As an analyst with a background in the mutual funds industry and a keen interest in Bitcoin and ETFs, I’m thrilled to witness Fidelity’s FBTC making waves in the Spot Bitcoin ETF market. With close to $600 million in inflows over the past two days, FBTC has surpassed $9.5 billion in assets under management, a significant achievement for this player traditionally overshadowed by industry giants like BlackRock.

A well-known player in mutual funds, Fidelity’s FBTC, has sparked renewed excitement in the US for Spot Bitcoin Exchange-Traded Funds (ETFs). This interest has led to approximately $600 million in total ETF inflows over the past two days.

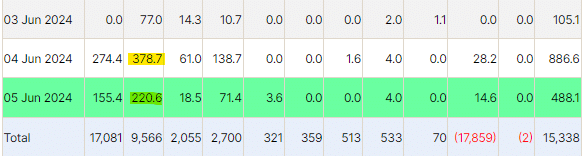

On June 5th, Fidelity’s FBTC experienced a notable increase with approximately $220 million in new investments, adding up to nearly $600 million over two days. Consequently, the value of assets under FBTC’s management surpassed $9.5 billion. However, despite this growth spurt, BlackRock’s IBIT still manages more than twice as much assets as FBTC does.

Based on Farside Investors’ figures, Bitcoin exchange-traded funds (ETFs) have seen 17 consecutive days of inflows, with a massive intake of $488 million on June 5. Grayscale’s GBTC, FBTC, and IBIT reportedly brought in $14.6 million, $220.6 million, and $155.4 million respectively, resulting in an impressive cumulative net inflow exceeding $15.338 billion – a significant milestone considering daily Bitcoin mining rates.

The CEO of Franklin Templeton, Jenny Johnson, identified this trend as the initial influx of pioneering investors, implying that a larger influx of institutional investors is expected to follow suit. She underscored that the current optimistic outlook fails to account for the potential future engagement of institutions in Bitcoin Exchange-Traded Funds (ETFs).

As an analyst, I would rephrase it as follows: With over $420 million in assets under management, Franklin’s Bitcoin ETF represents a growing segment of the market for such investment vehicles. This expansion underscores the increasing acceptance of Bitcoin ETFs and aligns with the broader industry trend toward growth.

Fidelity’s FBTC, a player in the Spot Bitcoin ETF market from Fidelity Investments, is proving increasing robustness. It holds its ground against larger rivals, such as BlackRock’s IBIT, despite the latter having twice the assets under management.

Read More

- 10 Most Anticipated Anime of 2025

- Gold Rate Forecast

- Pi Network (PI) Price Prediction for 2025

- USD CNY PREDICTION

- USD MXN PREDICTION

- Silver Rate Forecast

- USD JPY PREDICTION

- EUR CNY PREDICTION

- Brent Oil Forecast

- Castle Duels tier list – Best Legendary and Epic cards

2024-06-06 09:40