As a seasoned crypto investor with several years of experience under my belt, I’ve seen my fair share of market volatility and price swings. The recent sharp drop in Bitcoin’s price has undoubtedly caused a wave of anxiety among traders, myself included.

The substantial decline in Bitcoin‘s price has caused a noticeable shift in attitude among cryptocurrency investors.

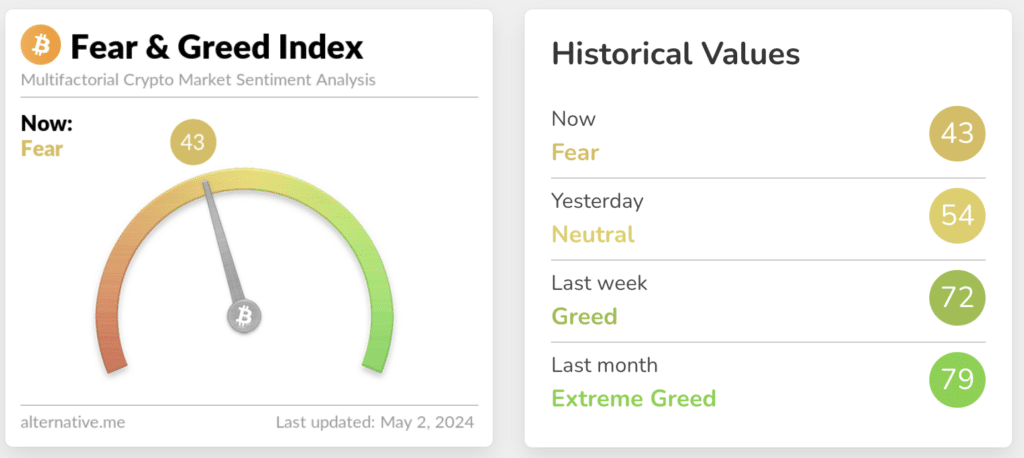

The Crypto Fear and Greed Index, indicating the sentiment of the crypto market, reached a low of 43 – its most subdued level since last October.

The indicator has shifted from the “greed” region, which it occupied a week prior, to the “fear” region on the scale. This transition reflects increasing uneasiness among investors. Fear is signified by values between 26 and 46 on the scale, suggesting that pessimistic sentiment is likely dominating the market.

As a researcher studying the financial markets, I’ve observed that the ongoing withdrawal of capital from U.S. spot Exchange-Traded Funds (ETFs), including Bitcoin, has been putting pressure on the market. In particular, during May 1st, an unprecedented $564 million was taken out of the Bitcoin spot ETF – a record-breaking figure since its inception in January.

Despite Santiment analysts’ positive outlook on Bitcoin’s future price, they acknowledge that the recent market correction was expected due to Bitcoin’s significant growth in capitalization before the halving. After the halving in late April, investors bought based on speculation and sold due to news events.

Analysts attribute the expansion in Bitcoin’s market value during October 2023 and the early spring of 2024 to heightened anticipation surrounding the halving event. Conversely, investors who purchased Bitcoin towards the end of March, when its price peaked at a record high, have experienced financial losses.

Read More

- 10 Most Anticipated Anime of 2025

- Gold Rate Forecast

- Pi Network (PI) Price Prediction for 2025

- USD MXN PREDICTION

- USD CNY PREDICTION

- Silver Rate Forecast

- USD JPY PREDICTION

- EUR CNY PREDICTION

- Brent Oil Forecast

- Castle Duels tier list – Best Legendary and Epic cards

2024-05-02 18:14