As a seasoned crypto investor with a knack for deciphering market trends based on on-chain analysis, I find the recent developments surrounding Ethereum somewhat concerning. The staggering exchange net inflows and the whales’ increased selling pressure are bearish signals that cannot be ignored.

Large Ethereum holders are giving off bearish indications on the blockchain, as the second-biggest digital currency experiences difficulties due to a net outflow from exchanges.

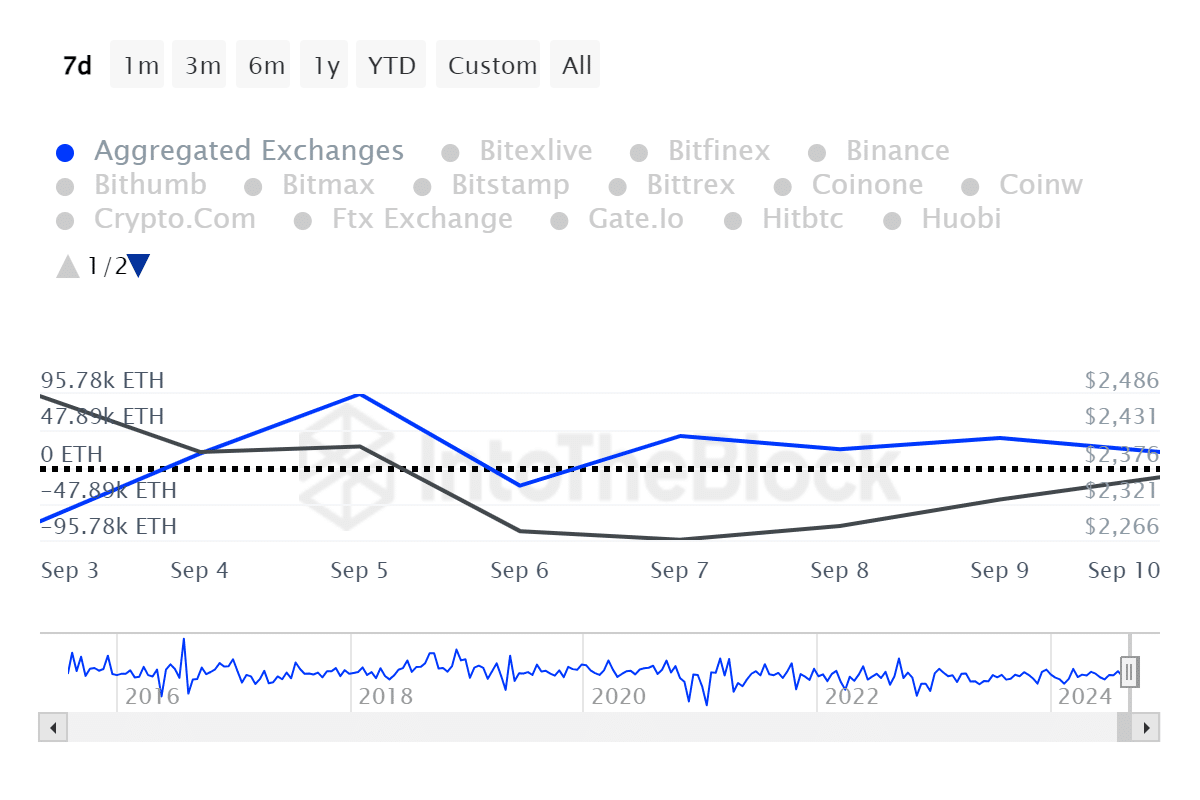

Based on information from IntoTheBlock, there was a net inflow of approximately $493 million in Ethereum (ETH) to centralized exchanges during the last week. A large amount of coins flowing into exchanges might suggest an upcoming sell-off, potentially causing prices to drop and indicating a bearish trend.

