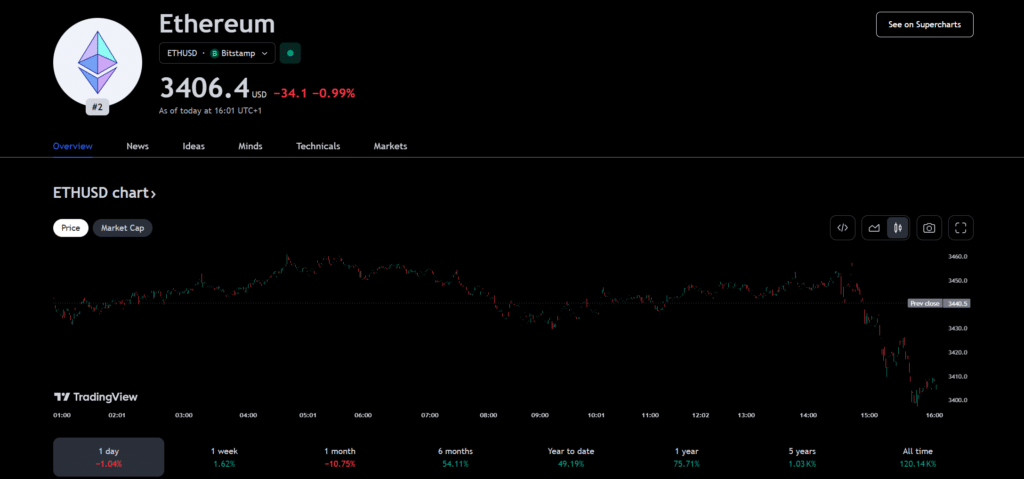

As an experienced analyst, I believe that the approval of spot Ethereum (ETH) ETFs by the SEC could significantly impact Ethereum prices, potentially pushing them above $4,000 and even retesting the $4,800 peak. The elimination of anxieties surrounding Ethereum and increased market demand from institutional investors would lead to a net positive outcome for ETH proponents.

As a researcher, I’ve been closely following the developments surrounding Ethereum and the potential approval of spot Ether Exchange-Traded Funds (ETFs) by the Securities and Exchange Commission (SEC). Based on my analysis, here are some reasons that suggest Ethereum prices could rise if this happens:

Expert Wooding anticipates that approved spot Ethereum (ETH) Exchange-Traded Funds (ETFs) will mirror the performance of Bitcoin (BTC) ETFs and propel ETH prices beyond $4,000. The approval process for these funds is believed to allay concerns and significantly increase investor interest in Ethereum.

As a researcher exploring the potential price movements of Ether (ETH) based on the inflow of funds from spot Bitcoin Exchange Traded Funds (ETFs), I believe that Ether could challenge its previous peak at $4,800 if these new financial instruments attract between 10-20% of the total flows.

The CEO of SCRYPT expressed to crypto.news that this development will provide access to a new customer base, leading to heightened interest and eventually causing prices to climb in the short term, medium term, and long term following the approval.

