The Pectra upgrade strolls into town like it owns the place, promising extra blob space, smart accounts—even poking validators into getting up early and doing proper work. There’s buzz on the wind, the kind you hear on evenings before a storm, and folks are watching Arbitrum (ARB), StarkNet (STRK), Mantle (MNT), Aevo (AEVO), and Fuel (FUEL) like farmers eyeing the horizon for rainclouds. Lower costs, grander scale, and extra tricks for the Layer-2 crowd—everyone’s hungry for a little hope, even as wallets are feeling thin. But after recent price dips, the real question: are these upgrades a ladder out of the mud, or just another patch for worn-out boots? 🌧️👢🚀

The lot of ‘em took quite the tumble, like coins rolling off a tilted saloon table. Yet, with on-chain upgrades looming, some say a tailwind’s coming. If Layer-2s can catch it, there’s upside waiting—big ‘if’, like a promise from a politician with a crooked grin.

Arbitrum (ARB)

With Pectra’s new blob space and slicker data pipes, Arbitrum dreams of slashing L1 fees and bulldozing a bigger road for traffic. EIP-7702 walks in, whistling, offering smart accounts for gasless rides, batching the chores, and making onboarding as simple as pie—at least, that’s the fantasy. Developers and users might actually crack a grin.

Of course, that sunny vision hasn’t warmed ARB’s price, which slipped over 6% in seven days. If ARB drops to $0.292 it’ll be clinging to a support level like a miner’s hem to his last dollar, maybe even splashing down to $0.27 if the storm’s rough.

Hopeful folks are eyeing $0.315 for a bullish turn; break that, and it’s off to $0.345 and $0.363, provided the wind doesn’t change again. Hope springs, if not eternal, then at least quarterly.

StarkNet (STRK)

Pectra’s upgrades bring cheaper, scalier calldata—great news for StarkNet, which clings to Ethereum like a barnacle to a drifting ship. EIP-7002 unties some knots, letting validator withdrawals go a little wilder and paving easier roads for re-staking and moving liquidity (no more stuffing cash under the mattress).

But STRK tumbled over 13.5% the past week—a fall as elegant as a lopsided scarecrow. EMA lines mutter: “still down.” If the price slumps to $0.116, folks might want to start whittling worry-sticks. But catch a ride on a bullish breeze, and $0.136 beckons, with $0.15 and $0.161 waving from the horizon, hats off and grinning.

Mantle (MNT)

Mantle sits at the table, no cards up its sleeve but hoping for Pectra’s improvements—maybe validator stakes lurching higher, keeping the big whales happy. Restaked ETH weaves into their world, giving some backbone to the whole wobbly contraption. As blob space grows, Mantle’s rollups and L2 apps might actually get cheaper—shocking, in crypto, where things usually just get fancier but not better.

