As a long-term crypto investor with experience in various projects and protocols, I find the Runes Protocol intriguing. It’s an innovative solution designed to improve transaction efficiency and lower costs within the Bitcoin ecosystem by utilizing its UTXO model without introducing a secondary fee token.

Andras Brekken, the founder of SideShift.ai, recently imparted his knowledge about the budding Runes Protocol and its potential effects on the Bitcoin community.

Crypto.news obtained unique insights from Brekken through emails regarding his perspectives on the Runes Protocol, a topic that generated significant buzz and acclaim following the latest Bitcoin Halving event.

As a protocol analyst, I’d describe The Runes Protocol in this way: I’ve come across an innovative solution called The Runes Protocol. Instead of introducing a new fee token like other token standards do, it builds upon the Bitcoin UTXO model. This straightforward approach could potentially enhance transaction efficiency and reduce costs.

According to Brekken, Runes’ standard version surpasses its predecessors by adhering to Bitcoin’s UTXO (Unspent Transaction Output) model instead of introducing a secondary fee token. This choice results in affordable token transfers and minting processes, thereby enhancing acceptance within the Bitcoin user base.

As an analyst, I would interpret Brekken’s findings by saying that I believe the sudden increase in activity on Runes can be linked to the changing investment trends among investors. Instead of focusing solely on Non-Fungible Tokens (NFTs), there has been a noticeable shift towards meme coins, particularly those built on the Solana (SOL) platform.

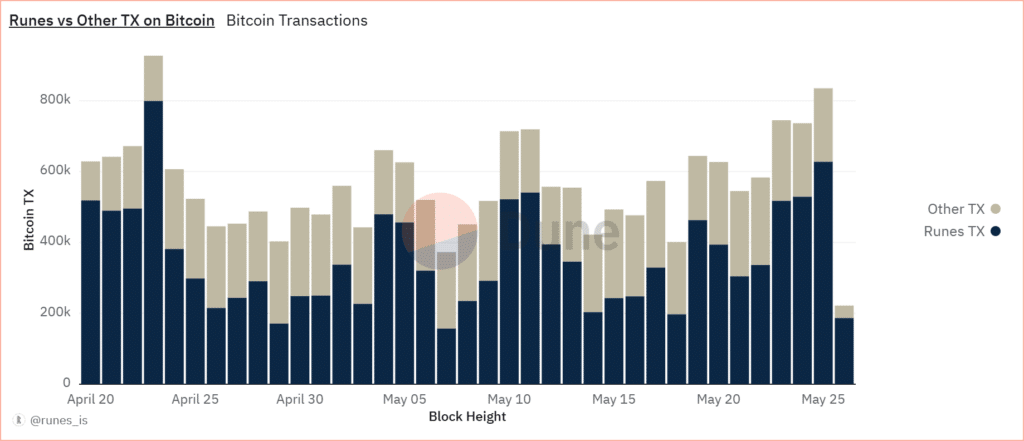

Based on information from Dune Analytics, Runes account for over half or slightly under 50% of the daily Bitcoin transactions as of now, demonstrating their enduring significance within the Bitcoin network following the Halving event.

With the arrival of Runes, investors were able to stay engaged in the meme coin craze while sheltering themselves under the protective wing of Bitcoin (BTC). As Brekken put it, investors purchased Runes with the intention of surfing the memecoin surge on the Bitcoin platform.

Runes, which had a promising start, has lately experienced a decrease in engagement. The number of newly created tokens and wallet transactions has significantly dropped. According to Brekken’s perspective, this is a typical occurrence in the volatile world of meme coin trading, where activity often shifts between different blockchains.

In simpler terms, the Runes community should aggressively seek attention from meme coin traders during the next market shift. These traders are advised to jump on the Runes bandwagon and aim for creating the first “billion-dollar meme” on this platform, emulating successful meme coins like PEPE, WIF, or BONK. This approach could potentially rekindle interest in Runes during market fluctuations.

Read More

- 10 Most Anticipated Anime of 2025

- USD CNY PREDICTION

- Pi Network (PI) Price Prediction for 2025

- Silver Rate Forecast

- Gold Rate Forecast

- USD MXN PREDICTION

- Brent Oil Forecast

- USD JPY PREDICTION

- EUR CNY PREDICTION

- Ash Echoes tier list and a reroll guide

2024-05-28 20:31