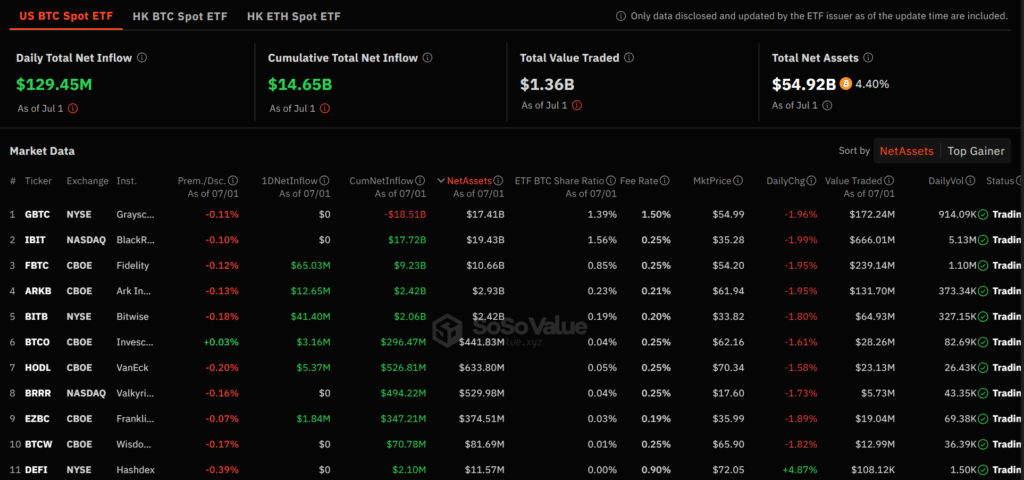

Within just half a year of being available on the market, Bitcoin spot ETFs in grayscale form amassed an impressive $35 billion in assets under management (AUM). This figure aligns with Wooding’s predictions, which also hint at potential net inflows of around $5 billion for Ethereum spot ETFs over the same time frame, as suggested by a report from the Gemini crypto exchange.

No staking, higher yield

Critics have raised questions about the necessity of institutional Ethereum ETFs, just as it was a matter of time rather than if for observers to embrace spot Ethereum ETFs.

As a market analyst, I would describe Bitcoin and Ethereum from my perspective in the following way: Bitcoin is predominantly viewed as a digital equivalent of gold, serving as a storehouse of value. On the other hand, Ethereum functions as an advanced ecosystem where smart contracts pave the way for decentralized applications to thrive. In this market, Ether plays a crucial role as a liquid asset and an essential economic tool.

As a researcher studying the world of Exchange-Traded Funds (ETFs), I’ve come across an intriguing issue regarding Ethereum (ETH) and ETFs that hold this cryptocurrency as an asset. The situation is such that these funds accumulate large amounts of dormant Ether, waiting for price increases to sell. This phenomenon becomes even more pronounced when we consider the proposed spot ETH funds lack staking activities.

According to Wooding’s perspective, a decrease in the availability of Ether liquids and an increase in dormant ETH might encourage more individuals to stake Ether directly. This could lead to higher yields from on-chain staking. Furthermore, the substantial supply held by spot Ethereum Trusts (ETFs) could be captured by this process.

“Although ETH held by ETFs during dormancy may initially decrease DeFi liquidity, the expanded market presence and heightened involvement could potentially lead to greater direct interaction in staking and DeFi, offsetting the initial effect,” Wooding explained in an email interview with crypto.news.

When will we see spot Ethereum ETF?

Following the SEC’s preliminary approval for Ethereum (ETH) spot exchange-traded funds (ETFs) about a month ago, industry insiders and experts anticipate that final approvals will be granted before Q3 2024 comes to an end. Bloomberg analyst James Seyffart speculates that the regulatory go-ahead could happen as early as this month, while SEC chairman Gary Gensler has indicated that a decision should be reached by the end of summer.

Despite some uncertainty following the SEC’s lawsuit against ConsenSys regarding MetaMask wallets and staking services, Wooding remains optimistic that the regulatory body will give its approval for a spot Ethereum ETF this month.

As a crypto investor, I believe that shunning Ethereum funds could potentially tarnish the SEC’s reputation for being forward-thinking and competent in the digital asset space. The CEO of SCRYPT further emphasized that such a denial might trigger more regulatory dialogue, leading to improved and more sophisticated proposals down the line.

According to Woodings, even if the SEC rejects proposed spot Ether ETFs, the price of Ethereum may temporarily decrease. However, he is skeptical about the likelihood of such an outcome and believes that any market downturn would be brief. Wooding reasons that Ethereum’s underlying value and utility remain robust, and investors are likely to shift their focus back to its technological advancements and real-world applications once the ETF decision is out of the spotlight.

Read More

- 10 Most Anticipated Anime of 2025

- Gold Rate Forecast

- Grimguard Tactics tier list – Ranking the main classes

- USD MXN PREDICTION

- PUBG Mobile heads back to Riyadh for EWC 2025

- Silver Rate Forecast

- Brent Oil Forecast

- Castle Duels tier list – Best Legendary and Epic cards

- How to Watch 2025 NBA Draft Live Online Without Cable

- USD CNY PREDICTION

2024-07-02 18:39