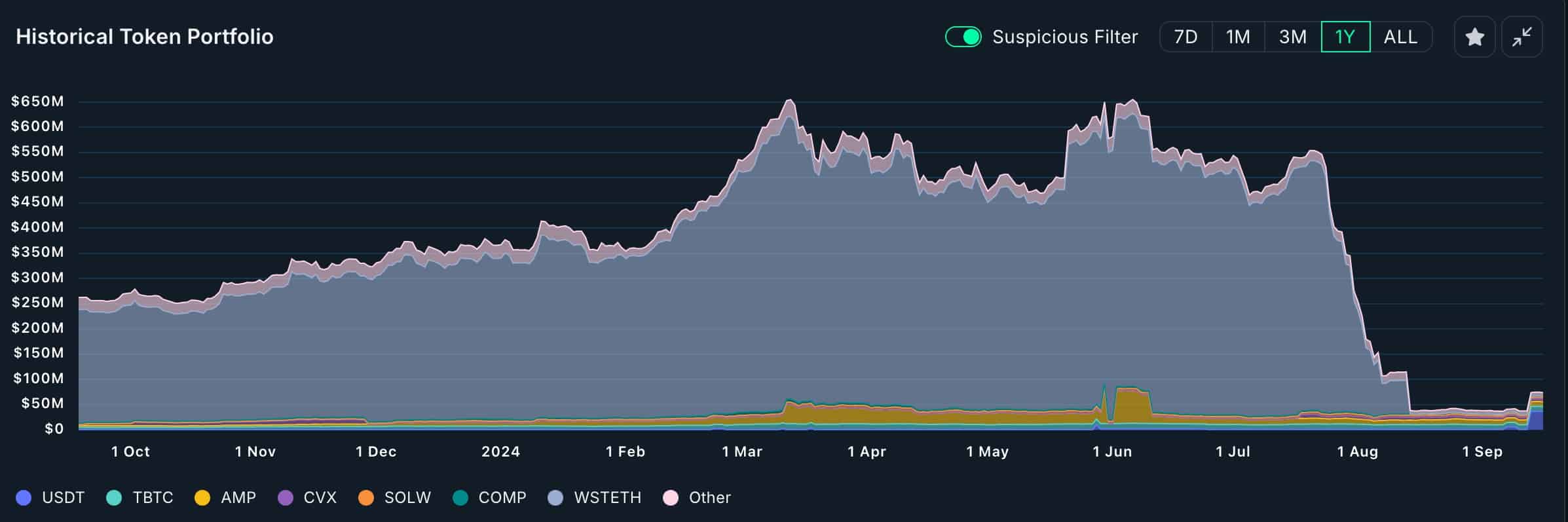

One prominent figure in the cryptocurrency market, Jump Trading, has been reported by Nansen to have liquidated all its Ethereum assets. Initially holding over $531 million worth of Ether in July, they are now said to possess none.

Ethereum has more downside in BTC terms

The ongoing Ether sell-off began after it formed a triple-top chart pattern around the 0.088 level between May 2021 and September 2021. The coin then dropped below the pattern’s neckline at 0.049 on May 20 of this year.

Additionally, it developed a “death crossover” in April, where its 50-week and 200-week moving averages intersected, suggesting a potential downtrend ahead.

The Relative Strength Index (RSI) has pulled back and re-entered the oversold zone at 30, suggesting substantial bearish momentum. This trend implies that Ether might face more downward pressure, with the potential support level at 0.0224, a decrease of approximately 42% from its current value.

Read More

- 10 Most Anticipated Anime of 2025

- USD CNY PREDICTION

- Pi Network (PI) Price Prediction for 2025

- Silver Rate Forecast

- Gold Rate Forecast

- USD MXN PREDICTION

- USD JPY PREDICTION

- Brent Oil Forecast

- EUR CNY PREDICTION

- How to Watch 2025 NBA Draft Live Online Without Cable

2024-09-16 16:44