As a seasoned researcher with years of experience in the cryptocurrency market, I find it fascinating to observe the intricate dynamics between large holders and retail traders in shaping the price action of Ethereum (ETH). The recent data suggests that we are witnessing a selloff from Ethereum whales while the asset’s price remains bullish.

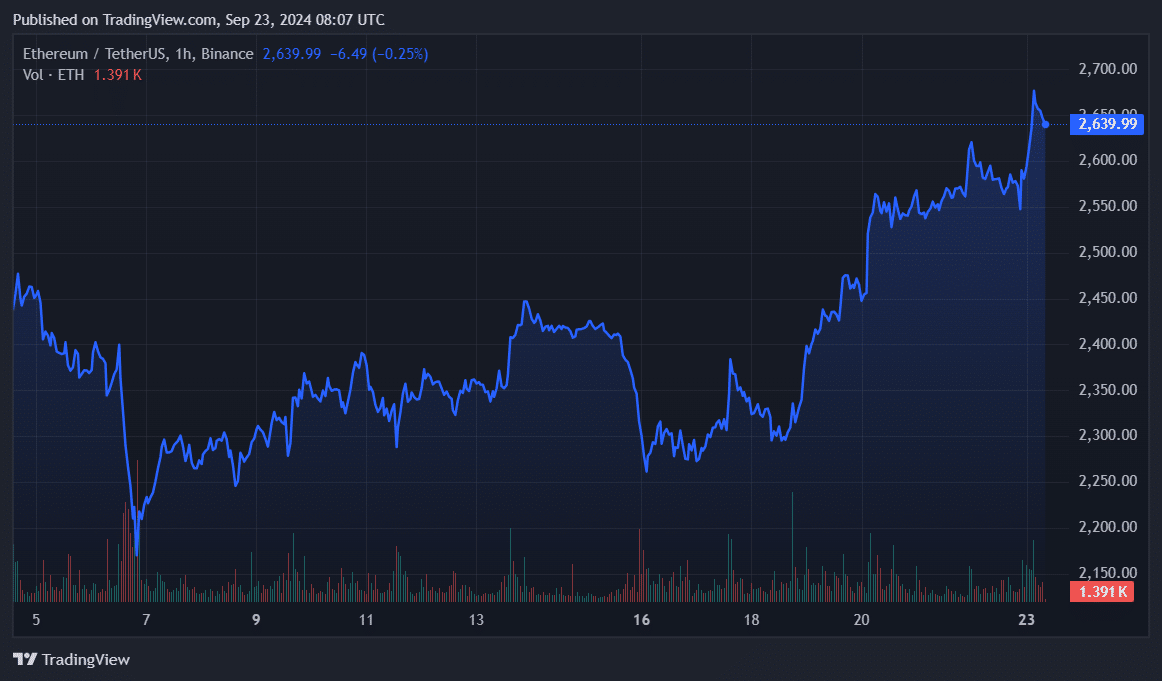

Over the last week, large Ethereum holders have been offloading their assets, as indicated by on-chain data. Yet, the price of Ethereum has continued to rise, maintaining a bullish trend.