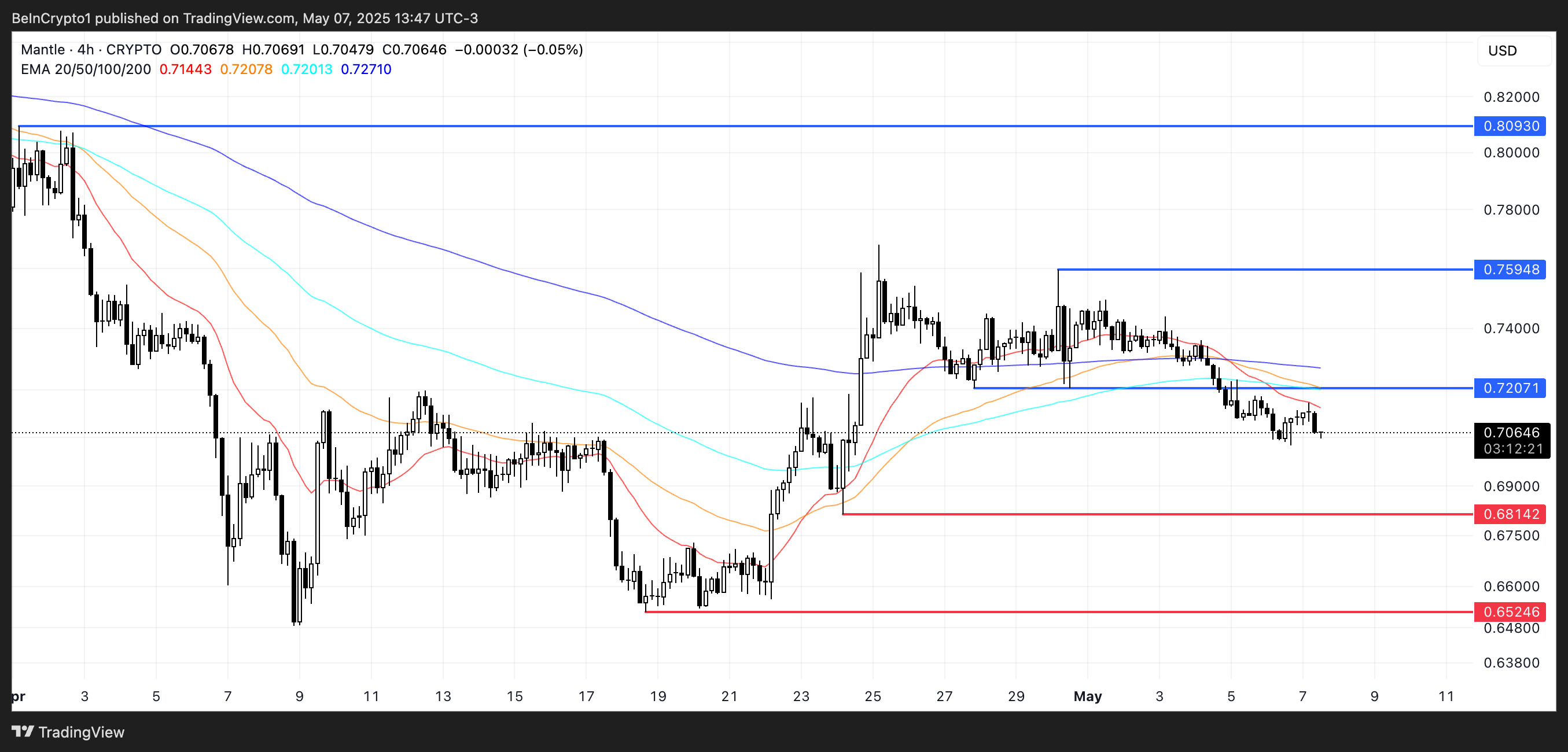

“Death cross!” cry the doomsayers—the chart’s down 2.6%, and $0.68 is the only plank left above shark-infested waters. Lose that, and $0.652 is next on the slip-n-slide. Reverse course, though, and $0.72 is the next handhold. Make it past that, $0.759 and even a dreamy $0.809. Stranger things have happened—just not often on Monday mornings.

Aevo (AEVO)

Aevo, hotshot derivatives outfit on Layer 2, stands to shave costs thanks to Pectra’s blob-splosion. Cheaper L2 fees = traders less grumpy, more trades flying. Perpetuals and options settle faster, and maybe, just maybe, gasless trading makes you look heroic while saving a nickel. (Account recovery gets easier, but good luck finding your backup phrase from 2020.)

AEVO, meanwhile, lost nearly 12% this week—the $0.10 line is looking shaky. Drop through, and it’s off to $0.096, then $0.082, or $0.0756 if things get real gloomy. Flip the script above $0.107, and maybe you’ll see $0.115, then $0.121, and hey, perhaps even an optimistic tweet or two.

Fuel Network (FUEL)

Fuel Network, built for throughput and sly developer grins, stands to hustle with Pectra’s blob space. Cheaper data on Ethereum means Fuel can run more transactions while not watering down its moonshine. Smart accounts (EIP-7702 again, really making friends) let devs trick out their wallets and smooth-talking onboarding flows.

FUEL’s EMAs look bullish for now—short-term averages preening higher than long-term like roosters after a good rain. Still, $0.012 is the ceiling du jour. Punch through, and maybe you’ll see $0.0129, $0.014, or even $0.0163. Drop below $0.010, though, and it gets dark quick: $0.0084, then $0.0077, and then you’re just reminiscing about the good old days.

Read More

- Brent Oil Forecast

- USD MXN PREDICTION

- 10 Most Anticipated Anime of 2025

- USD JPY PREDICTION

- Silver Rate Forecast

- Pi Network (PI) Price Prediction for 2025

- USD CNY PREDICTION

- How to Watch 2025 NBA Draft Live Online Without Cable

- Gold Rate Forecast

- EUR CNY PREDICTION

2025-05-08 01:09