TL;DR

- Ethereum is once again the belle of the ball, with analysts puffing up their chests and predicting it’ll break records (perhaps even its own ego, if possible) rather soon.

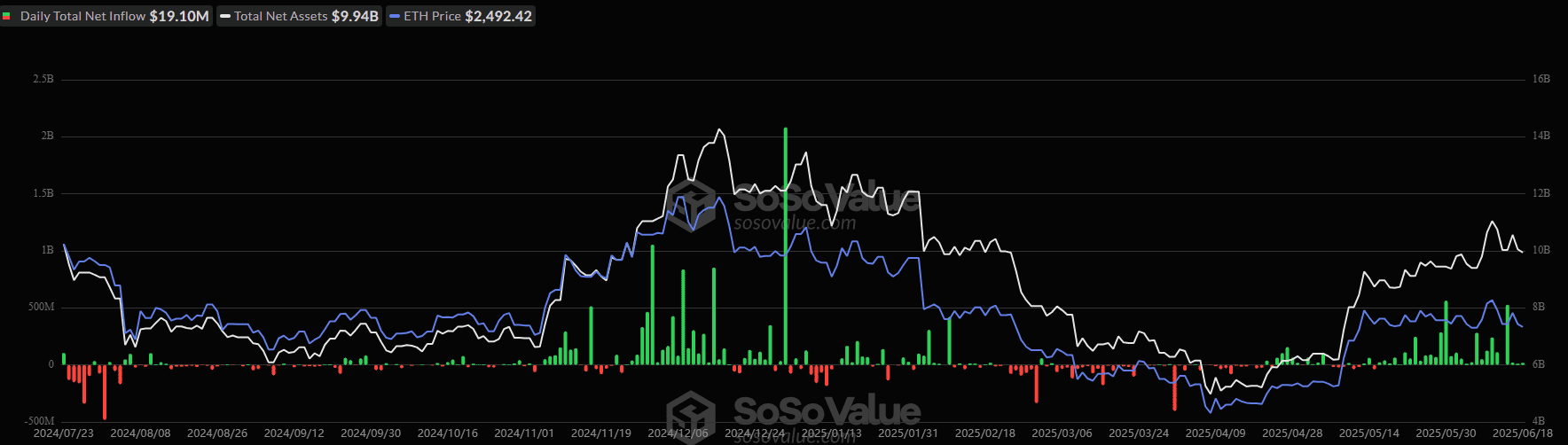

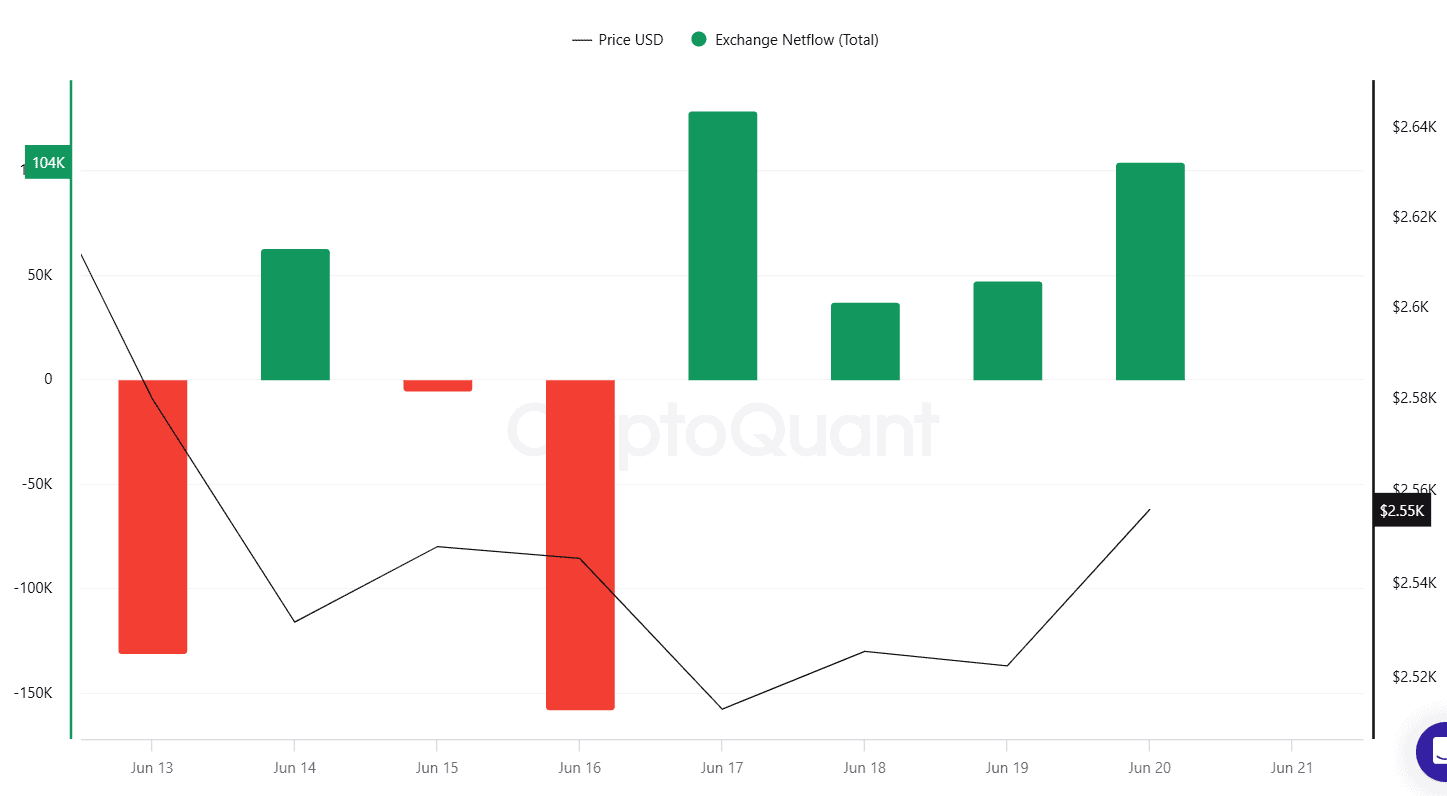

- Spot ETH ETFs are slurping up cash as if they’ve never seen a dollar before—signalling bullish vibes from the Big Money crowd. On the other hand, positive exchange netflows—the party poopers—just might hint at some sellers lurking in the shadows.

Is ETH Worth a Flutter?

Gone, it seems, are the days when Ethereum was languishing below $1,400, doing an impression of a limp lettuce leaf in April. Now it’s strutting about above $2,500, much like an overcaffeinated peacock at a pigeon convention.

The crypto crowd is once more giddy, convinced they’ve found the golden goose (never mind the eggs—those are expensive). Crypto Rover, a chap followed by more than 1.2 million eager souls, declared ETH “the most obvious trade in 2025!” (One wonders if he shouts this at taxi drivers, too.)

$ETH is the most obvious trade in 2025!

— Crypto Rover (@rovercrc) June 19, 2025

Rover claims this current ETH caper is reminiscent of the 2020 run—back when it frolicked upward until late 2021 and practically brushed $5,000 (a number that still gives many traders heartburn).

Enter Crypto Caesar, who noticed ETH’s recent sparkling hour—“it’s looking good for now,” he mused, before adding that perhaps only World War III could upset this apple cart (because why stop at mere global recession, eh?).

Not to be left out, Crypto Fella is betting his bowler hat that an ETH rally isn’t a matter of “if” but “when”—though he does mutter darkly about a potential dip before champagne corks start flying again. Such is the plot of every great crypto saga: up, down, and, with luck, not out.

