As a seasoned researcher with years of experience in the crypto market, I find the recent surge in Ethereum (ETH) intriguing and promising. With a background that has seen me through multiple bull and bear cycles, I can confidently say that the current $2,800 mark is not just another milestone but a significant step towards wider mainstream adoption.

Large investors are showing significant interest in Ethereum as its value exceeds a three-month peak of $2,800.

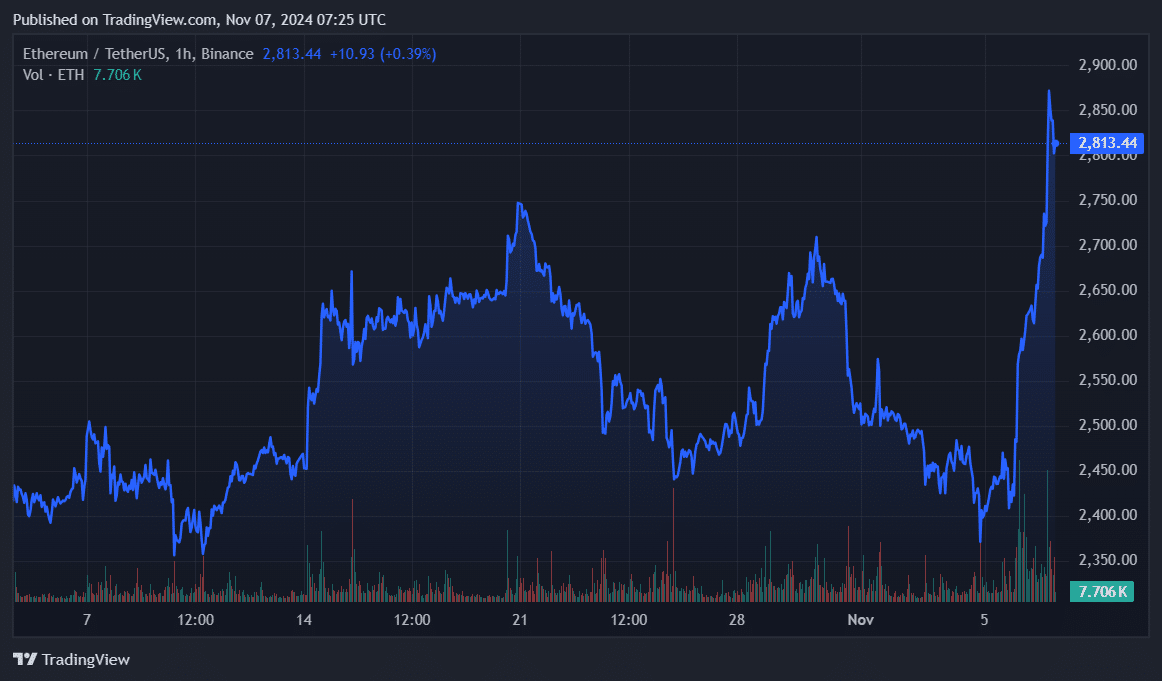

In the last 24 hours, Ethereum (ETH) experienced an 8% increase and is currently being traded near the $2,800 price point. As the top alternative coin, its market capitalization soared beyond $336 billion. Moreover, its daily trading volume jumped by 27%, reaching approximately $38 billion.

This afternoon saw ETH reach a peak of $2,870, however, it subsequently experienced a swift decline as a result of temporary profit-selling.

