As a seasoned crypto investor with a keen interest in the regulatory landscape, I’m closely monitoring the latest developments regarding the potential approval of spot Ethereum ETFs by the U.S. Securities and Exchange Commission (SEC). The recent flurry of activity, including Fidelity’s updated S-1 form and reported instructions from the SEC to other issuers and exchanges, has fueled optimism in the market.

Multiple crypto ETF providers are reportedly making last-minute adjustments to their SEC applications, following enhanced prospects for approved Ethereum spot products within the past day.

Fidelity, a prominent figure on Wall Street, recently revised its proposed Ethereum ETF application with the U.S. Securities and Exchange Commission (SEC). Notably absent from the updated submission was any mention of staking – a potential indication that Fidelity has been engaging in discussions with regulatory authorities regarding this aspect of the ETF.

Several sources indicated that the securities regulatory body has advised other Ether (ETH) ETF applicants and stock markets, such as Nasdaq, to hasten their filing enhancements in anticipation of potential preliminary approvals.

At press time, crypto.news had yet to hear back from exchanges and providers on the matter.

🚨NEW: Issuers and exchanges must submit amendments to their 19b-4 filings by 10:30AM today. It appears that Fidelity has ruled out staking as an option. There have been some interactions regarding S-1s, but the significance remains uncertain.

— Eleanor Terrett (@EleanorTerrett) May 21, 2024

The revised filing by Fidelity with the SEC could reaffirm the regulatory body’s current stance regarding staking platforms linked to Ethereum’s proof-of-stake (PoS) mechanism.

After The Merge event in 2022, the regulatory agency initiated probes into the decentralized network and filed lawsuits against the leading US cryptocurrency exchange, Coinbase. The allegation was that Coinbase had been providing unregistered securities through its Ethereum staking service.

As a crypto investor, I’ve kept a close eye on the developments regarding the potential approval of Bitcoin exchange-traded funds (ETFs) by the Securities and Exchange Commission (SEC). Just hours before the deadline for their final decision on two bids from VanEck and ARK 21Shares this week, I received news that Fidelity had filed a similar application. This sudden turn of events adds another layer of intrigue to the situation and increases the anticipation in the crypto community. Let’s see how the SEC will respond to these applications and what impact it may have on the market.

Michael Sonnenshein, the CEO of Grayscale Investments, resigned on May 20th. Despite this change in leadership, the company continues to pursue its plan to classify Ethereum as a commodity, as expressed by Scott Johnsson from Van Buren Capital GP. They are in line with the industry viewpoint that considers Ether a non-security crypto asset.

Expert: Jake Chervisy, the General Counsel at Variant Fund, stated that receiving approval for the fund might bring about a more definitive categorization of Ether, potentially putting an end to the ongoing debate that has lasted over a year.

ETF approval chatter boosts Ethereum market

Following documents indicating that the Securities and Exchange Commission (SEC) could endorse spot Ethereum Exchange-Traded Funds (ETFs), Ethereum recaptured its $450 billion market capitalization and experienced a surge of over 22% within a 24-hour period, as reported by CoinMarketCap.

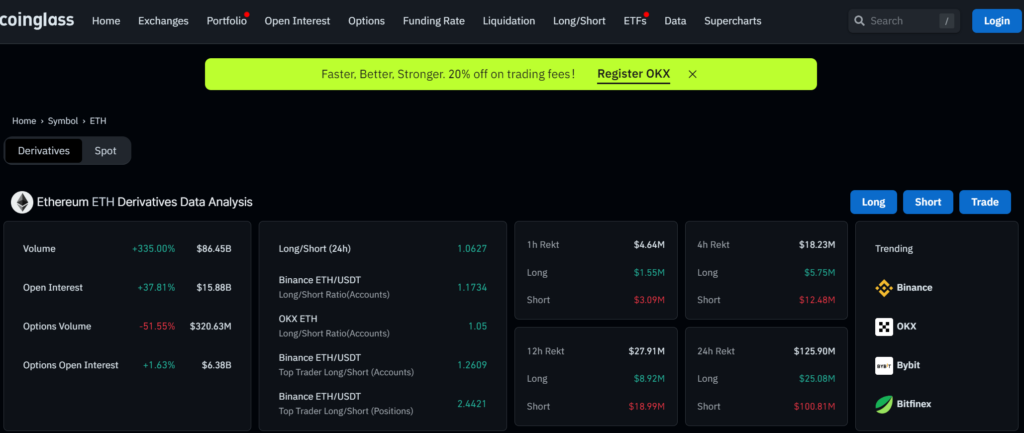

The data from CoinGlass revealed a new peak for Ether futures on centralized exchanges, with the total open interest (OI) in these contracts exceeding $15 billion for the first time. Binance led the way in trading volume, accounting for approximately $5.97 billion of this OI.

Read More

- 10 Most Anticipated Anime of 2025

- USD CNY PREDICTION

- Pi Network (PI) Price Prediction for 2025

- Silver Rate Forecast

- Gold Rate Forecast

- USD MXN PREDICTION

- USD JPY PREDICTION

- Brent Oil Forecast

- EUR CNY PREDICTION

- How to Watch 2025 NBA Draft Live Online Without Cable

2024-05-21 18:10