As a seasoned analyst with over two decades of experience in the financial markets, I’ve seen my fair share of market fluctuations and trends. The recent rally in Ethereum (ETH) is indeed intriguing, especially considering Jump Trading’s resumed selling of Ether tokens.

Ethereum price continued its recovery even as Jump Trading resumed offloading its tokens this week.

On Wednesday, the price of Ethereum (ETH) reached an peak of $2,753 – a level not seen since August 4 – marking a 30% increase from its lowest point this month.

Jump Trading is selling Ether

During this period, the surge in value was observed not just in Bitcoin but also in various other cryptocurrencies. Remarkably, the price of Bitcoin peaked at around $61,000, and the total market capitalization of all cryptocurrencies collectively reached an impressive $2.15 trillion.

Despite Jump Trading continuing to offload its Ether holdings, Ethereum still surged, as reported by LookOnChain. The company allegedly acquired 17,049 Ether tokens valued at approximately $46.4 million from Lido and subsequently sold them.

Just now, Jump Trading resumed selling Ethereum (ETH)! They recently acquired 17,049 ETH ($46.44M) from Lido and moved it out to sell. At present, they still hold 21,394 wstETH ($68.58M).— Lookonchain (@lookonchain) August 14, 2024

Over the last few weeks, Jump Trading has unloaded some of its tokens, contributing to the fact that Ethereum’s decline during the recent “Crypto Black Monday” was more severe compared to Bitcoin and other cryptocurrencies.

As an analyst, I can confirm that our holdings in Arkham remain substantial, comprising 24,919 Ether tokens, 28,735 stETH tokens, and 675 wETH coins. The combined value of these assets surpasses $423 million, underscoring the strength of our investment portfolio.

It’s plausible that the resurgence in Ethereum’s price could be due to a return of investors to Ethereum Exchange-Traded Funds (ETFs) dealing directly with spot Ethereum. According to SoSoValue, these ETFs have seen over $24.3 million in net inflows.

A significant portion of these inflows was channeled into BlackRock’s Ethereum-focused ETF, boosting its managed assets to approximately $843 million. With such ongoing trends, it’s anticipated that this fund could surpass the $1 billion mark within the next few months.

On Tuesday, Fidelity’s ETH fund amassed a total of $5.4 million in assets, while Invesco’s QETH held approximately $813,000. Other ETFs from firms such as Bitwise, VanEck, and Franklin Templeton did not receive any new investments that day. On the other hand, Grayscale’s Ethereum Trust experienced over $31 million in withdrawals. Its smaller trust has garnered a substantial sum of over $981 million due to its lower costs.

Ethereum price death cross is a risk

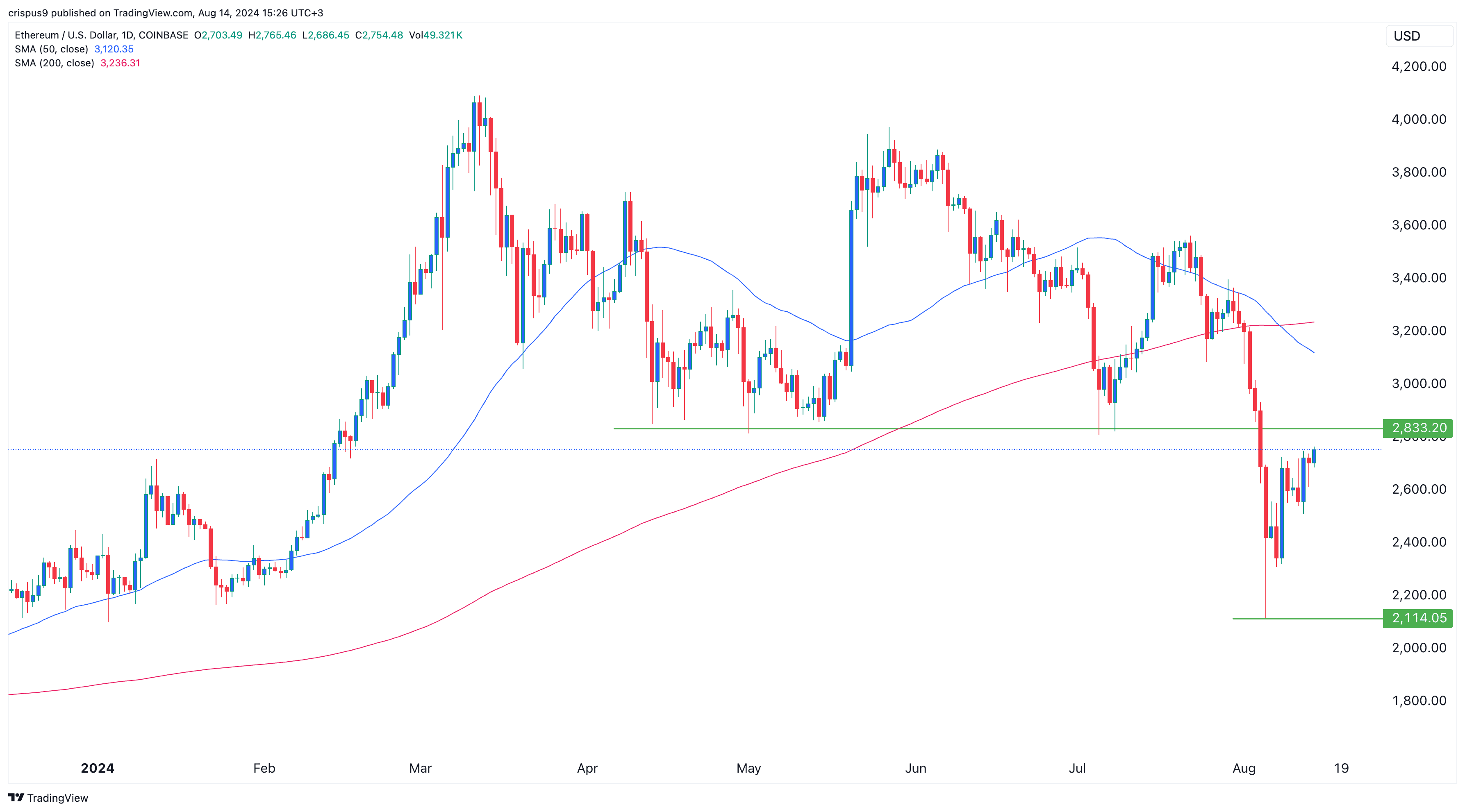

Although Ethereum might show potential for further decline, it’s important to note that it has exhibited a ‘death cross’ pattern on its daily chart. This occurs when the 50-day and 200-day Simple Moving Averages crossed each other on Aug. 7. Historically, this pattern often indicates a continued drop in price.

If Ethereum manages to transition the significant resistance at $2,833 into a support point, this would indicate a positive trend for the coin. This level is important because it represents Ethereum’s lowest swing during April, May, and July, as well as the neckline of a slanted triple-top pattern on its chart.

Instead, if the price falls slightly below the previous week’s low of $2,114, it could suggest a continuation of the downtrend, implying that the ‘bears’ (those who believe prices will fall) are currently in control.

Read More

- 10 Most Anticipated Anime of 2025

- Gold Rate Forecast

- Pi Network (PI) Price Prediction for 2025

- USD CNY PREDICTION

- USD MXN PREDICTION

- Silver Rate Forecast

- USD JPY PREDICTION

- EUR CNY PREDICTION

- Brent Oil Forecast

- Castle Duels tier list – Best Legendary and Epic cards

2024-08-14 16:01