As a seasoned crypto investor with a few battle scars from past market corrections, I’ve learned to take price volatility in stride. The recent correction in Ethereum (ETH) following its month-high wasn’t entirely unexpected, given the rapid price increase after the SEC’s ETF approval.

Days after hitting a month-high of $3,943, the price of Ethereum (ETH) has begun to correct.

Following the SEC’s approval of NASDAQ and NYSE’s applications to list Ethereum exchange-traded funds, there was an initial surge in the cryptocurrency market.

As a crypto investor, I’m thrilled about the recent turn of events in the regulatory landscape. The Securities and Exchange Commission (SEC) surprised us all on May 23rd by giving the green light to certain ETF applicants, marking a major win for those firms and a positive step forward for our industry as a whole. Despite the fact that final approvals are still required before these products can officially launch, this decision is a significant and unexpected victory.

Prior to Monday, it was widely expected that regulators would dismiss the filings. However, nine companies, such as VanEck, ARK Investments/21Shares, and BlackRock, are optimistic about launching Ethereum-linked ETFs. This comes after the SEC’s groundbreaking approval of Bitcoin ETFs in January.

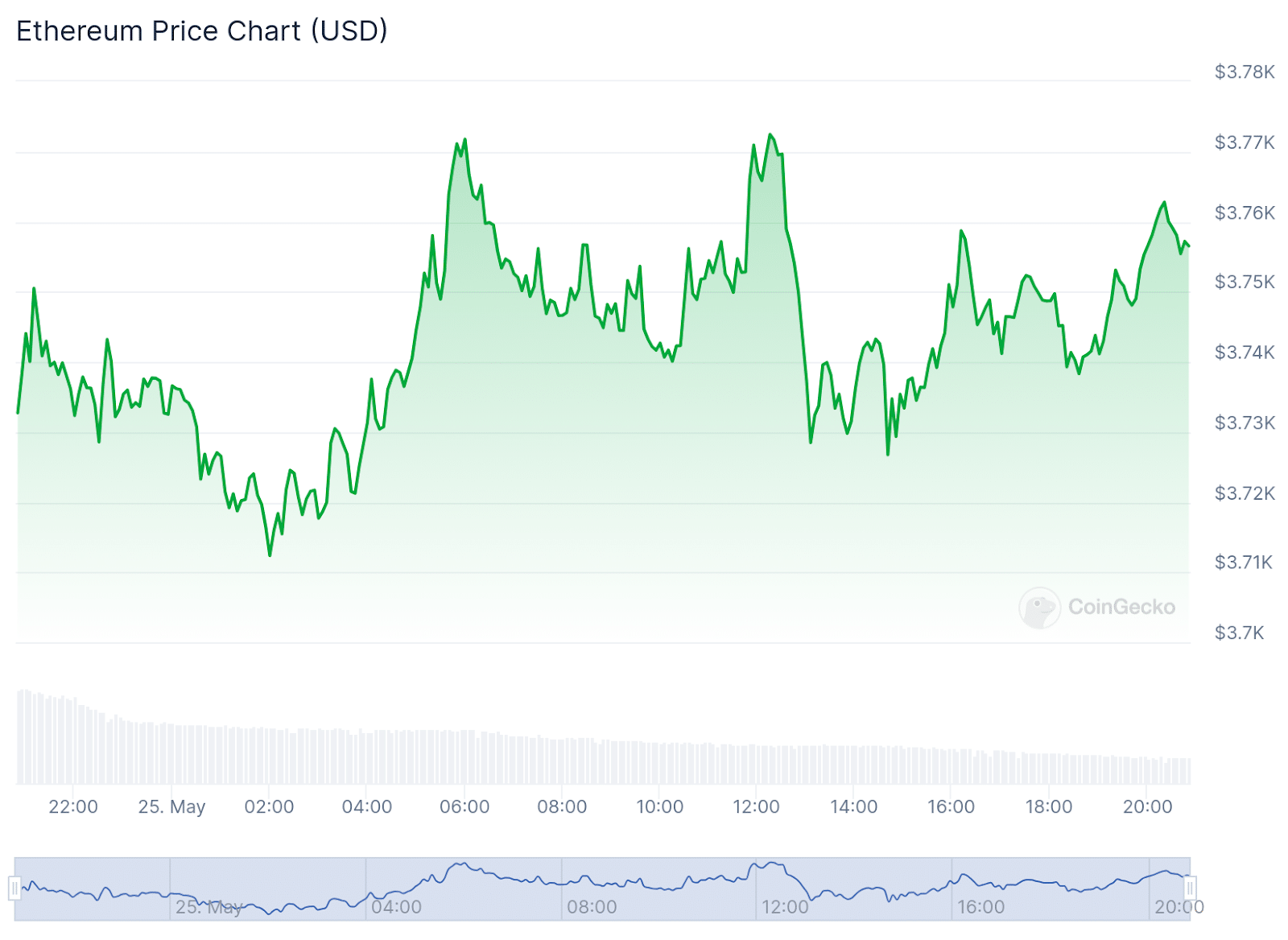

As a researcher studying the cryptocurrency market, I’ve observed an intriguing trend with the second-largest digital asset by market capitalization. Following its approval for exchange-traded fund (ETF) listing, there was an initial surge in its price. However, since then, it has experienced a decline of over 4% and is now being traded at around $3,760.

Despite a small 0.9% rise in the past day and a more substantial 20.7% surge over the last week, Ethereum’s current price represents a notable gain of 28.5% compared to two weeks ago, and a 19% hike over the past month, based on CoinGecko’s statistics.

As a researcher studying the cryptocurrency market, I’ve observed that Ethereum’s price has been fluctuating within a narrow range over the past day, hovering between $3,776 and $3,710. This pattern suggests an accumulation of energy or momentum, which could result in a significant price movement. Depending on the direction of this movement, we may see Ethereum breaking through the current consolidation range, potentially leading to a notable increase or decrease in its value.

At this juncture, the next direction for ETH remains uncertain.

According to QCP Capital’s market analysts, the Securities and Exchange Commission (SEC) giving its green light to Ethereum spot ETFs might push Ethereum prices up to $5,000 by the year-end.

Read More

- 10 Most Anticipated Anime of 2025

- Gold Rate Forecast

- Pi Network (PI) Price Prediction for 2025

- USD CNY PREDICTION

- USD MXN PREDICTION

- Silver Rate Forecast

- USD JPY PREDICTION

- EUR CNY PREDICTION

- Brent Oil Forecast

- Castle Duels tier list – Best Legendary and Epic cards

2024-05-25 23:40