If this chatter sparks your curiosity (or makes you want to hide your wallet), rest assured: there’s a whole article devoted to recent forecasts for your reading pleasure. Or pain. One never knows with Ethereum.

Do the Tea Leaves Approve?

These past weeks, spot ETH ETFs have seen the sort of cash inflows that would make even a blockchain blush. SoSoValue tells us May 15 was the last time more people legged it than arrived—clearly, the trendsetters are filing in.

This buy-fest is, so the experts say, generally a bullish signal. ETFs actually hold ETH, so the money’s not just changing hands, it’s getting cozy in the vault—presumably with snacks and a soft blanket.

Still, not all’s well in blockchain paradise. Positive exchange netflows have cropped up lately, meaning some ETH holders are shifting their loot to centralized exchanges. That’s usually what one does before the ‘For Sale’ signs go up—a move that might, for a time, rain on the bullish parade.

To sum up: bulls are thundering, bears are snarling, and somewhere in the middle, ETH is counting the votes and wondering whether to don its moon boots or retreat to the sofa for a quiet lie-down. Stay tuned—things are bound to get even sillier 🤡💸.

Read More

- 10 Most Anticipated Anime of 2025

- Brent Oil Forecast

- Silver Rate Forecast

- USD MXN PREDICTION

- PUBG Mobile heads back to Riyadh for EWC 2025

- Gold Rate Forecast

- Grimguard Tactics tier list – Ranking the main classes

- Pi Network (PI) Price Prediction for 2025

- Castle Duels tier list – Best Legendary and Epic cards

- How to Watch 2025 NBA Draft Live Online Without Cable

2025-06-20 18:38