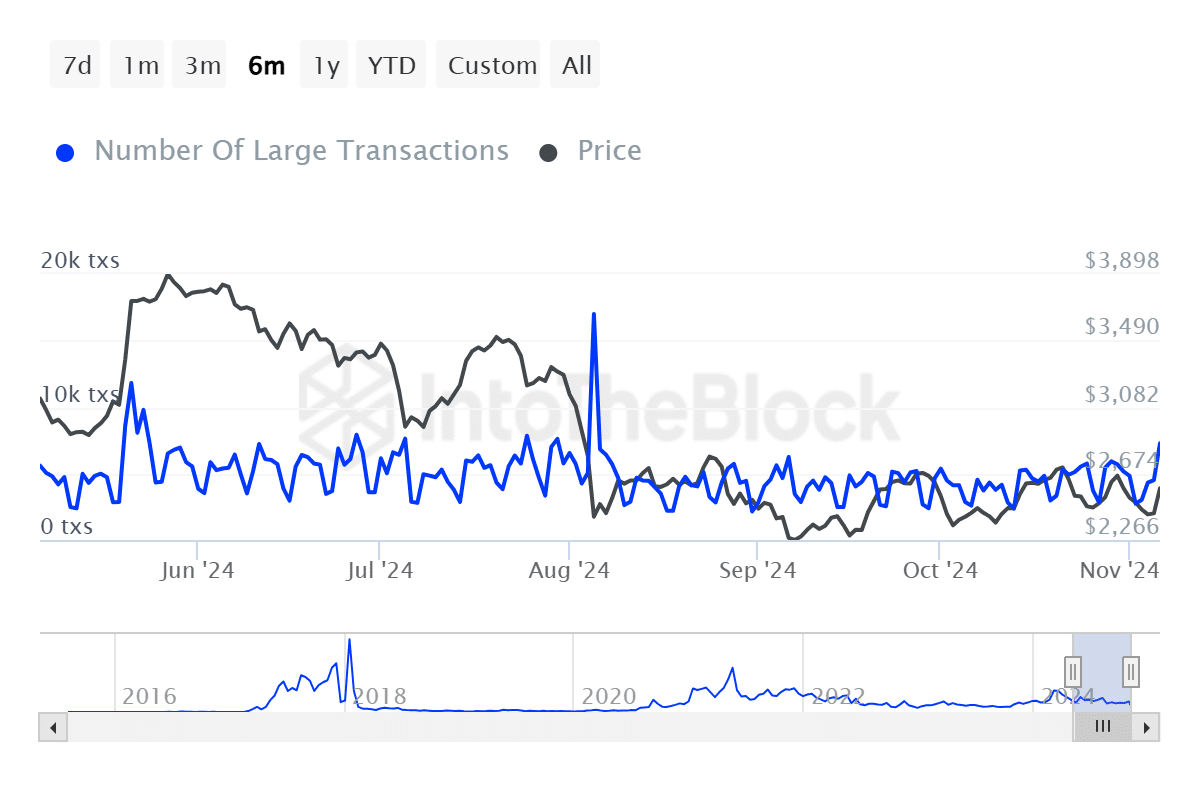

On November 6th, there was a significant rise in Ethereum (ETH) prices, and this increase coincided with an impressive surge in whale activities. As per data from IntoTheBlock, the number of large Ethereum transactions, valued at least $100,000, spiked by 60%, reaching a three-month high of 7,270 unique transactions on that day.

Data from ITB shows that large holders moved over $8.7 billion worth of ETH yesterday.

However, it’s worth noting that the rate at which large Ethereum (ETH) investors, often referred to as ‘whales’, have been buying ETH has decreased noticeably over the last week. According to ITB data, the net inflow of ETH held by these big investors dropped from 91,300 ETH on October 31 to just 5,930 ETH by November 6.

The decrease in whale activity might suggest doubt or hesitation among large Ethereum investors, as the recent market upswing seems to be driven by the news of the U.S. presidential election.

It’s important to note that 53% of the ETH supply is sitting in whale addresses. If whales start making deposits into the exchanges, it could soon trigger another phase of fear, uncertainty and doubt, also known as FUD, among retail investors.

Yesterday, the amount of Ethereum entering exchanges fell significantly to approximately 4,170 ETH, as compared to Tuesday’s inflow of around 71,720 ETH, based on information from ITB data. This indicates a substantial decrease in the net inflow of Ethereum into these platforms.

Approximately 71% of Ethereum (ETH) owners currently find themselves in a profitable position. Given that more than 74% of these addresses have held ETH for longer than a year, according to ITB data, it’s reasonable to expect some profit-taking as part of the usual market dynamics.

Read More

- Gold Rate Forecast

- Silver Rate Forecast

- Pi Network (PI) Price Prediction for 2025

- USD CNY PREDICTION

- 10 Most Anticipated Anime of 2025

- EUR CNY PREDICTION

- Brent Oil Forecast

- USD MXN PREDICTION

- Hero Tale best builds – One for melee, one for ranged characters

- Roblox: Project Egoist codes (June 2025)

2024-11-07 11:00