As a seasoned researcher with a keen interest in the ever-evolving world of cryptocurrencies, I find myself intrigued by the latest surge in FET, the native token of Artificial Superintelligence Alliance. Having witnessed the tumultuous rollercoaster ride that is the crypto market, I must admit it’s refreshing to see a significant recovery from the massive crash we experienced just a few weeks ago.

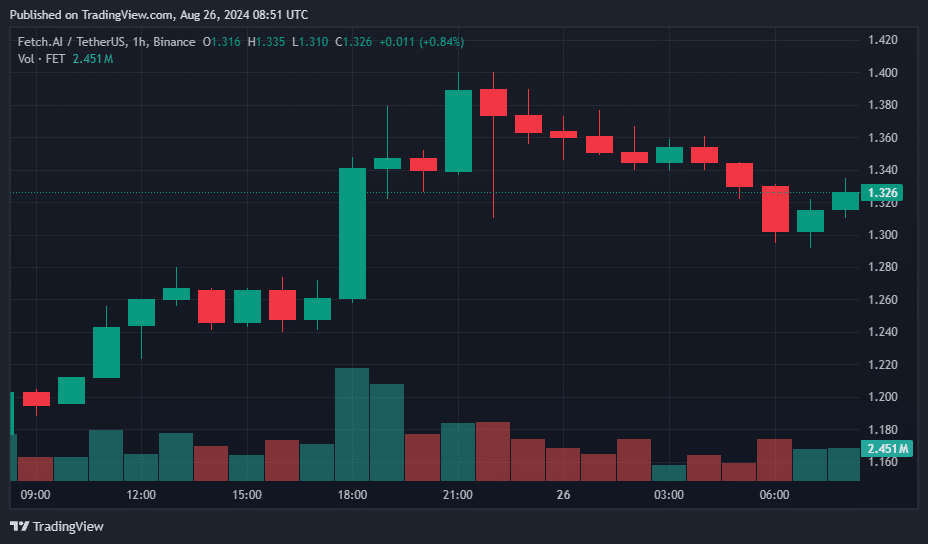

As a researcher, I’ve noticed an impressive 11% surge in the value of FET, the native token of the Artificial Superintelligence Alliance, as observed during the early hours of August 26th. This places it at the top among the leading 100 cryptocurrencies in terms of growth.

Currently, FET is experiencing an increase of 11.7% within the last 24 hours and is being traded at $1.32 – a level not reached since July 27. On August 26, it peaked at $1.39, marking a significant rise of 93% from its drop to $0.72 on August 5, when a massive global crypto market crash occurred, leading to more than $1 billion in liquidations.

Even though it has made a substantial comeback since then, the cryptocurrency asset remains 62% below its peak value of $3.45, which was reached on March 28, 2024.

The recent revelation of Fetch.ai’s Innovation Lab in San Francisco marks a fresh wave of excitement in the field of Field-Effect Transistors (FET), as Fetch.ai is a trailblazer in autonomous digital ecosystems and an essential component of the Artificial Superintelligence Alliance.

The corporation plans to invest $10 million annually to aid startups that build on their platform, offering potential funding of up to $1 million per project. Furthermore, Fetch.ai is initiating an internship program focused on fostering skills in areas like decentralized technology, artificial intelligence, and machine learning.

As a crypto investor, I’m excited about the surge in FET price, which seems to be fueled by mounting expectations surrounding Nvidia’s Q2 earnings report, scheduled for release after market close on August 28th.

This year, Nvidia’s shares have surged by over 176%, boosting its total market worth to exceed $3.1 trillion, thereby placing it among the top three most valuable companies globally in terms of market capitalization.

In the coming period, the earnings are anticipated to offer insights into the persistent need for Artificial Intelligence (AI). Notably, Nvidia experienced a remarkable rise in its revenue, exceeding 240% to reach approximately $26 billion during the initial quarter. Experts speculate that the revenue could climb even higher to an estimated $28.6 billion in the subsequent quarter.

Robust earnings and optimistic predictions point towards growth in the AI sector, possibly driving up costs for associated investments. This trend has also boosted AI-based cryptocurrencies, as mentioned by crypto.news on June 20. Yet, if performance doesn’t meet expectations, there might be a sudden market correction.

The Artificial Superintelligence Partnership, situated where blockchain and semiconductor industries intersect, shares a business strategy similar to Nvidia’s. This alliance is a collaborative effort involving three AI projects: Fetch.ai, SingularityNET, and Ocean Protocol. Their goal is to speed up the development of decentralized Artificial General Intelligence and eventually, Artificial Superintelligence.

According to CoinGecko’s data, the combined market value of all Artificial Intelligence (AI) related tokens was approximately $25.9 billion on August 26. The trading activity for these tokens amounted to around $1.3 billion that day.

Read More

- 10 Most Anticipated Anime of 2025

- Gold Rate Forecast

- Pi Network (PI) Price Prediction for 2025

- USD CNY PREDICTION

- USD MXN PREDICTION

- Silver Rate Forecast

- USD JPY PREDICTION

- EUR CNY PREDICTION

- Brent Oil Forecast

- Castle Duels tier list – Best Legendary and Epic cards

2024-08-26 12:04