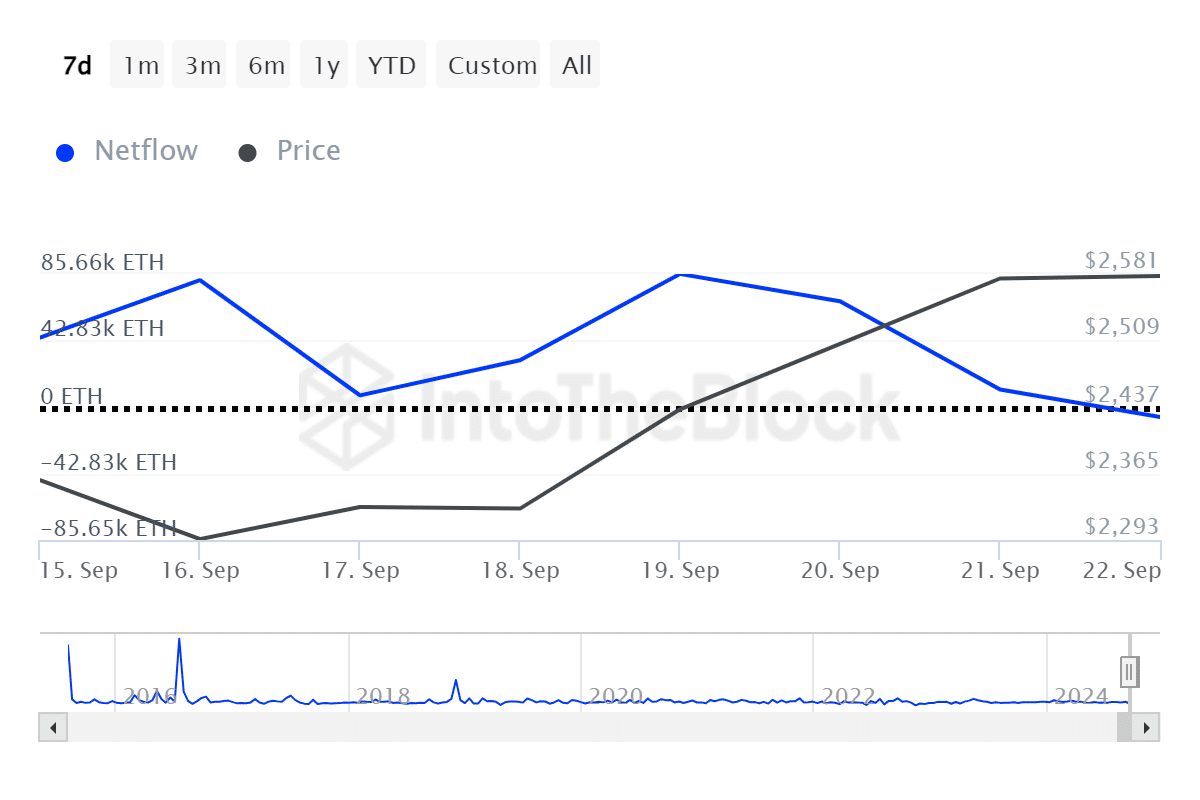

Based on information from IntoTheBlock, the amount of Ethereum (ETH) being transferred into large holder wallets dropped significantly from an inflow of 85,650 ETH on September 19 to an outflow of 6,420 ETH on September 23.

As a crypto investor, I noticed on September 19 that the indicator signaled a significant sell-off by Ethereum whales as the price climbed from $2,300 to $2,400. It seems that the bullish push driving ETH prices has primarily stemmed from retail traders rather than large holders in this instance.

Information from ITB indicates that Ethereum experienced a net influx of approximately 150,690 ETH on September 19, but this influx gradually decreased. Over the last week, there has been around $480 million in inflows into centralized exchanges involving Ethereum.

As a crypto investor, I noticed over the weekend, my fellow retail traders were more actively participating in the market, which seems to have pushed the asset’s price upward based on the large holder to exchange net inflow ratio.

In contrast to large sellers (whales) offloading their Ethereum holdings, the popular altcoin increased by 15% over the last seven days. Currently, it has risen by 2.2% in the last 24 hours and is being traded at approximately $2,640. Earlier today, Ethereum reached a local peak of $2,685 – marking its first such level in a month – with bullish on-chain signals persisting.

As a crypto investor, I’m observing that the current market capitalization of Ethereum stands at an impressive $319 billion, while its daily trading volume surpasses the $17 billion mark, indicating high liquidity and robust investor interest.

One significant factor fueling the general market optimism was the 0.5% reduction in interest rates made by the U.S. Federal Reserve. Yet, for Ethereum’s price to continue climbing towards the $2,800 level, it requires more substantial buying activity.

Read More

- 10 Most Anticipated Anime of 2025

- Gold Rate Forecast

- Pi Network (PI) Price Prediction for 2025

- USD MXN PREDICTION

- USD CNY PREDICTION

- Silver Rate Forecast

- USD JPY PREDICTION

- EUR CNY PREDICTION

- Brent Oil Forecast

- Castle Duels tier list – Best Legendary and Epic cards

2024-09-23 12:46