As a seasoned analyst with years of experience in the cryptocurrency market, I have witnessed many ups and downs, bull runs, and bear markets. Having closely followed Ethereum’s journey since its early days, I must say that its recent price movements are intriguing.

The value of Ethereum is generating interest as it experienced a 1.4% increase over the last 24 hours, climbing from a significant support point of $2,300 to reach $2,411. This has sparked curiosity among many investors: will Ethereum’s price trajectory continue to climb?

Current Ethereum Price Movements

Ethereum (ETH) is demonstrating signs of a resurgence, following a triangular trajectory. Lately, the Ethereum price bounced back from $2,332, a significant level linked to the Fibonacci extension. If ETH manages to stay above this point, it could potentially reach $2,598, which corresponds to the 0.618 daily Fibonacci Extension. The trading volume has increased by 67%, suggesting heightened market enthusiasm.

If Ethereum doesn’t manage to maintain its position above $2,300, there’s a possibility of it falling down to approximately $2,100, representing a 12% decline from its current value.

Institutional Activity: How Whales and ETFs Affect Ethereum Price

The cost of Ethereum is encountering hurdles because large-scale investors are showing hesitancy, as indicated by a $560 million withdrawal from US spot ETH ETFs, with Grayscale’s ETHE leading the trend. This suggests that major stakeholders are adopting a more cautious approach.

Furthermore, substantial Ethereum (ETH) holdings, even those traced back to the Chinese administration, have started offloading approximately 1.3 billion dollars’ worth of ETH. This, combined with other recent ETH market developments, may potentially intensify selling trends and influence the value of ETH against the US dollar.

Ethereum’s Network Growth and Long-Term Outlook

Although there are some lingering worries, Ethereum’s core foundations continue to be robust. The network has undergone significant enhancements, among them the introduction of Ethereum staking through the Beacon chain, with approximately 34.7 million ETH currently staked. This equates to nearly a quarter of the total ETH supply, bolstering Ethereum’s position as a leading Layer 1 blockchain. Similarly encouraging advancements have recently boosted the optimistic perspective for another significant altcoin, Ripple (XRP).

As a researcher immersed in the world of Decentralized Finance (DeFi), I find myself consistently amazed by Ethereum’s stature. With an impressive Total Value Locked (TVL) of approximately $44 billion, it is undeniably a force to be reckoned with. Moreover, its stablecoin market capitalization towers at a staggering $84 billion, further cementing its position as a leading player.

Beyond ETH: Why Minotaurus ($MTAUR) Is Catching ETH Holders’ Attention

With Ethereum seeing a recent resurgence, many crypto fans are placing significant bets on it. Although Ethereum looks promising, it’s wise to spread your investments. Social media chatter points towards Minotaurus ($MTAUR) as a preferred choice among Ethereum holders, making it an intriguing alternative to explore.

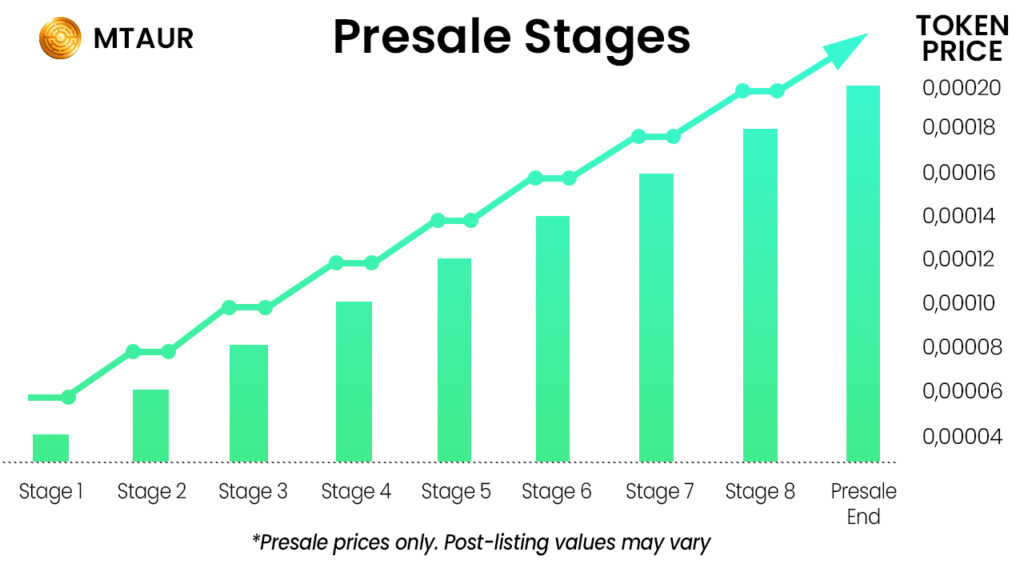

With its presale already surpassing $100,000, Minotaurus ($MTAUR) provides an opportunity for potential buyers at a reduced price. Specifically, you can acquire tokens for $0.00005964, which is a 70% discount from the official listing price. Distinguishing itself among other ICOs, Minotaurus boasts genuine in-game utility. Notably, industry experts and influential figures view Minotaurus as more than mere hype; they believe it’s designed for long-term success.

In addition to this, Minotaurus has revealed a $100,000 giveaway for those who purchase presales. This generous offering includes 100 winners, with the top prize being a substantial $50,000. The odds seem favorable! Furthermore, referral and vesting programs designed for holders demonstrate Minotaurus’s commitment to prioritizing their community.

Certainly! Here’s a suggestion for paraphrasing the given text in an easy-to-understand and natural manner:

Conclusion

The Ethereum market shows resilience despite significant institutional outflows and whale activity. While the support level at $2,300 remains crucial, the price’s ability to rebound signals a strong underlying demand. If Ethereum maintains its current course and breaks past $2,598, it could continue its upward momentum. However, holders should keep an eye on external factors.

If you’re considering jumping on board the Ethereum trend and want to do so with assurance, consider incorporating Minotaurus ($MTAUR) into your portfolio. This token holds great promise, featuring affordable entry points and an exciting opportunity for substantial growth. However, act quickly – the presale token pool is rapidly diminishing.

Read More

- 10 Most Anticipated Anime of 2025

- Pi Network (PI) Price Prediction for 2025

- Silver Rate Forecast

- USD MXN PREDICTION

- USD CNY PREDICTION

- USD JPY PREDICTION

- Gold Rate Forecast

- Brent Oil Forecast

- How to Watch 2025 NBA Draft Live Online Without Cable

- Castle Duels tier list – Best Legendary and Epic cards

2024-10-13 09:41