As a seasoned cryptocurrency analyst with years of experience observing market trends and whale activities, I find the recent decline in daily Ethereum (ETH) whale transactions intriguing, especially considering the asset’s impressive price surge over the past day. ETH is currently up by 4.4%, trading at $3,350, after registering a remarkable recovery of 13% over the past week.

Over the last 24 hours, there has been a significant drop in large-scale Ethereum (ETH) transactions among whales, despite the cryptocurrency’s price experiencing a substantial increase.

Ether (ETH), the second largest cryptocurrency, has experienced a noteworthy surge of 4.4% in the last 24 hours and is currently priced at $3,350. Over the past week, there’s been an impressive turnaround for ETH as it gains 13%, contributing to the broader crypto market rebound.

Ethereum currently has a market cap of $400 billion with a daily trading volume of $12.7 billion.

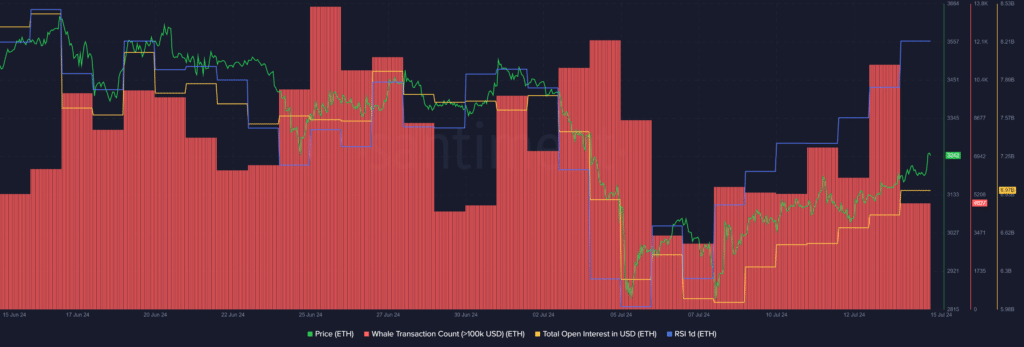

Based on Santiment’s data, there was a significant decrease of approximately 56% in the number of Ethereum transactions worth $100,000 or more, going from 11,115 daily occurrences to just 4,827 over the past 24 hours.

The decreasing level of whale involvement indicates that small investors have significantly driven up the asset’s price with a minimal probability of market manipulation from large whale players.

While the data obtained from the market intelligence platform indicates a weekly increase for Ethereum’s total open interest, it has climbed significantly from $6.04 billion on July 8 to $6.97 billion as of the current reporting period.

As a researcher studying cryptocurrency markets, I’ve observed that heightened open interest often leads to significant price volatility. This is primarily due to the increased number of positions being liquidated. For instance, when the Ethereum price surged, according to Coinglass data, the total amount of ETH liquidations reached a staggering $24 million. A considerable portion of this, approximately $5 million, was attributed to long positions, while nearly $19 million came from short positions.

Just like Ethereum’s Relative Strength Index (RSI) on the Ethereum network, which has been steadily rising since July 7, now sits at the 50 level, indicating, based on Santiment’s data, that the asset is in a favorable position for a possible price increase.

Read More

- Gold Rate Forecast

- Silver Rate Forecast

- Pi Network (PI) Price Prediction for 2025

- USD CNY PREDICTION

- USD MXN PREDICTION

- 10 Most Anticipated Anime of 2025

- EUR CNY PREDICTION

- Brent Oil Forecast

- Capcom has revealed the full Monster Hunter Wilds version 1.011 update patch notes

- Hero Tale best builds – One for melee, one for ranged characters

2024-07-15 12:46