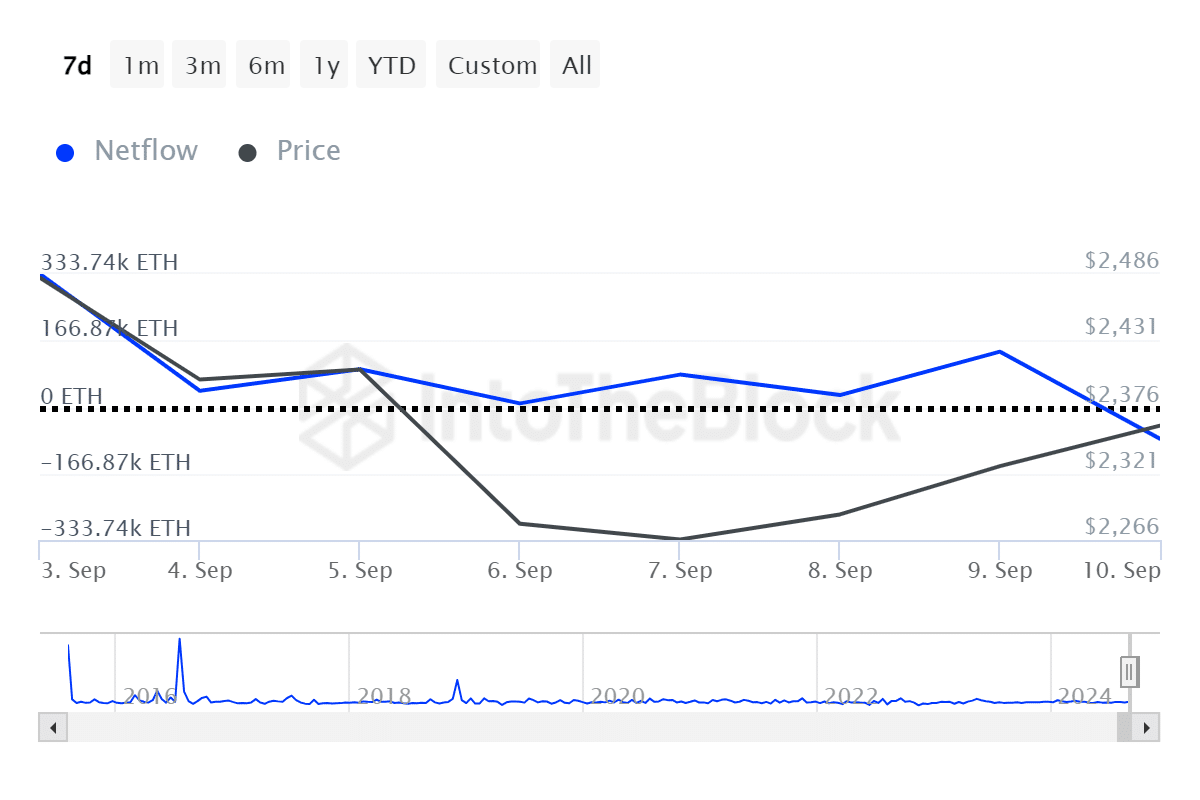

Data from ITB shows that Ethereum whales recorded 283,430 ETH, worth roughly $660 million, in outflows on Sept. 10. On the other hand, the large holders’ inflows declined from 312,250 ETH to 203,630 ETH on the same day.

This shows increased selling pressure from whales.

On Tuesday, according to ITB data, there was a significant outflow of nearly 80,000 ETH, equivalent to around $185 million, from the accounts of major Ethereum holders. Interestingly, the net flow of Ethereum held by whales has dropped by a staggering 296% over the last week.

One of the bearish whale movements came from Ethereum co-founder Vitalik Buterin and the Ethereum Foundation.

As a result, the large-scale sales from Ethereum’s influential investors have caused its market value to decrease to approximately $280 billion. Over the last 24 hours, ETH has dropped by 1.1%, currently trading at around $2,325 as I write this.

On September 7, the second-largest digital currency reached a local low of $2,150, but subsequently bounced back and surpassed the $2,300 threshold following an exit of approximately 40,000 Ether from futures trading platforms.

Today’s release of the U.S. Consumer Price Index (CPI), detailing the nation’s inflation rate, has the potential to significantly impact various financial markets, including cryptocurrencies. The CPI data will become available today, September 11th.

If the Consumer Price Index (CPI) falls short of the predicted 2.6%, a positive trend, or bullish sentiment, might arise in the digital asset market, while if it exceeds this figure, a bearish trend could follow.

Read More

- 10 Most Anticipated Anime of 2025

- USD MXN PREDICTION

- Brent Oil Forecast

- Pi Network (PI) Price Prediction for 2025

- Silver Rate Forecast

- USD JPY PREDICTION

- USD CNY PREDICTION

- How to Watch 2025 NBA Draft Live Online Without Cable

- Gold Rate Forecast

- Castle Duels tier list – Best Legendary and Epic cards

2024-09-11 13:32